You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Would Ben Stein admit he was wrong?

- Thread starter barelyworking

- Start date

Why would he or any of the many morons in that video admit they are wrong?

There is no one to hold their feet to the fire. Heck if there was no one to call me a lying decietful weasel i would be on here claiming a 110% winning clip in my picks!

and i would never have to apologize or scale back any thing if one of my picks backfired badly and many people got burned.

There is no one to hold their feet to the fire. Heck if there was no one to call me a lying decietful weasel i would be on here claiming a 110% winning clip in my picks!

and i would never have to apologize or scale back any thing if one of my picks backfired badly and many people got burned.

Why would he or any of the many morons in that video admit they are wrong?

There is no one to hold their feet to the fire. Heck if there was no one to call me a lying decietful weasel i would be on here claiming a 110% winning clip in my picks!

and i would never have to apologize or scale back any thing if one of my picks backfired badly and many people got burned.

Finally something out of your mouth besides a well spent cock. I agree, in the MSM there is no accountability, hence why the cycle continues and that another reason why Americans are stupid.

But the MSM has always been weird anyway...

it has an agenda, it always has had an agenda, right from 1950.

Sometimes you agree with its agenda, at other times in your life you will fundamentally disagree.

If you want to try and get behind the BS nowadays at least you can go on the net.

The net!

a poor subject to focus on imo.

Like a couple of football fans arguing about a trout fishing program on channel 327.

it has an agenda, it always has had an agenda, right from 1950.

Sometimes you agree with its agenda, at other times in your life you will fundamentally disagree.

If you want to try and get behind the BS nowadays at least you can go on the net.

The net!

a poor subject to focus on imo.

Like a couple of football fans arguing about a trout fishing program on channel 327.

Finally something out of your mouth besides a well spent cock. I agree, in the MSM there is no accountability, hence why the cycle continues and that another reason why Americans are stupid.

I will take that as a complement coming from the progeny of a professional goat rapist!

Your momma shoulda stayed with the goats!

why everybody gives peter shiff props is beyond me

guy has been dead wrong about hyperinflation and been getting his ass handed to him just like everybody else of late

i mean he was right about the economy going to shit but not about the dollar and foreign markets

his euro pacific capital fund down a ton and its mantra is "there is a bull market somewhere" (well no there isn't this is global recession/depression unfolding)

maybe he'll prove right down the road

but for the time being deflation the name of the game just like the 30s

probably a reason almost nobody in the MSM yapping up deflation....roubini the only guy with a voice in the MSM that's been right to date

--------------------------

This week, Asian markets were initially energized by China's announcement of a near $600 billion economic stimulus package for its own economy. Although I have never been a fan of government-fueled stimuli, the relative wisdom of the plan hinges on the source of funds the Chinese government decides to utilize. Their best choice would be the country's nearly $2 trillion in foreign reserves, the largest portion of which is held in U.S. Treasury and agency debt. This pile of dollars, which really amounts to no more than a subsidy for U.S. consumers, does nothing to benefit Chinese citizens.

If it does decide to employ this ocean of cash, China will become a net seller of U.S Treasuries just as the U.S. Government itself will be pushing up its issuance of new Treasury bonds into record territory. With two huge sellers and few major buyers (just about every major creditor nation having problems of their own), the Federal Reserve will become the only reliable customer. As a result, not only will the Fed monetize our own economic stimulus packages, but will be forced to provide the same service to the Chinese.

Most economists feel that China will maintain the status quo by borrowing or printing the funds for their own stimulus while continuing to hoard its trillions of existing U.S. dollars. Most also believe that the Chinese will substantially increase their dollar holdings in order to finance America's never-ending string of bailouts and its ballooning Federal deficit, which is soon to pass $1 trillion annually. These optimists are in for a rude awakening.

The Chinese cannot follow such a course without unleashing intolerable inflation at home. Selling down their vast reserves of U.S. debt and using the proceeds for domestic infrastructure projects (or anything else for that matter) is a vastly superior stimulus mechanism than "lending" to Americans so we keep "buying" their products. When Chinese authorities finally figure this out the United States will suffer the consequences.

As they have in the past my critics will cavalierly dismiss this view. However, as the following compilation of some of my 2006 and 2007 television appearances attests, my economic predictions have proved extremely prescient:

Click here to watch it on YouTube.

However, given recent global stock market and currency volatility, some are questioning the wisdom of my investment strategy. I am confident that the short-term effects suffered by foreign stocks and currencies as a result of financial de-leveraging and losses on bad U.S. debt will prove temporary. If so, my market forecasts will ultimately prove just as accurate as my economic predictions. Those who are currently patting themselves on the back for having had the apparent foresight to stay in U.S. dollars will be singing a different tune when the music stops playing.

Sincerely,

Peter Schiff

President and Chief Global Strategist

Euro Pacific Capital

guy has been dead wrong about hyperinflation and been getting his ass handed to him just like everybody else of late

i mean he was right about the economy going to shit but not about the dollar and foreign markets

his euro pacific capital fund down a ton and its mantra is "there is a bull market somewhere" (well no there isn't this is global recession/depression unfolding)

maybe he'll prove right down the road

but for the time being deflation the name of the game just like the 30s

probably a reason almost nobody in the MSM yapping up deflation....roubini the only guy with a voice in the MSM that's been right to date

--------------------------

This week, Asian markets were initially energized by China's announcement of a near $600 billion economic stimulus package for its own economy. Although I have never been a fan of government-fueled stimuli, the relative wisdom of the plan hinges on the source of funds the Chinese government decides to utilize. Their best choice would be the country's nearly $2 trillion in foreign reserves, the largest portion of which is held in U.S. Treasury and agency debt. This pile of dollars, which really amounts to no more than a subsidy for U.S. consumers, does nothing to benefit Chinese citizens.

If it does decide to employ this ocean of cash, China will become a net seller of U.S Treasuries just as the U.S. Government itself will be pushing up its issuance of new Treasury bonds into record territory. With two huge sellers and few major buyers (just about every major creditor nation having problems of their own), the Federal Reserve will become the only reliable customer. As a result, not only will the Fed monetize our own economic stimulus packages, but will be forced to provide the same service to the Chinese.

Most economists feel that China will maintain the status quo by borrowing or printing the funds for their own stimulus while continuing to hoard its trillions of existing U.S. dollars. Most also believe that the Chinese will substantially increase their dollar holdings in order to finance America's never-ending string of bailouts and its ballooning Federal deficit, which is soon to pass $1 trillion annually. These optimists are in for a rude awakening.

The Chinese cannot follow such a course without unleashing intolerable inflation at home. Selling down their vast reserves of U.S. debt and using the proceeds for domestic infrastructure projects (or anything else for that matter) is a vastly superior stimulus mechanism than "lending" to Americans so we keep "buying" their products. When Chinese authorities finally figure this out the United States will suffer the consequences.

As they have in the past my critics will cavalierly dismiss this view. However, as the following compilation of some of my 2006 and 2007 television appearances attests, my economic predictions have proved extremely prescient:

Click here to watch it on YouTube.

However, given recent global stock market and currency volatility, some are questioning the wisdom of my investment strategy. I am confident that the short-term effects suffered by foreign stocks and currencies as a result of financial de-leveraging and losses on bad U.S. debt will prove temporary. If so, my market forecasts will ultimately prove just as accurate as my economic predictions. Those who are currently patting themselves on the back for having had the apparent foresight to stay in U.S. dollars will be singing a different tune when the music stops playing.

Sincerely,

Peter Schiff

President and Chief Global Strategist

Euro Pacific Capital

Last edited:

why did we not hyperinflate after the first depression?

fiat is faith as long as they retain faith the game continues

and the USD is the center of the fiat universe since we are the big boy in the global economy that the entire global economy depends on

i don't like the game but that's how its played and nothing you or me rant on this forum is gonna change the fact that 90%+ of world population still sees value in holding fiat money

and even me and you continue to play the game gaining fiat dollars for our labors and buying goods with those fiat dollars

fiat is faith as long as they retain faith the game continues

and the USD is the center of the fiat universe since we are the big boy in the global economy that the entire global economy depends on

i don't like the game but that's how its played and nothing you or me rant on this forum is gonna change the fact that 90%+ of world population still sees value in holding fiat money

and even me and you continue to play the game gaining fiat dollars for our labors and buying goods with those fiat dollars

Hyperinflation is the long term outcome. You'll get your beloved Deflation, but hyperinflation is coming...just gonna take a little time.

Tiznow.. I have to agree with this bestial molestor in this case!

Schiff will ultimately be proven right about hyper-inflation in the long run! I simply dont see how we dont get hyperinflation very soon. And i do think it will hit hard and quicker than most would anticipate.

Every one and their momma knows the government money printing presses are working at top speed right now trying to pump as much cash into the system as possible.

Inflation is almost inevitable. Schiff may have timed it badly, but he will be proven right ulitiamtely just as he was in those clips.

for the US to hyperinflate basically the entire global economy will have to be reduced to a bartering society

only way we hyperinflate is if the entire global fiat based financial system blows up complete faith is lost and nobody accepts fiat dollars for labors and goods

there will be inflation on the back end (just as there always has been) once the system flushes out all the deflating debt

only way we hyperinflate is if the entire global fiat based financial system blows up complete faith is lost and nobody accepts fiat dollars for labors and goods

there will be inflation on the back end (just as there always has been) once the system flushes out all the deflating debt

:nohead:

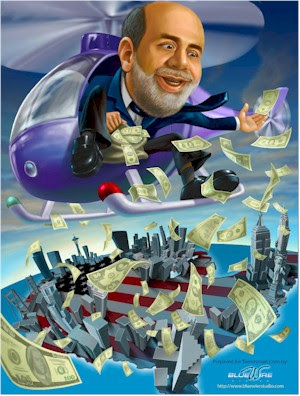

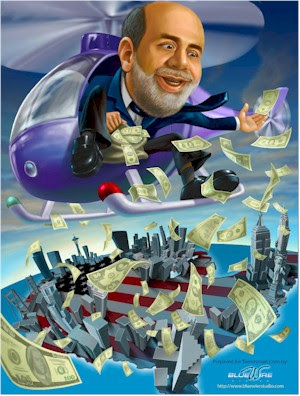

Who is heading the means of printing money?

Who gave a speech on November 21, 2002 as a Fed Governor to the National Economists Club entitled "Deflation: Making Sure ‘It’ Doesn’t Happen Here."

Who said...

"I am confident that the Fed would take whatever means necessary to prevent significant deflation in the United States …"

:think2:

So then, if not deflation then what? Remember that guy Newton? Do you the presses stopping from printing anytime soon?

Who is heading the means of printing money?

Who gave a speech on November 21, 2002 as a Fed Governor to the National Economists Club entitled "Deflation: Making Sure ‘It’ Doesn’t Happen Here."

Who said...

"I am confident that the Fed would take whatever means necessary to prevent significant deflation in the United States …"

:think2:

So then, if not deflation then what? Remember that guy Newton? Do you the presses stopping from printing anytime soon?

After the Great Depression, just like after every other depression in our history, there was an industrial and manufacturing base in this country that enabled us to produce our way back to prosperity. That base is GONE FOR GOOD. Explain to me Tizzy, how we avoid either going bankrupt or devaluing the dollar to practically nothing once the Chinese stop funding our debt.

After the Great Depression, just like after every other depression in our history, there was an industrial and manufacturing base in this country that enabled us to produce our way back to prosperity. That base is GONE FOR GOOD.

Didnt even think of that, but true that. We dont produce SHIT and Tiz knows this very well and has said so himself. Good point Mama.

Didnt even think of that, but true that. We dont produce SHIT and Tiz knows this very well and has said so himself. Good point Mama.

We produce toilet paper and bullets.. and bombs too!

I smell an Obama war...:sad3: I am not kidding folks..

(seriously.. Its true if you look at history. Any time a big empire is on its knees, time to blow up somebody!!!)

Peter Shiff is exactly right, and its common sense whats going on.

The problem is solving these problems is politically impossible, because it means we need to feel the pain, now, not later.

Ron Paul was the only one with the balls to stand up and tell people the truth, but again, the american public just wasnt ready to really accept the truth

I think they do now, and if not, they certainly will after Obama gets done with us

More bailouts, what a joke!

The problem is solving these problems is politically impossible, because it means we need to feel the pain, now, not later.

Ron Paul was the only one with the balls to stand up and tell people the truth, but again, the american public just wasnt ready to really accept the truth

I think they do now, and if not, they certainly will after Obama gets done with us

More bailouts, what a joke!

After the Great Depression, just like after every other depression in our history, there was an industrial and manufacturing base in this country that enabled us to produce our way back to prosperity. That base is GONE FOR GOOD. Explain to me Tizzy, how we avoid either going bankrupt or devaluing the dollar to practically nothing once the Chinese stop funding our debt.

it will move back this way some and our export market will close the gap on our deficits as we consume less imports

we still export alot of shit people will need regardless of how bad the economy gets

it will all be a very very painful process though

a strong dollar is horrible for the current state/setup of the global economy

as for china if they dump dollar they go down the tubes with us

they need us

they can't survive depending on their own domestic consumption

they have yet to build a middle class and a large majority of their population still lives in poverty and are feeling the wrath of inflation created by a few of them living a better life if the big cities while creating a massive environmental disaster in the process

anyway i'm in the minority as usual

where i like to be

oil at 55 and the hyperinflationists just won't give up.....

also read the sell, sell, sell thread i did more ranting there

USD is the gold standard of the fiat universe

assuming the keep the faith alive in fiat and too date they've seemed to have a good job of that getting libor and ted spreads down and partially nationalizing the big banks

i don't like the game but it is what it is

Last edited:

ope:

ope: