You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Crypto holders

- Thread starter Mr_Mark

- Start date

The liquidity environment in the next 5-10 yrs will be different than the last 10 years. The Fed primer for QT cycle: $50B/mo (June-July-Aug). After that, it will be on auto pilot at the rate of $90B/mo for a duration of 2 years.

Jay Powell blew up crypto market and sent bitcoin crashing 90% in 2018 - it's about halfway there this time.

Jay Powell blew up crypto market and sent bitcoin crashing 90% in 2018 - it's about halfway there this time.

Bitcoin crashed in January 2018. It crashed because of the normal cycle. Jay Powell bashed it months after.The liquidity environment in the next 5-10 yrs will be different than the last 10 years. The Fed primer for QT cycle: $50B/mo (June-July-Aug). After that, it will be on auto pilot at the rate of $90B/mo for a duration of 2 years.

Jay Powell blew up crypto market and sent bitcoin crashing 90% in 2018 - it's about halfway there this time.

Cuban and Musk both talk out of both sides of their mouth a lot and part of their brands are portraying being the cool, futuristic billionaires. I mean Musk pimped doge and that shit is worthless.

But Buffett didn't see the internet or the big tech stocks as worth buying until long after they grew rapidly, the guys 90, he IS the establishment. Of course he is going to be behind on disruptive technology that threatens the status quo, whatever that may be

Dimon just a banker, his opinions can change by the week

You can make arguments for both sides by blindly appealing to authority really

But Buffett didn't see the internet or the big tech stocks as worth buying until long after they grew rapidly, the guys 90, he IS the establishment. Of course he is going to be behind on disruptive technology that threatens the status quo, whatever that may be

Dimon just a banker, his opinions can change by the week

You can make arguments for both sides by blindly appealing to authority really

The liquidity environment in the next 5-10 yrs will be different than the last 10 years. The Fed primer for QT cycle: $50B/mo (June-July-Aug). After that, it will be on auto pilot at the rate of $90B/mo for a duration of 2 years.

Jay Powell blew up crypto market and sent bitcoin crashing 90% in 2018 - it's about halfway there this time.

Maybe, how long have people been saying that?

Might be 5-10yrs, might be another 6 months. If you couldn't do 50B month in 2018, why can you do it now? And 90B? Who knows?

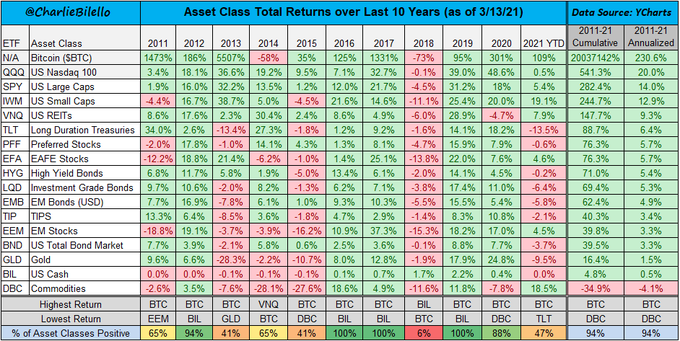

No clue where bitcoin is heading, but even if it drops to $10K, bitcoin is still the best asset class since 2009. It traded for a dollar when it first started at Mt.Gox in 2010.

The last Fed QT cycle started in Nov 17' and ended in Dec 18' with the run rate of $50B/mo. They U-turned it in Jan 19'.

The upcoming Fed QT cycle will begin next month. They have prepared the market for this. They're planning to shrink the balance sheet to $6.5T by 2025.

Jay Powell didn't have to deal with 10% inflation in 18/19, or Bernanke/Yellen, US inflation was very steady at 2% - 2.5% since 2009, then shit hit the fan following the pandemic.

I don't believe the Fed can engineer a 'soft landing'. Jay admitted it, his hand is tied, so he could blow up bitcoin, QQQ, S&P500, or even housing along the way until the inflation rate comes down to a manageable range.

The last Fed QT cycle started in Nov 17' and ended in Dec 18' with the run rate of $50B/mo. They U-turned it in Jan 19'.

The upcoming Fed QT cycle will begin next month. They have prepared the market for this. They're planning to shrink the balance sheet to $6.5T by 2025.

Jay Powell didn't have to deal with 10% inflation in 18/19, or Bernanke/Yellen, US inflation was very steady at 2% - 2.5% since 2009, then shit hit the fan following the pandemic.

I don't believe the Fed can engineer a 'soft landing'. Jay admitted it, his hand is tied, so he could blow up bitcoin, QQQ, S&P500, or even housing along the way until the inflation rate comes down to a manageable range.

ill believe that when I see it

You think they’re gonna torch off 30-40 trillion in wealth? (give or take)

rates aren’t even over 1% and QT hasn’t even started and SPY is down 15%

rates had to get to 2.5 and 50b month of QE led to about 800b of reduction last time for those type of downturn #s

put/pivot comes way before all that imo

You think they’re gonna torch off 30-40 trillion in wealth? (give or take)

rates aren’t even over 1% and QT hasn’t even started and SPY is down 15%

rates had to get to 2.5 and 50b month of QE led to about 800b of reduction last time for those type of downturn #s

put/pivot comes way before all that imo

They telegraphed rate hike well in advance that the Fed will start Sep with 2.25%, maybe the market has priced it in. Banks are sitting on 2.5T excess liquidity currently, they don't lend it. You would think if the Fed takes that $ away tomorrow, it shouldn't be an issue.

Energy is the problem. We don't know the full effect of Russia oil embargo yet. That senile Chuck Grassley has another go at NOPEC. Nightmare scenario for energy market is the US sanctioning Russia/Saudi at the same time. They don't want to push the Saudis to the breaking point, it could spell the end for the US dollar.

Energy is the problem. We don't know the full effect of Russia oil embargo yet. That senile Chuck Grassley has another go at NOPEC. Nightmare scenario for energy market is the US sanctioning Russia/Saudi at the same time. They don't want to push the Saudis to the breaking point, it could spell the end for the US dollar.

The reason the telegraphing led to a delayed reaction from the market is because no one believes them. After all the pivots, rate cuts, QE every time there is softening in assets, why would they? (Perhaps inflation 40yr is a new beast but they’ve just cried wolf too many times)

Powell said early March he is the new Volkcer and the market didn’t care until about 30-40 days later. The dot plots said they would start raising aggressively I believe 4-5 months ago?

Even now, does anyone really believe they are going to fight inflation at all costs if it means tipping the economy as collateral? Once something breaks, there will be a pivot to dovishness

You really think the FFR will be over 3% by the end of the year? Or that they’re gonna reduce by 95B a month? Lol shit will break fast, it already is and we’re in inning 1

Powell said early March he is the new Volkcer and the market didn’t care until about 30-40 days later. The dot plots said they would start raising aggressively I believe 4-5 months ago?

Even now, does anyone really believe they are going to fight inflation at all costs if it means tipping the economy as collateral? Once something breaks, there will be a pivot to dovishness

You really think the FFR will be over 3% by the end of the year? Or that they’re gonna reduce by 95B a month? Lol shit will break fast, it already is and we’re in inning 1