| � | |||||||||||||||||

| |||||||||||||||||

| |||||||||||||||||

|

| � | |||||||||||||||||

| |||||||||||||||||

| |||||||||||||||||

|

| Good morning. (Was this newsletter forwarded to you? Sign up here.) |

|

| [h=2]High grades for college endowments[/h] |

| University endowment managers, long criticized for the fees they pay out to private equity firms and hedge funds, have something to show for it: eye-popping returns. Yesterday, M.I.T. reported that its endowment had gained 56 percent in its most recent fiscal year, which ended in June. Yale also published its latest returns yesterday, with its endowment up 40 percent over the same period, its third-highest annual return since 1970. Dartmouth posted a return of nearly 47 percent. Duke reported a 56 percent return. |

| Harvard, which runs the biggest endowment (worth $53 billion), said yesterday that its fiscal-year return lagged many of its rivals, rising a mere 34 percent. Harvard’s endowment manager said this “tremendous” return nonetheless reflected “the opportunity cost of taking lower risk” than many of the school’s peers. |

| A big reason for the gains is investments with private equity firms, which in some years have received more in fees than endowments have paid out in tuition help. Harvard’s private equity investments, worth a third of its total portfolio, returned 77 percent in its latest fiscal year. Venture capital funds are also recording huge returns: The University of North Carolina logged a 142 percent return from that portion of its $10 billion endowment. |

| Are these returns worth the risk? Many endowments, like Harvard’s, have increased their allocations to private equity, venture capital and hedge funds in recent years, saying that this provides crucial diversification from broader stock and bond market trends. These “alternative” investments can result in outsize returns, subject to hefty fees, but can be less predictable than more conservative choices. The S&P 500 was up about 40 percent in the year to June, putting endowments’ returns in perspective. Even with U.N.C.’s venture capital gains, its total endowment was up 42 percent. Yale’s fund had nearly 40 percent of its portfolio in private equity funds, and matched the return of a diversified index fund. |

| High returns also complicate the debate about big endowments’ tax status. One of the few tax increases that President Donald Trump pushed through was a 1.4 percent levy on the largest university endowments’ investment income. Facing lobbying by the affected institutions, Democrats have discussed reducing the tax as part of the spending bills slowly working their way through Congress. The bumper returns that many schools just reported could make that harder to justify. |

| [h=3]HERE’S WHAT’S HAPPENING[/h] |

| It’s the first day of Italy’s sweeping vaccine mandate. All workers across public and private sectors are now required to show proof of vaccination against the coronavirus or they will be put on unpaid leave. Lines formed outside the country’s office buildings, and officials braced for protests. Follow The Times’s live, on-the-ground updates as the first-of-its-kind mandate for a Western democracy comes into force. |

| An F.D.A. panel recommends a Moderna booster. Advisers voted unanimously in favor of approving a half-dose booster of the coronavirus vaccine. Those eligible for the extra shot include people over 65 and other adults considered at high risk, the same groups now eligible for a Pfizer-BioNTech booster. |

| Boeing is in more trouble. A former Boeing pilot accused of deceiving the F.A.A. was indicted by a federal grand jury for statements he made about the 737 Max jet, the plane involved in two crashes in which 346 people were killed. Separately, the company is dealing with a new type of defect on its 787 Dreamliner. |

| LinkedIn is shutting down its social networking service in China. The Microsoft-owned site cited “a significantly more challenging operating environment and greater compliance requirements” in making the move. It was one of the last foreign social networking sites operating in the country — Twitter and Facebook have been blocked for years, and Google left more than a decade ago — and will instead offer users in China a new app focused solely on job postings. |

| Netflix faces outside criticism and internal unrest. The comedian Dave Chappelle’s special, “The Closer,” was called transphobic by several organizations, including GLAAD. It has thrust Netflix into difficult cultural debates, the kind usually focused on Facebook and Google, which are playing out in heated internal discussions as employees accuse the streaming giant’s executives of facilitating the spread of hate speech. |

| [h=2]Banks report sunny earnings, but clouds loom[/h] |

| The nation’s largest banks this week reported bumper earnings for the third quarter, propelling the stock market higher. Profits at Bank of America, Citigroup, JPMorgan Chase, Morgan Stanley and Wells Fargo rose by more than 50 percent, on average. (Goldman Sachs reports later today.) Driving the banks’ earnings increase was a flurry of fee-generating deal-making activity, but other parts of their businesses, like trading and lending, were down. |

| Those six banks hold more than 40 percent of all assets in the sector, which means that their fortunes can provide a pretty good weather vane for the economy in general. Here’s the forecast: |

| Partly sunny with unseasonably high temperatures: Deal-making was strong, with M.&A. fees hitting record highs, a sign that executives are optimistic about the future. Consumers are also opening their wallets, with credit card spending up more than 20 percent in the third quarter, versus a year ago, at Bank of America, Citi and JPMorgan. “If you look at the economy, it’s improving, people are spending more and businesses are going to have to start investing,” Paul Donofrio, Bank of America’s C.F.O., said yesterday. |

| Late thunderstorms possible: Trading revenue fell at JPMorgan and Citigroup and rose slightly at Morgan Stanley, reflecting the recent turmoil in markets. What’s more, a good portion of the banks’ earnings in the latest quarter came from tapping rainy-day funds. Bank of America, Citi, JPMorgan and Wells Fargo pulled a collective $6 billion out of accounts meant to cover future loan losses. And loan growth overall was again disappointing. If higher spending shows optimism for today, a lack of lending may be a sign that consumers and businesses still see clouds on the horizon. |

| [h=2]Seen and heard[/h] |

| “We need some of the world’s greatest brains and minds fixed on trying to repair this planet, not trying to find the next place to go and live.” |

| — Prince William, taking aim at billionaires spending their money on going to space rather than on fighting climate change on Earth. |

| “The state companies are going their own way. They don’t care about the political pressure worldwide to control emissions.” |

| — René Ortiz, a former OPEC secretary general and a former energy minister in Ecuador, on how government-owned energy companies are increasing production as U.S. and European companies pare supply because of climate concerns. |

| “It’s a racecar slowing down ahead of a turn, but it’s still going faster than we ever have in our lives.” |

| — Igor Popov, the chief economist at Apartment List, on the rapid rise in rent prices, which is stoking inflation and putting pressure on policymakers to react. |

| [h=2]In the papers[/h] |

| Some of the academic research that caught our eye this week, summarized in one sentence: |

|

|

| [h=2]Crypto players mobilize in D.C.[/h] |

| Coinbase, the cryptocurrency exchange, started a high-profile public policy campaign yesterday, posting its blueprint for crypto regulations on GitHub, which mainly serves as an open-source software code library, for public comment. “Our purpose in publishing this proposal was to contribute to a broad conversation and to do so openly and democratically,” a Coinbase spokeswoman told DealBook. |

| Federal agencies are racing to address the potential risks in the fast-growing crypto industry, and a burgeoning lobby has emerged to influence the shape of regulations. |

| Coinbase is flipping the script. Traditionally, lawmakers and regulators solicit comments from the public when considering new rules and regulations. But Coinbase appears to be losing patience, feuding publicly last month on Twitter with the S.E.C. over a proposed crypto product and now subtly co-opting the government’s role as representative of the people. |

| But old-fashioned lobbying is still important. Although Coinbase did not submit its proposal to the Senate Banking Committee, which recently requested input on crypto regulations, it met with staff at 30 congressional offices and engaged directly with at least 20 members of Congress before publishing it, the company told reporters. It also “reached out” to the S.E.C., it said. |

| Crypto advocates are flooding the zone. The venture capital firm Andreessen Horowitz, an early Coinbase investor, submitted its thoughts to the banking panel, and representatives have been making the rounds in Washington this week to advance the firm’s views. Katie Haun, a former federal prosecutor who co-leads Andreessen’s crypto fund, was also in town. |

| “Crypto knows how to get through to members,” Kristin Smith of the Blockchain Association told lawyers this week at a D.C. Bar Association event. The industry’s ability to engage with Congress and encourage enthusiasts to press its policy views is unique, she said. Crypto now has “more of a voice and a seat at the table,” she added. Mobilizing crypto Twitter — a “highly communicative community” — is the industry’s “special tool,” she said. |

| Enterprise Subscriptions |

| If you want to unlock the full breadth of coverage of The New York Times for you and your team, get an institutional digital subscription. |

| [h=3]THE SPEED READ[/h] |

| Deals |

|

| Policy |

|

| Best of the rest |

|

| Anna Schaverien contributed reporting. |

| Thanks for reading! We’ll see you tomorrow. |

| We’d like your feedback. Please email thoughts and suggestions to dealbook@nytimes.com. |

|

|

|

|

|

|

| Andrew Ross Sorkin, Founder/Editor-at-Large, New York @andrewrsorkin |

| Jason Karaian, Editor, London @jkaraian |

| Sarah Kessler, Deputy Editor, Chicago @sarahfkessler |

| Stephen Gandel, News Editor, New York @stephengandel |

| Michael J. de la Merced, Reporter, London @m_delamerced |

| Lauren Hirsch, Reporter, New York @LaurenSHirsch |

| Ephrat Livni, Reporter, Washington D.C. @el72champs |

Read in Browser

Read in Browser

|

|

| Global Market Comments October 15, 2021 Fiat Lux Featured Trade:(HOW THE MAD HEDGE MARKET TIMING ALGORITHM WORKS)

|

| � |

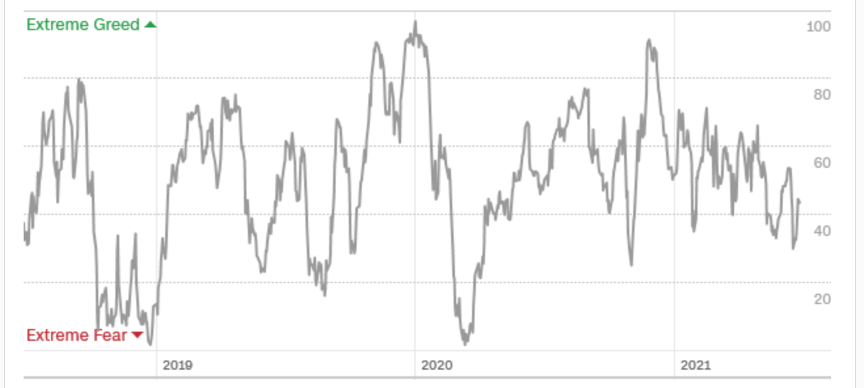

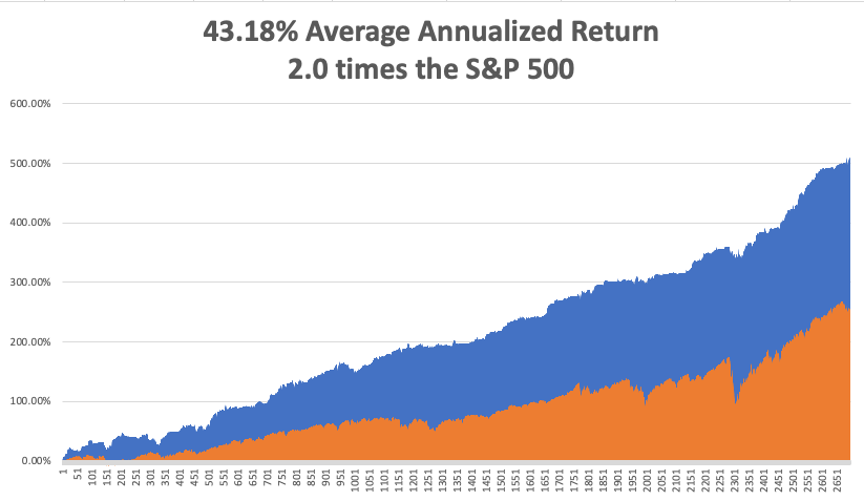

How the Mad Hedge Market Timing Algorithm WorksSince we have just taken in a large number of new subscribers from around the world, I will go through the basics of my Mad Hedge Market Timing Index one more time. I have tried to make this as easy to use as possible, even devoid of the thought process. When the index is reading 20 or below, you only consider “BUY” ideas. When it reads over 80, it’s time to “SELL.” Everything in between is a varying shade of grey. Most of the time, the index fluctuates between 20-80, which means that there is absolutely nothing to do today, although I am leaning towards more “BUYS”. To identify a coming market reversal, it’s good to see the index chop around for at least a few weeks at an extreme reading. Look at the three-year chart of the Mad Hedge Market Timing Index. After three years of battle testing, the algorithm has earned its stripes. I started posting it at the top of every newsletter and Trade Alert two years ago and will continue to do so in the future. The success rate of calls by the index in 2021 is about 95%. Once I implemented my proprietary Mad Hedge Market Timing Index in October 2016, the average annualized performance of my Trade Alertservice has doubled to an eye-popping 43%. As a result, new subscribers have been beating down the doors trying to get in. Let me list the highpoints of having a friendly algorithm looking over your shoulder on every trade. *Algorithms have become so dominant in the market, accounting for up to 90% of total trading volume, that you should never trade without one *It does the work of a seasoned 100-man research department in seconds *It runs real-time and optimizes returns with the addition of every new data point far faster than any human can. Imagine a trading strategy that upgrades itself 1,000 times a day! *It is artificial intelligence-driven and self-learning. *Don’t go to a gunfight with a knife. If you are trading against algos alone, you WILL lose! *Algorithms provide you with a defined systematic trading discipline that will enhance your profits. And here’s the amazing thing. My Mad Hedge Market Timing Indexcorrectly predicted the outcome of the presidential election, while I got it dead wrong. You saw this in stocks like US Steel (X), which took off like a scalded chimp the week before the election. When my and the Market Timing Index’s views sharply diverge, I go into cash rather than bet against it. Since then, my Trade Alert performance has been on an absolute tear. In 2017, we earned an eye-popping 57.39%. In 2018, I clocked 23.67% while the Dow Average was down 8%, a beat of 31%. So far in 2020, we are up 25.83%. Here are just a handful of some of the elements which the Mad Hedge Market Timing Index analyzes real-time, 24/7. 50 and 200 day moving averages across all markets and industries The Volatility Index (VIX) The junk bond (JNK)/US Treasury bond spread (TLT) Stocks hitting 52 day highs versus 52 day lows McClellan Volume Summation Index 20-day stock-bond performance spread 5-day put/call ratio Stocks with rising versus falling volume Relative Strength Indicator 12-month US GDP Trend Case Shiller S&P 500 National Home Price Index Of course, the Trade Alert service is not entirely algorithm-driven. It is just one tool to use among many others. Yes, 50 years of experience trading the markets is still worth quite a lot. I plan to constantly revise and upgrade the algorithm that drives the Mad Hedge Market Timing Index continuously, as new data sets become available.

|

Quote of the Day[FONT=Arial, Helvetica, sans-serif]“I think, it’s very obvious what’s going on. It’s the miracle of free money, zero commissions, and a lot of people getting checks that exceed what they would get if they went to work,” said my former hedge fund investor friend, Leon Cooperman of Omega Family Office.

|

| This is not a solicitation to buy or sell securities The Mad Hedge Fund Trader is not an Investment advisor For full disclosures click here at: http://www.madhedgefundtrader.com/disclosures The "Diary of a Mad Hedge Fund Trader"(TM) and the "Mad Hedge Fund Trader" (TM) are protected by the United States Patent and Trademark Office The "Diary of the Mad Hedge Fund Trader" (C) is protected by the United States Copyright Office |

|

| � | |||||||||||||||||||

Read in Browser | |||||||||||||||||||

| |||||||||||||||||||

TOGETHER WITH

| |||||||||||||||||||

|

AVDL is tanking. What happened there?

| Read in Browser | |||||||||||||||||

| � | |||||||||||||||||

| � | |||||||||||||||||

| � |

As I mentioned last week, I sold off my Tesla shares....and now it's over $875. Unbelievable.[/QUOTE

Gezzzz..that blows CB

We finally moved to the FH.. turned out real nice.

2-2 in the NFL again 15 and 9 on the year.

Global Market Comments

October 18, 2021

Fiat LuxFeatured Trade:(MARKET OUTLOOK FOR THE WEEK AHEAD, or THE GOOD NEWS IS HERE)

(GS), (MS), (JPM), (BAC), (C), (BLK), (TLT), (BRKB), (SPY)

The Market Outlook for the Week Ahead, or The Good News is HereHere’s the good news.

You know those pesky seasonals that have been a drag of the market for the past five months? You know, that sell in May and go away thing?

It’s about to end, vanish, and vaporize.

We are only ten trading days away from when seasonals turn hugely positive on November 1.

On top of that, the pandemic is rapidly receding, the economy reaccelerating, and workers are returning to the workforce. The action Biden took with the west coast ports should unlock the logjam there. It all sounds like a Goldilocks scenario.

The ports issue has nothing to do with the pandemic. The truth is that with 6% GDP growth, the US economy is growing faster than it has ever done before. That means we are buying a lot more stuff, more than our antiquated infrastructure can handle. Unlock the ports, and growth could accelerate even further.

Bitcoin has been on fire as well, doubling since August 1. The focus has been on the launch of the first crypto futures ETF, which may happen as early as today. All of the trade alerts we issued in this space have been total home runs. (Click here for our Bitcoin Letter).

As a result, Bitcoin is within striking range of hitting a new all-time high at $66,000. Break that, and we could see a melt-up straight to $100,000.

Want another reason to be bullish? The Millennial generation is about to inherit $68 trillion by 2030. Guess where that is going? Bitcoin and all other risk assets, as younger investors tend to be more aggressive.

So, what to do about all of this?

Keep doing more of what’s working. Buy financials and Bitcoin and sell short bonds. Wait for tech to bottom out at the next interest rate peak, then load the boat there once again.

Make as much money as you can now because 2022 could be a year of diminished expectations. Stocks might rise by only 15% compared to this year’s 30% torrid rate.

As for Bitcoin, that is a horse of a different color.

CPI Hits 5.4%, and was up 0.4% in September, a high for this cycle. This time, it was food and energy that took the lead. Used car prices, which went ballistic last month, showed a decline. Supply chain problems are wreaking havoc and those with inventory can charge whatever they want. The Fed thinks this is transitory, the bond market doesn’t. Sell rallies in the (TLT).

Weekly Jobless Claims Plunge to 293,000, a new post-pandemic low. With delta in retreat, higher wages are luring people back to work to deal with massive supply chain problems. This may be the beginning of the big drop in unemployment to pre-pandemic levels. Stocks will love it. Buy stocks on dips.

Big Banks Report Blowout Earnings and are firing on all cylinders. The best is yet to come. Interest rates are rising, default rates are falling, profit margins expanding, and the economy is growing at a record rate. Buy (JPM), BAC), and (C) on dips.

The Nonfarm Payroll Bombs in September, coming in at only 194,000. That follows a weak 235,000 in August. The headline Unemployment Rate dropped to a new post-pandemic low of 4.8%, down from a peak of 22%. It’s not a soggy economy that’s causing this, but a shortage of people to hire. Some 10 million workers have gone missing from the American economy, and many may never come back.

Bitcoin Soars to $61,000, a five-month high, putting the previous $66,000 high in range. With ten crypto ETFs waiting in the wings for SEC approval, a flood of money is about to hit the sector. Several countries are now considering the adoption of Bitcoin as a national currency after El Salvador’s move. Keep buying Bitcoin dips. Mad Hedge Bitcoin Letter followers are making a fortune.

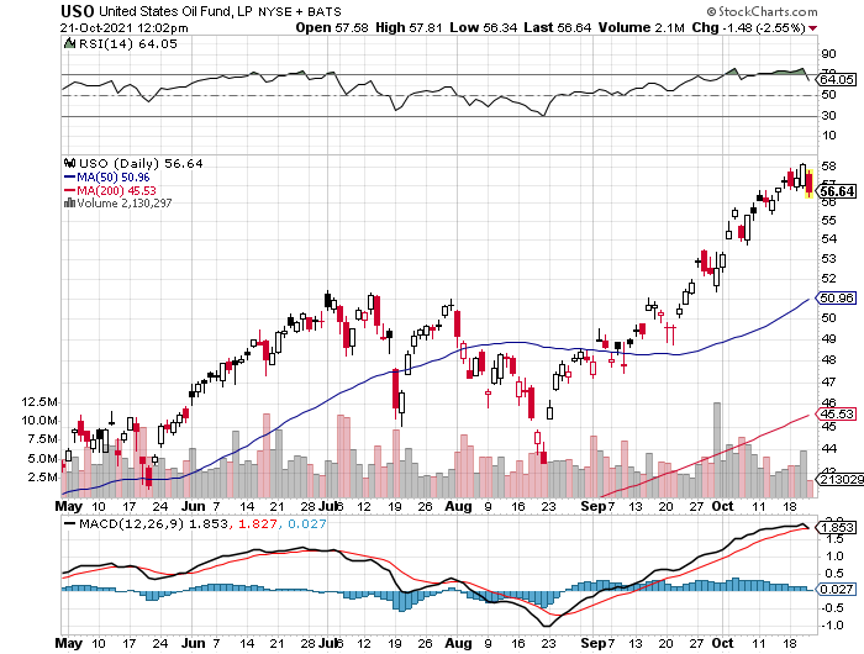

Oil (USO) Tops $80, after OPEC limits production increases to 400,000 barrels a day, dragging on the stocks market. Prices are approaching levels that will restrain growth. Pandemic under-investment and distribution problems have triggered a short squeeze. There will be many spikes on the way to zero.

Fed Minutes Show Taper to Start in November, as discussed in the September meeting. They may start with $15 billion a month in fewer bond purchases. The inflation boogie man is getting bigger with the 5.4% print on Tuesday. Sell rallies in the (TLT)

JOLTS Comes in at 10.4 million indicating that the labor shortage is getting more severe. Millions are still staying home for fear of catching covid. There is also a massive skills disparity resulting from decades of under-investment in education.

IMF Cuts Global Growth Forecast to 5.9%. Supply chains, delta, inflation worries, and vaccine access are to blame.

US Dollar (UUP) Hits One-Year High on rising interest rates. This will continue for the foreseeable future. Stand aside from the (UUP) as this is a countertrend trade. We may be only 15 basis points away from an interim peak in rates at 1.76% for the ten-year.

My Ten-Year View

When we come out the other side of pandemic, we will be perfectly poised to launch into my new American Golden Age, or the next Roaring Twenties. With interest rates still at zero, oil cheap, there will be no reason not to. The Dow Average will rise by 800% to 240,000 or more in the coming decade. The American coming out the other side of the pandemic will be far more efficient and profitable than the old. Dow 240,000 here we come!

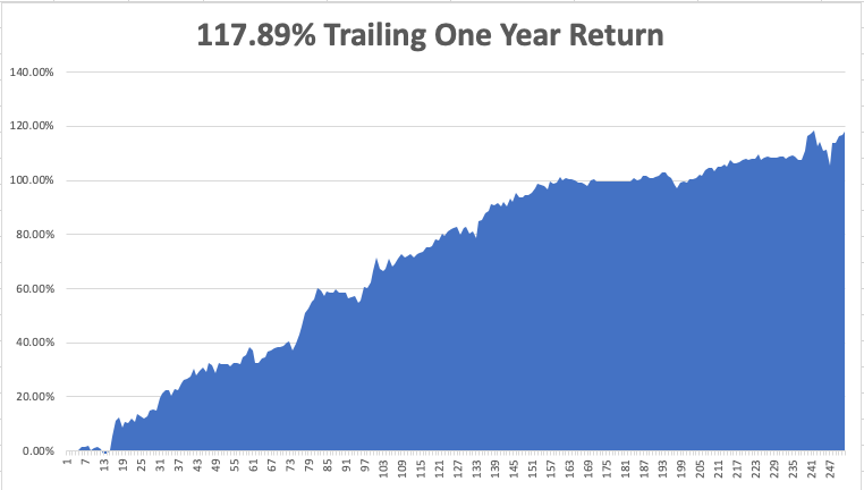

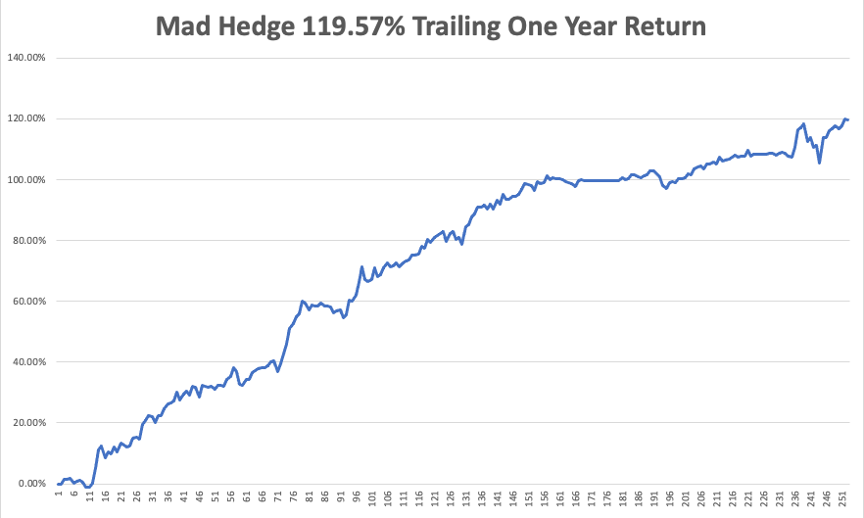

My Mad Hedge Global Trading Dispatch saw a heroic +8.91% gain so far in October. My 2021 year-to-date performance soared to 81.51%. The Dow Average was up 15.4% so far in 2021.

Figuring that we are either at, or close to a market bottom, and being a man of my convictions, I kept 90% invested in financial stocks all the wall until the October 15 options expirations. Those include (MS), (GS), (JPM), (BLK), (BRKB), (BAC), and (C).

The payday was big and more than covered earlier in the month stop-losses in (SPY) and (DIS). I quick trip by the Volatility Index (VIX) to $29, then back to $15 was a big help.

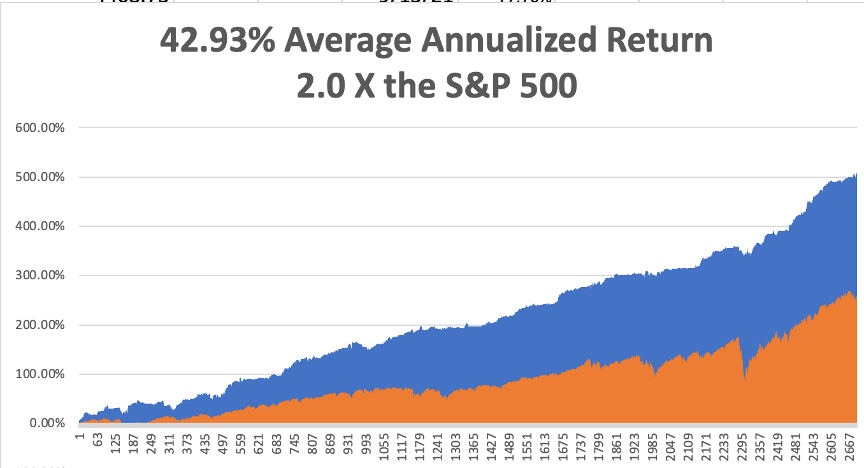

That brings my 12-year total return to 511.06%, some 2.00 times the S&P 500 (SPX) over the same period. My 12-year average annualized return now stands at an unbelievable 43.19%, easily the highest in the industry.

My trailing one-year return popped back to positively eye-popping 119.57%. I truly have to pinch myself when I see numbers like this. I bet many of you are making the biggest money of your long lives.

We need to keep an eye on the number of US Coronavirus cases at 45 million and rising quickly and deaths topping 725,000, which you can find here.

The coming week will be slow on the data front.

On Monday, October 18 at 8:15 AM, Industrial Production for September is published. Johnson & Johnson (JNJ) reports.

On Tuesday, October 19 at 8:00 AM, the Housing Starts for September are released. Netflix (NFLX) reports.

On Wednesday, October 20 at 7:30 AM, Crude Oil Stocks are announced. Tesla (TSLA) and IMB (IBM) report.

On Thursday, October 21 at 8:30 AM, Weekly Jobless Claims are announced. At 10:00 AM, Existing Home Sales for September are printed. Alaska Air (ALK) and Southwest Air (LUV) report.

On Friday, October 22 at 8:45 AM, the US Markit Flash Manufacturing and Services PMI is out. American Express (AXP) reports. At 2:00 PM, the Baker Hughes Oil Rig Count are disclosed.

As for me, I normally avoid the diplomatic circuit, as the few non-committal comments and soggy appetizers I get aren’t worth the investment of time.

But I jumped at the chance to celebrate the 70[SUP]th[/SUP] anniversary of the founding of the People’s Republic of China with San Francisco consul general Gao Zhansheng.

When I casually mention that I survived the Cultural Revolution from 1968 to 1976 and interviewed major political figures like Premier Deng Xiaoping, who launched the Middle Kingdom into the modern era, and his predecessor, Zhou Enlai, modern-day Chinese are enthralled.Happy Birthday, China!

It’s like going to a Fourth of July party and letting drop that I palled around with Thomas Jefferson and Benjamin Franklin.

Five minutes into the great hall, and I ran into my old friend Wen. She started out her career with the Chinese Intelligence Service and had made the jump to the Foreign Ministry, as all their best people did. Wen was passing through town with a visiting trade mission.

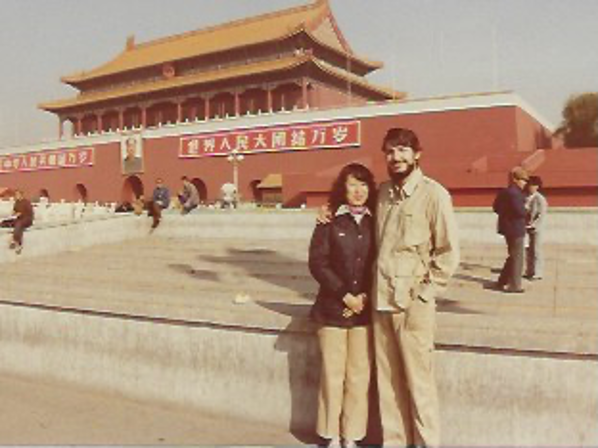

When I was touring China in the seventies as the guest of the Bank of China, Wen was assigned as my guide and translator, and we kept in touch over the years. I was assigned a bodyguard who doubled as the driver of a tank-like Russian sedan, a Volga.

The Cultural Revolution was on, and while the major cities were safe, we ran the risk of running into a renegade band of xenophobic Red Guards, with potentially fatal consequences.

By the time Wen married, China had already adopted its one-child policy. As much as she wanted more children, she understood the government’s need to adopt such a drastic policy. Without it, the population today would be 1.6 billion, not 1.2 billion, and all of the money that went into buying capital goods would have been spent on food imports instead.

The country would have stagnated at its 1980 per capita income of $100/year. There would have been no Chinese economic miracle. She was very proud of her one son, who was a software engineer at Microsoft (MSFT) in Beijing.

I asked if she recalled our first trip together and a dark cloud came over her face. We were touring a section of Fuzhou in southern China when three policemen marched up. They started shouting at Wen that we were in a restricted section of the city where foreigners were not allowed. They started mercilessly beating her with clubs.

I was about to intercede when my late wife, Kyoko, let go with a blood-curdling tirade in Japanese that froze them in their tracks. I saw from the fear in their faces that she had ignited their wartime fear of Japanese authority and the dreaded Kempeitai, or secret police, and they beat a hasty retreat.

To this day, I’m not exactly sure what Kyoko said. We took Wen back to our hotel room and bandaged her up, putting ice on the giant goose egg on her head. When I left, I gave her my paperback copy of HG Well’s A Short History of the World, which she treasured, as the book was then banned in China.

Wen mentioned that she was approaching the mandatory retirement age of 60, and soon would be leaving the Foreign Service. I suggested she move to San Francisco, which offered a thriving Chinese community.

She laughed. No matter how much prices had fallen, she could never afford anything here on a Chinese civil servant’s salary.

I asked Wen if she still had the book I gave her nearly five decades ago. She said it had become a treasured family heirloom and was being passed down through the generations.

As she smiled, I notice the faint scar on her eyebrow from that unpleasantness so long ago.

Good Luck and Good Trading

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

Kyoko and I in Beijing in 1977

Quote of the Day“He who sacrifices freedom for security deserves neither,” said Benjamin Franklin, the Revolutionary War US ambassador to Paris and signer of the Declaration of Independence.

This is not a solicitation to buy or sell securities

The Mad Hedge Fund Trader is not an Investment advisor

For full disclosures click here at:

http://www.madhedgefundtrader.com/disclosures

The "Diary of a Mad Hedge Fund Trader"(TM)

and the "Mad Hedge Fund Trader" (TM)

are protected by the United States Patent and Trademark Office

The "Diary of the Mad Hedge Fund Trader" (C)

is protected by the United States Copyright Office

Futures trading involves a high degree of risk and may not be suitable for everyone.

Post up some FH pics.

|

| Global Market Comments October 19, 2021 Fiat Lux SPECIAL BITCOIN ISSUEFeatured Trade:(WHERE DOES BITCOIN GO FROM HERE?)

($BTCUSD), (ETH), (CRPT), (BLOK), (MSTR)

|

| � |

Where Does Bitcoin Go From Here?I first got involved with bitcoin in 2011, when a subscriber wanting to thank me for a spectacular investment performance GAVE me ten Bitcoin. They we then worth $1 each. Then, I forgot about them. When they appreciated to $100 in 2013, I decided to sell them and take the family out to dinner at The French Laundry, the best restaurant in California’s Napa Valley. I thought I was a genius. Back then, early in the life of Bitcoin, theft was rampant, and exchange regularly went bankrupt. So cashing in on my windfall wasn’t such an unreasonable thing to do. That turned out to be the most expensive dinner of my life. If I had kept the ten Bitcoin, they would be worth today over $600,000. Maybe I’m not such a genius after all. Unless you have been living in a cave for the past five years, you have probably heard of Bitcoin. By now, you have decided that it is the greatest money-making opportunity of all time or the greatest scam since Carlo Ponzi amassed a fortune selling international postal coupons in 1922. Some things are certain. Bitcoin will change the financial system beyond all recognition. It will revolutionize banking and investment. And it will vastly accelerate the digitization of the global economy to everyone’s benefit. After reading this book, you may or may not want to invest in Bitcoin. However, a working knowledge of what it is and how it works will become essential for everyone as the 21st century unfolds. For s start, Bitcoin, other cryptos, and future cryptos yet to be invented, will save $1 trillion a year in transaction costs in the global economy. Who will be the beneficiary of this bounty? You, me, and all the companies we invest in. It is certain that some form of current or future crypto will be a stepping stone to a global digital currency, not just for emerging nations like El Salvador, but all nations. And here is the most interesting thing. The eventual impact of crypto on our lives hasn’t even been imagined yet. Going back to my Defense Department days, I was one of a handful who was present at the birth of the Internet and the similarities are legion. A few clever people were aware of bits and corners of the Internet back in 1989, but nobody had a big picture. Long term predictions might as well have been science fiction. Insiders were buying up domain names for a dollar each, such as Mcdonalds . com, whitehouse . com, and sex . com. The McDonald’s site was later sold to the fastfood company for $10 million. When the Internet began mass adoption in 1995, no one imagined that every taxi company in the world would be out of business in 15 years. New York City taxi medallions once worth $1 million became worthless, prompting many suicides. Nor did prime downtown apartment owners all over the world expect they could rent their homes for astronomical daily rates through Airbnb (ABNB). They didn’t even expect that a small startup named Netflix (NFLX) would stream videos online, wiping out Blockbuster Video. Bitcoin was created by Satoshi Nakamoto, a pseudonymous person or team who outlined the technology in a 2008 white paper. Nobody knows for sure. It might even be a US government agency that invented Bitcoin. It’s an appealingly simple concept: bitcoin is digital money that allows for secure, trustless, peer-to-peer transactions on the internet. Unlike other payment services, like ******’s Venmo (PYPL), which rely on the traditional financial system for permission to transfer money and on existing debit/credit accounts, bitcoin is decentralized: any two people, anywhere in the world, can send bitcoin to each other without the involvement of a bank, government, or other institution. Every transaction involving Bitcoin is tracked on the blockchain, which is like a bank’s ledger, or log of customers’ funds going in and out of the bank. In simple terms, it’s a record of every transaction ever made using bitcoin. Think of blockchain as a chain of blocks of code, each one of which contains millions of lines of code. Unlike a bank’s ledger, the Bitcoin blockchain is distributed across the entire network. No company, country, or third party is in control of it; and anyone can become part of that network. The Mad Hedge Fund Trader is part of that network, otherwise known as a “node.” There will only ever be 21 million Bitcoins. This is digital money that cannot be inflated or manipulated in any way. It isn’t necessary to buy an entire bitcoin: you can buy just a fraction of one if that’s all you want or need. To open my own crypto wallet, I started with an initial buy of one ten thousand of a Bitcoin, or $10. Now, I’m trading in the millions. Whatever the outcome of Bitcoin is, one thing is certain. None of our lives will be the same.

|

Quote of the Day"The less prudent you find the actions of others, the more prudent you need to act yourself," said Oracle of Omaha, Warren Buffett.

|

| This is not a solicitation to buy or sell securities The Mad Hedge Fund Trader is not an Investment advisor For full disclosures click here at: http://www.madhedgefundtrader.com/disclosures The "Diary of a Mad Hedge Fund Trader"(TM) and the "Mad Hedge Fund Trader" (TM) are protected by the United States Patent and Trademark Office The "Diary of the Mad Hedge Fund Trader" (C) is protected by the United States Copyright Office Futures trading involves a high degree of risk and may not be suitable for everyone.[FONT="][/FONT] |

| |||||||||||||||||

| |||||||||||||||||

|

|

| Global Market Comments October 21, 2021 Fiat Lux Featured Trade:(MY 20 RULES FOR TRADING IN 2022)

|

| � |

My 20 Rules for Trading in 2022I usually try to catch three or four trend changes a year, which might generate 100-200 trades, and often come in frenzied bursts. Since I am one of the greatest tightwads that ever walked the planet, I only like to buy positions when we are at the height of despair and despondency, and traders are raining off the Golden Gate Bridge like a winter downpour. Similarly, I only like to sell when the markets are tripping on steroids and ecstasy and are convinced that they can live forever.

Over the five decades that I have been trading, I have learned a number of tried and true rules which have saved my bacon countless times. I will share them with you today. 1) Don’t over trade. This is the number one reason why individual investors lose money. Look at your trades of the past year and apply the 90/10 rule. Dump the least profitable 90% and watch your performance skyrocket. Then aim for that 10%. Over-trading is a great early retirement plan for your broker, not you. 2) Always use stops. Risk control is the measure of the good hedge fund trader. If you lose all your capital on the lemons, you can’t play when the great trades set up. Consider cash as having an option value. It's easier to dig yourself out of a small hole than a big one. 3) Don’t forget to sell. Date, don’t marry your positions. Remember, hogs get fed and pigs get slaughtered. My late mentor, Barton Biggs, told me to always leave the last 10% of a move for the next guy. 4) You don’t have to be a genius to play this game. If that was required, Wall Street would have run out of players a long time ago. If you employ risk control and stops, then you can be wrong 40% of the time, and still make a living. That’s a little better than a coin toss. If you are wrong only 30% of the time, you can make millions. If you are wrong a scant 20% of the time, you are heading a trading desk at Goldman Sachs. If you are wrong a scant 10% of the time, you are running a $20 billion hedge fund that the public only hears about when you pay $100 million for a pickled shark at a modern art auction. If someone says they are never wrong, as is often claimed in other newsletters and trade mentoring services, run a mile, because it is impossible. By the way, I was wrong 7% of the time in 2021. That’s what you’re paying for. 5) This is hard work. Trading attracts a lot of wide-eyed, naïve, but lazy people because it appears so easy from the outside. You buy a stock, watch it go up, and make money. How hard is that? The reality is that successful investing requires twice as much work as a normal job. The more research you put into a trade, the more comfortable you will become, and the more profitable it will be. That’s what this letter is for. 6) Don’t chase the market. If you do, it will turn back and bite you. Wait for it to come to you. If you miss the train, there will be another one along in minutes, hours, days, weeks, or months. Patience is a virtue. 7) Limit Your Losses. When I put on a position, I calculate how much I am willing to lose to keep it. I then put a stop just below there. If I get triggered, I just walk away. Emotion never enters the equation, just cold, steely-eyed discipline. Only enter a trade when the risk/ reward is in your favor. You can start at 3:1. That means only risk a dollar to potentially make three. 8) Don’t confuse a bull market with brilliance. I am not smart, just old as dirt. Nothing new ever happens, just endless repetition of the old stuff. But is this 1921, or 1929? 9) Tape this quote from the great economist and early hedge fund trader of the 1930’s, John Maynard Keynes, to your computer monitor: "Markets can remain illogical longer than you can remain solvent." Hang around long enough, and you will see this proven time and again (ten-year Treasuries at 0.31%?!). 10) Don’t believe the media. I know, I used to be one of them. There is a reason why they are talking heads and not billionaire traders. Look for the hard data, the numbers, and you’ll see that often the talking heads, the paid industry apologists, and politicians don’t know what they are talking about (the Gulf oil spill will create a dead zone for decades?). Average out all the public commentary, and half are bullish and half bearish at any given time. The problem is that they never tell you which one is right (that is my job). When they all go one way, the markets usually go the opposite direction.

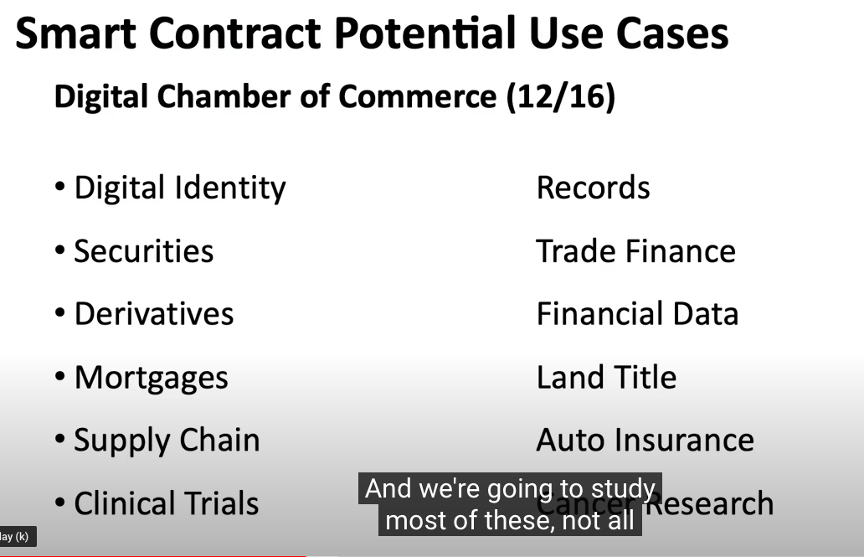

12) Sometimes the conventional wisdom is right. 13) Invest like a fundamentalist, execute like a technical analyst. This is what all the pros do. 14) Use technical analysis only, and you will buy every rally, sell every dip, and end up broke. That said, learn what an “outside reversal” is, and who the heck is that Italian renaissance guy, Leonardo Fibonacci. 15) The simpler a market approach, the better it works because more people understand it and buy it. Everyone talks about “buy low and sell high”, but few actually do it. All black boxes eventually blow up, if they were ever there in the first place. 16) Markets are made up of people. Understand and anticipate how they think, and you will know what the markets are going to do. 17) Understand what information is in the market and what isn’t and you will make more money. 18) Do the hard trade, the one that everyone tells you that you are “Mad” to do. If you add a position and then throw up on your shoes afterwards, then you know you’ve done the right thing. This is why people started calling me “Mad” 40 years ago. (What? Japan was a huge buy in 1980? Tech stocks were a huge buy last summer?). 19) If you are trying to get out of a hole, the first thing to do is quit digging and throw away the shovel. Sell everything. A blank position sheet can be invigorating ad illuminating. 20) Making money in the market is an unnatural act, and fights against the tide of evolution. We, humans, are predators and hunters evolved to track game on the horizon of an African savanna. Modern humans are maybe 5 million years old, but civilization has been around for only 10,000 years. Our brains have not had time to make the adjustment. In the market, this means that if a stock has gone up, you believe it will continue to do so. This is why market tops and bottoms see volume spikes. To make money, you have to go against these innate instincts. Some people are born with this ability, while others can only learn it through decades of training. I am in the latter group.

Great Hunter, Lousy Trader

|

Quote of the Day“Bonds are priced artificially because you’ve got some guy buying tens of billions of dollars’ worth a month. That will change at some point, and when it does, people are going to lose a lot of money,” said the Oracle of Omaha, Warren Buffett.

|

| This is not a solicitation to buy or sell securities The Mad Hedge Fund Trader is not an Investment advisor For full disclosures click here at: http://www.madhedgefundtrader.com/disclosures The "Diary of a Mad Hedge Fund Trader"(TM) and the "Mad Hedge Fund Trader" (TM) are protected by the United States Patent and Trademark Office The "Diary of the Mad Hedge Fund Trader" (C) is protected by the United States Copyright Office Futures trading involves a high degree of risk and may not be su |

| Good morning. (Was this newsletter forwarded to you? Sign up here.) |

|

| [h=2]Second time’s the charm?[/h] |

| After two years, a failed I.P.O., a plunging valuation and a pandemic that reset many workers’ relationships with the office, the co-working company WeWork will begin a new life today as a publicly traded company. |

| WeWork argues it’s a better company now. It has renegotiated or exited some 500 leases this year, saving over $400 million, according to its C.E.O., Sandeep Mathrani. And its deal to go public via a merger with a SPAC, BowX, will provide $1.3 billion in new capital. |

| It has significantly dialed back the ambitions of Adam Neumann, a founder and former C.E.O., who pitched WeWork as the future of … well, a lot of things. He spooked many inside and outside the company with what they viewed as reckless management before his ouster. |

| But WeWork’s future remains murky. It is still burning cash as customers drop their membership fees in an era of remote working. SoftBank, the company’s biggest backer, faces an uphill climb just to break even on its multibillion-dollar investment. Once valued at $47 billion, WeWork is expected to trade at a market cap of around $8 billion. “I made a wrong decision,” Masa Son, SoftBank’s chief, said last year. |

| And Neumann hasn’t gone away. He and WeWork’s other founder, Miguel McKelvey, are hosting a party this morning to celebrate the company going public, DealBook has confirmed. Neumann still owns an 11 percent stake in WeWork, and can observe board meetings starting next year. That raises questions about whether WeWork can ever escape his shadow. |

| [h=3]HERE’S WHAT’S HAPPENING[/h] |

| Donald Trump turns to a SPAC to back his media venture. The former president said he was teaming up with Digital World Acquisition Group to form a publicly traded media group to rival the “liberal media consortium.” Digital World is led by Patrick Orlando, a former Deutsche Bank executive. |

| Shares in Evergrande plunge after a failed stake sale. The embattled Chinese real estate giant’s stock fell more than 13 percent after it announced the end of its efforts to sell part of its property services business. The company is now days away from officially declaring default. |

| A twist in the Fed’s trading scandal. The central bank’s ethics office warned the Fed chair, Jay Powell, and regional bank presidents in March 2020 against trading in their personal accounts, though several later did, The Times’s Jeanna Smialek reports. |

| Amazon faces another unionization movement. Workers at a Staten Island warehouse that was scrutinized over its workplace conditions said they would formally begin a labor organization drive. It comes after a similar campaign in Alabama failed, though Amazon was accused of improperly influencing the vote. |

| Netflix workers log off in protest. Dozens of employees walked out of a company office in Los Angeles, while others ended work early, to voice their displeasure at Dave Chappelle’s recent comedy special, which they said promoted bigotry against transgender people. |

| [h=2]****** pins a deal for Pinterest[/h] |

| ****** has offered to buy Pinterest in a deal valued around $45 billion, according to people with knowledge of the discussions. If completed, the takeover would be the largest in the consumer internet industry over the past decade, topping Microsoft’s $26.2 billion purchase of LinkedIn in 2016 and Salesforce’s $27.7 billion acquisition of Slack last year. |

| The move is part of PayPal’s goal to drive further into e-commerce — and to put it on a different path than its rival Square. Through Pinterest’s app, people can save images to digital pinboards and buy goods directly through “buyable pins.” |

| “Sometimes we buy things that people don’t expect,” Dan Schulman, PayPal’s C.E.O., said last month, foreshadowing the Pinterest approach. In context, he was referring to the company’s $4 billion acquisition of Honey, a coupon payment platform, in 2019. Schulman has said that ****** aims to become a comprehensive “super app,” like those found in Asia. Investors are wary: PayPal’s shares fell 6 percent after news of the potential deal. |

| “We are perplexed by this potential transaction, and see little or no strategic rationale,” Adam Jeffrey, an analyst at Truist, said, worrying that it could create conflict with PayPal’s other marketplace customers. He noted the deal’s rationale in some ways harkened back to eBay’s acquisition of ****** 20 years ago, which was unwound in 2015 so that ****** could more easily sign agreements with rivals to eBay. |

| Fintech companies are flush with cash and using it for deals. Square has announced deals to buy the music streaming service Tidal for nearly $300 million and the “buy now, pay later” company Afterpay for $29 billion. And ****** recently acquired its own “buy now, pay later” company, Paidy, and iZettle, a payment processor. |

| [h=2]“DuPont attempted to dump its liabilities on Chemours, just as it dumped GenX and other forever chemicals into the Cape Fear River.”[/h] |

| — Josh Stein, North Carolina’s state attorney general, who is suing Chemours and DuPont for dumping chemicals and using a “shell game” to shirk accountability. |

| [h=2]Crypto’s new highs and lows[/h] |

| The price of Bitcoin set a new high yesterday, nearly hitting $67,000. The cryptocurrency has doubled over the past three months, with enthusiasm fueled by the launch of the first U.S. Bitcoin-linked exchange-traded fund this week, exposing a broader range of investors to the crypto world. |

|

| Another E.T.F. is on the way. VanEck’s Bitcoin futures E.T.F. will become effective on Saturday, the company told DealBook. VanEck first filed for approval of a Bitcoin fund in 2017, and its E.T.F. could start trading on Monday. In its first two days of trading, the ProShares Bitcoin futures E.T.F. amassed assets of $1.1 billion. |

| The focus on crypto is not all celebratory. Today, a group of top U.S. financial regulators will meet to discuss stablecoins ahead of a forthcoming Treasury Department report on oversight of the fast-growing assets. These cryptocurrencies, whose values are ostensibly pegged to stable assets like the dollar, are integral to transactions in the burgeoning world of crypto financial services because the volatility of Bitcoin and others are impractical for that purpose. Regulators fear that stablecoins could become a systemic risk as crypto and traditional markets increasingly entwine. The Treasury Department declined to comment on today’s meeting. |

| Tethered to what? Last week, the C.F.T.C. ordered Tether, the issuer of the most popular dollar-backed stablecoin, to pay $41 million in fines for years of misleading statements about the assets backing its tokens. Yesterday, the activist short-seller Hindenburg Research offered a $1 million bounty for information about Tether’s reserves. |

| [h=2]Joe Manchin’s billionaire adviser[/h] |

| Nelson Peltz, the billionaire financier famous for shaking up companies he invests in, told CNBC yesterday that he speaks with Senator Joe Manchin weekly. “Joe is the most important guy in D.C. — maybe the most important guy in America today,” Peltz said of the West Virginia Democrat, a key swing voter in a narrowly divided Congress. “I call him every week and say: ‘Joe, you’re doing great. Stay tough.’” |

| Manchin’s powwows with Peltz raise questions for the senator, who has faced criticism from his party after The Times reported that he was pushing to block a key program in President Biden’s plan to combat climate change. The $150 billion clean electricity program would have rewarded utilities that shut down coal and natural gas plants in favor of greener energy, and penalized those that did not. |

| The problem: Peltz’s investment firm, Trian Partners, is a big shareholder in General Electric, one of the largest managers of gas-fueled electricity plants. Peltz’s son-in-law Ed Garden, who is also a Trian partner, is a G.E. board member. Biden’s clean electricity program would have had a significant effect on G.E., which reported more than $17 billion in revenue from its power business last year, about three-quarters of which came from gas-power generation. (G.E. also has a growing renewable energy business, and some of Biden’s other climate proposals could benefit those operations.) |

| A spokesperson for Peltz declined to comment. Manchin’s office did not return a request for comment. |

| Will Manchin’s supporters be bothered by him getting advice from a Wall Street billionaire? Regardless, the fact is that West Virginia is one of the nation’s largest coal and natural gas producing states. On top of that, Manchin, as The Times has reported, owns a stake in a coal brokerage business he founded that is now run by his son. |

|

| [h=2]The $50 billion question about legacy admissions[/h] |

| Amherst College announced yesterday that it would end legacy admissions, which give the children of alumni preferred treatment in the application process. It joins other selective schools, like M.I.T., Johns Hopkins and Caltech, in scrapping the practice. |

| Elite schools say legacy admissions encourage alumni to donate more,but a study that tracked giving at 100 schools from 1998 to 2008 found no evidence of that. Still, schools with legacy admissions tend to attract higher alumni donations in general than others, possibly because they overselect from wealthy families. |

| Amherst’s decision raises issues around the admissions process. And if the trend catches on, there could be a huge amount of money at stake. According to one survey, U.S. higher-education institutions pulled in nearly $50 billion in donations in the year to June 2020. Here are some of our questions about that money if others end legacy admissions: |

|

| What do you think will happen? Let us know at dealbook@nytimes.com. Include your name and location, and we may feature your response in a future newsletter. |

| Enterprise Subscriptions |

| To unlock the full breadth of coverage of The New York Times for you and your team, get an institutional digital subscription. |

| [h=3]THE SPEED READ[/h] |

| Deals |

|

| Policy |

|

| Best of the rest |

|

| Thanks for reading! We’ll see you tomorrow. |

| We’d like your feedback. Please email thoughts and suggestions to dealbook@nytimes.com. |

|

|

|

|

|

|

| Andrew Ross Sorkin, Founder/Editor-at-Large, New York @andrewrsorkin |

| Jason Karaian, Editor, London @jkaraian |

| Sarah Kessler, Deputy Editor, Chicago @sarahfkessler |

| Stephen Gandel, News Editor, New York @stephengandel |

| Michael J. de la Merced, Reporter, London @m_delamerced |

| Lauren Hirsch, Reporter, New York @LaurenSHirsch |

| Ephrat Livni, Reporter, Washington D.C. @el72champs |

|

| Global Market Comments October 21, 2021 Fiat Lux Featured Trade:(MY 20 RULES FOR TRADING IN 2022)

|

| � |

My 20 Rules for Trading in 2022I usually try to catch three or four trend changes a year, which might generate 100-200 trades, and often come in frenzied bursts. Since I am one of the greatest tightwads that ever walked the planet, I only like to buy positions when we are at the height of despair and despondency, and traders are raining off the Golden Gate Bridge like a winter downpour. Similarly, I only like to sell when the markets are tripping on steroids and ecstasy and are convinced that they can live forever.

Over the five decades that I have been trading, I have learned a number of tried and true rules which have saved my bacon countless times. I will share them with you today. 1) Don’t over trade. This is the number one reason why individual investors lose money. Look at your trades of the past year and apply the 90/10 rule. Dump the least profitable 90% and watch your performance skyrocket. Then aim for that 10%. Over-trading is a great early retirement plan for your broker, not you. 2) Always use stops. Risk control is the measure of the good hedge fund trader. If you lose all your capital on the lemons, you can’t play when the great trades set up. Consider cash as having an option value. It's easier to dig yourself out of a small hole than a big one. 3) Don’t forget to sell. Date, don’t marry your positions. Remember, hogs get fed and pigs get slaughtered. My late mentor, Barton Biggs, told me to always leave the last 10% of a move for the next guy. 4) You don’t have to be a genius to play this game. If that was required, Wall Street would have run out of players a long time ago. If you employ risk control and stops, then you can be wrong 40% of the time, and still make a living. That’s a little better than a coin toss. If you are wrong only 30% of the time, you can make millions. If you are wrong a scant 20% of the time, you are heading a trading desk at Goldman Sachs. If you are wrong a scant 10% of the time, you are running a $20 billion hedge fund that the public only hears about when you pay $100 million for a pickled shark at a modern art auction. If someone says they are never wrong, as is often claimed in other newsletters and trade mentoring services, run a mile, because it is impossible. By the way, I was wrong 7% of the time in 2021. That’s what you’re paying for. 5) This is hard work. Trading attracts a lot of wide-eyed, naïve, but lazy people because it appears so easy from the outside. You buy a stock, watch it go up, and make money. How hard is that? The reality is that successful investing requires twice as much work as a normal job. The more research you put into a trade, the more comfortable you will become, and the more profitable it will be. That’s what this letter is for. 6) Don’t chase the market. If you do, it will turn back and bite you. Wait for it to come to you. If you miss the train, there will be another one along in minutes, hours, days, weeks, or months. Patience is a virtue. 7) Limit Your Losses. When I put on a position, I calculate how much I am willing to lose to keep it. I then put a stop just below there. If I get triggered, I just walk away. Emotion never enters the equation, just cold, steely-eyed discipline. Only enter a trade when the risk/ reward is in your favor. You can start at 3:1. That means only risk a dollar to potentially make three. 8) Don’t confuse a bull market with brilliance. I am not smart, just old as dirt. Nothing new ever happens, just endless repetition of the old stuff. But is this 1921, or 1929? 9) Tape this quote from the great economist and early hedge fund trader of the 1930’s, John Maynard Keynes, to your computer monitor: "Markets can remain illogical longer than you can remain solvent." Hang around long enough, and you will see this proven time and again (ten-year Treasuries at 0.31%?!). 10) Don’t believe the media. I know, I used to be one of them. There is a reason why they are talking heads and not billionaire traders. Look for the hard data, the numbers, and you’ll see that often the talking heads, the paid industry apologists, and politicians don’t know what they are talking about (the Gulf oil spill will create a dead zone for decades?). Average out all the public commentary, and half are bullish and half bearish at any given time. The problem is that they never tell you which one is right (that is my job). When they all go one way, the markets usually go the opposite direction.

12) Sometimes the conventional wisdom is right. 13) Invest like a fundamentalist, execute like a technical analyst. This is what all the pros do. 14) Use technical analysis only, and you will buy every rally, sell every dip, and end up broke. That said, learn what an “outside reversal” is, and who the heck is that Italian renaissance guy, Leonardo Fibonacci. 15) The simpler a market approach, the better it works because more people understand it and buy it. Everyone talks about “buy low and sell high”, but few actually do it. All black boxes eventually blow up, if they were ever there in the first place. 16) Markets are made up of people. Understand and anticipate how they think, and you will know what the markets are going to do. 17) Understand what information is in the market and what isn’t and you will make more money. 18) Do the hard trade, the one that everyone tells you that you are “Mad” to do. If you add a position and then throw up on your shoes afterwards, then you know you’ve done the right thing. This is why people started calling me “Mad” 40 years ago. (What? Japan was a huge buy in 1980? Tech stocks were a huge buy last summer?). 19) If you are trying to get out of a hole, the first thing to do is quit digging and throw away the shovel. Sell everything. A blank position sheet can be invigorating ad illuminating. 20) Making money in the market is an unnatural act, and fights against the tide of evolution. We, humans, are predators and hunters evolved to track game on the horizon of an African savanna. Modern humans are maybe 5 million years old, but civilization has been around for only 10,000 years. Our brains have not had time to make the adjustment. In the market, this means that if a stock has gone up, you believe it will continue to do so. This is why market tops and bottoms see volume spikes. To make money, you have to go against these innate instincts. Some people are born with this ability, while others can only learn it through decades of training. I am in the latter group.

Great Hunter, Lousy Trader

|

Quote of the Day“Bonds are priced artificially because you’ve got some guy buying tens of billions of dollars’ worth a month. That will change at some point, and when it does, people are going to lose a lot of money,” said the Oracle of Omaha, Warren Buffett.

|

| This is not a solicitation to buy or sell securities The Mad Hedge Fund Trader is not an Investment advisor For full disclosures click here at: http://www.madhedgefundtrader.com/disclosures The "Diary of a Mad Hedge Fund Trader"(TM) and the "Mad Hedge Fund Trader" (TM) are protected by the United States Patent and Trademark Office The "Diary of the Mad Hedge Fund Trader" (C) is protected by the United States Copyright Office Futures trading involves a high degree of risk and may not be su |

At some point the party and high ranking members will be very happy $$$ with chunks they've already extracted.

For BABA it's been a "if you can't beat um have them join in".....$$$$

greed is universal.

ha, J Ma sighting in Hong Kong, lol

who knew baba would be a value play;

https://markets.businessinsider.com...libaba-stock-q3-china-tech-regulation-2021-10

finished watching Squid Games a week ago, the ending scene had an interesting line....and for whatever reason Munger came to mind

contestant 001 :

Do you know what people with no money have in common with people with too much money. That living isnt fun

dunno, Charlie seems to like to make money.

BABA reports Nov 3rd

https://www.tipranks.com/stocks/baba/earnings-calendar

|

| Global Market Comments October 22, 2021 Fiat Lux Featured Trade:(OCTOBER 20 BIWEEKLY STRATEGY WEBINAR Q&A),

(DIS), (TLT), (TBT), (FXI), (BABA), (BIDU), (JD), (USO), (JPM), (MS), (GS), (BITO), ($BTCUSD)

|

| � |

October 20 Biweekly Strategy Webinar Q&ABelow please find subscribers’ Q&A for the October 20 Mad Hedge Fund Trader Global Strategy Webinar broadcast from the safety of Silicon Valley. Q: Why are stocks so high? Won’t inflation hurt companies? A: Inflation hurts bonds (TLT), not companies, which is why we are short the bond market and have been short for most of this year. Inflation actually helps companies because it allows them to raise prices at a faster rate. The ability to raise prices is the best that it’s been in 45 years, and that is enabling them to either maintain or increase profit margins. Q: Where is all this liquidity coming from to drive the stocks high after the Fed ends Quantitative easing? A: In the last 20 years, the liquidity of the US has gone from 6% of GDP to 47% of GDP. That is an enormous increase, and most of that money has gone into stocks and real estate, which is why both have been on a tear for the last 11 years. And I expect that to continue; the Fed isn’t even hinting at taking liquidity out of the system until well into 2023. On top of that, you have corporate profit exploding from $2 trillion last year to $10 trillion this year, adding another $8 trillion to the system, and outpacing any Fed taper by a five to one margin. Corporations alone are using these profits to buy back more than $1 trillion of their own stock this year. Q: I’m hearing so much about the supply chain problems these days. Is that just a short-term fixable problem or a long-term structural one? A: Absolutely it’s short-term. This actually isn’t a pandemic-related problem but a private capital investment one. It’s being caused by the record growth of the US economy which is sucking in more imports than it has ever seen before. We’ve actually exceeded pre-pandemic levels of imports a while ago. Import infrastructure isn’t big enough to handle it. If it was there wouldn’t be enough truckers to handle it. We had a shortage of 50,000 truckers before the pandemic, now we’re short 100,000. Some of these guys are making up to $100,000 a year, not bad for a high school level education. Expect it to get worse before it gets better, but it will get better eventually. That is why Amazon is having trouble, because supply chain problems may bring a weak Christmas, which is the most profitable time of year for them. If we get any big selloff at Amazon for this reason, you want to buy that bottom because it’ll double again in 3 years. Q: Walt Disney (DIS) has pretty much sideways the whole year around $70, is this going down or should I buy? A: I would look to buy but I would buy an in-the-money LEAPS, like a $150-$170 one year out. Disney’s been hit with a lot of slowdowns lately, slowdowns with park reopening, movie releases, new streaming customers. But these are all temporary slowdowns and will pick up again next year. Disney is the classic reopening play, so you will get another bite at the apple with a second reopening. Maybe “bite of the mouse” is a better metaphor. Q: Global growth is down because of China (FXI) with their PMI under 50; do you think they will drag down the entire global economy in 2022? A: No, if we recover, their largest customer, they will recover too. Remember their pandemic cases are only a tiny fraction of what ours were, some 4,000 or so, and their economy is still export-driven. You can't have major port congestion in Los Angeles and a weak economy in China, those are just two ends of one chain. I would look for a recovery in China next year. As for the stocks, I don’t know because that’s an entirely political issue; Baidu (BIDU), (JD), and Alibaba (BABA) are still getting beaten like a redheaded stepchild. We don’t know when that’s going to end; it’s an unknown. So, stand aside on Chinese plays, especially when the stuff at home is so much better with all these financials and tech stocks to invest in. Q: What do you think about meme stocks? A: I think you should avoid them like the plague. When there are so many good quality stocks with long term uptrends, why bother dumpster diving? You’re better off buying a lottery ticket. Q: Which US bank should I invest in? A: If you want the gold standard, you buy JP Morgan (JPM) which just announced blowout earnings. If you want a broker, go for Morgan Stanley (MS), which also just announced blowout earnings last week. And I want you to make my monthly pension payment secure, as it comes from Morgan Stanley. Keep those checks coming! Q: Are we headed to $150 oil (USO)? A: No, what we’re seeing here is a short-term spike in prices due to supply chain problems, OPEC discipline, a booming economy, and Russia trying to squeeze Europe on energy supplies. I don’t see it continuing much per year as the stocks could be popping out, so avoid oil and energy plays. The solar plays, like (TAN), (FSLR), and (SPWR) on the other hand, all look like they have miles to go. Q: You said in your Webinar that you can still get a 50% Return on the United States Treasury Bond Fund (TLT) LEAPS. Can you give me the specifics? A: If you went a year out on Tuesday when I recorded this webinar, you could buy the (TLT) October 2022 $150-$150 vertical bear put spread for $3.40 for a maximum profit on expiration at $5.00 of $47%. That’s where you buy the $155 put and sell short the $150 put against it. Since then, bonds have fallen by $3.00, and it is now trading at $3.60 giving you a 39% return. Try to establish this position on the next (TLT) rally. Q: What is your yearend target for Bitcoin? A: Now that we have broken the old high at $66,000, we should be able to make it to $100,000 by January. The SEC approving that new ProShares Bitcoin Strategy ETF (BITO) ETF unlocks trillions of dollars which can now go into Bitcoin, those regulated by the Investment Company Act of 1940. Crypto is now the fastest-growing segment of the financial markets. It’s inflation that driving this, and the Fed is throwing fuel on the fire by taking no action in the face of a red hot 5.4% Consumer Price Index. Even if the Fed does taper, the action will be more than offset by the massive $8 trillion increase in corporate profits. Companies are not only buying their own stocks, they are also using these profits to buy Bitcoin. I see this as a Bitcoin node myself. Be sure to dollar cost average your position by putting in a little bit of money every day because Bitcoin is wildly volatile, up 140% since August 1. By the way, it’s not too late to subscribe to the Mad Hedge Bitcoin Letter, which we are taking down from the store on Monday for a major upgrade by clicking here. We are raising prices after that. To watch a replay of this webinar with all the charts, bells, whistles, and classic rock music, just log in to www.madhedgefundtrader.com, go to MY ACCOUNT, click on the paid service you are currently in (GLOBAL TRADING DISPATCH, TECH LETTER, or BITCOIN LETTER), then select WEBINARS, and all the webinars from the last ten years are there in all their glory. Good luck and stay healthy. John Thomas CEO & Publisher The Diary of a Mad Hedge Fund Trader

|

Quote of the Day"The question is not whether Tesla will sell 80,000 or 90,000 cars this year, but whether they will sell 14 million or 15 million in 15 years. I believe they can do it," said Ron Baron of long-term value player, Baron Capital.

|