yeah, a political platform that includes decreased spending and increased taxation is DOA..

http://www.crfb.org/press-releases/budget-deal-may-be-worst-history

...fresh off the presses.....like fresh air...

Budget Deal May Be Worst in History

:monsters-

For Immediate Release

According to press reports, Congress and the President are close to a deal that would lift discretionary spending caps by $320 billion over the next two years. Depending on the details, this increase could add about $2 trillion to projected debt levels over the next decade, yet the agreement is reported to include less than $80 billion in offsets. The following is a statement from Maya MacGuineas, president of the Committee for a Responsible Federal Budget:

As we understand it, this agreement is a total abdication of fiscal responsibility by Congress and the President. It may end up being the worst budget agreement in our nation’s history, proposed at a time when our fiscal conditions are already precarious.

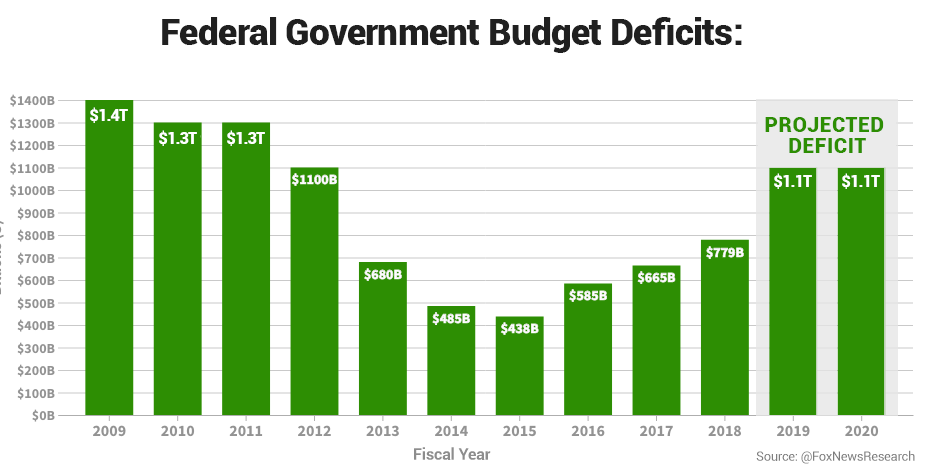

If this deal passes, President Trump will have increased discretionary spending by as much as 22 percent over his first term, :monsters- and enshrine trillion-dollar deficits into law.

Members of Congress should cancel their summer recess and return to the negotiating table for a better deal. If they don’t, those who support this deal should hang their heads in total shame as they bolt town. This deal would amount to nothing short of fiscal sabotage.

President Trump should reject this plan and honor his words from last year after signing the 2018 omnibus bill, when he said he would “never sign another bill like this again.” (.....um, where do i sign? ..)

There was a time when Republicans insisted on a dollar of spending cuts for every dollar increase in the debt limit. It’s hard to believe they are now considering the opposite – attaching $2 trillion of spending increases to a similar-sized debt limit hike.

when do these chaps from 'The Committe for a Responsible Federal Budget ' throw in the towel?

keep in mind, UE is at historic lows

...............

Draghi speaks today....

http://www.crfb.org/press-releases/budget-deal-may-be-worst-history

...fresh off the presses.....like fresh air...

Budget Deal May Be Worst in History

:monsters-

For Immediate Release

According to press reports, Congress and the President are close to a deal that would lift discretionary spending caps by $320 billion over the next two years. Depending on the details, this increase could add about $2 trillion to projected debt levels over the next decade, yet the agreement is reported to include less than $80 billion in offsets. The following is a statement from Maya MacGuineas, president of the Committee for a Responsible Federal Budget:

As we understand it, this agreement is a total abdication of fiscal responsibility by Congress and the President. It may end up being the worst budget agreement in our nation’s history, proposed at a time when our fiscal conditions are already precarious.

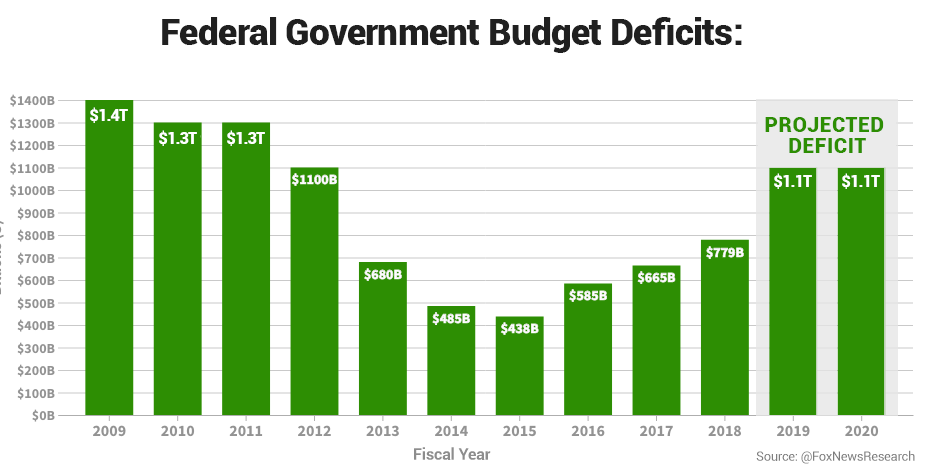

If this deal passes, President Trump will have increased discretionary spending by as much as 22 percent over his first term, :monsters- and enshrine trillion-dollar deficits into law.

Members of Congress should cancel their summer recess and return to the negotiating table for a better deal. If they don’t, those who support this deal should hang their heads in total shame as they bolt town. This deal would amount to nothing short of fiscal sabotage.

President Trump should reject this plan and honor his words from last year after signing the 2018 omnibus bill, when he said he would “never sign another bill like this again.” (.....um, where do i sign? ..)

There was a time when Republicans insisted on a dollar of spending cuts for every dollar increase in the debt limit. It’s hard to believe they are now considering the opposite – attaching $2 trillion of spending increases to a similar-sized debt limit hike.

when do these chaps from 'The Committe for a Responsible Federal Budget ' throw in the towel?

keep in mind, UE is at historic lows

...............

Draghi speaks today....