You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

The DOW Hits 20,000.....1/25/2017

- Thread starter Greenbacks

- Start date

I'm steadfast that he'll be inflationary. The bond market response to him winning was telling as was the fed's notes . He is now saying a 20% import tax on Mexico imports ? That tax will be transferred and paid by Americans buying Mexican made products . Further evidence he's inflationary . Personally , I don't want cheap money . Fed keep raising rates

looks like he may be the 'volatility ' president as well . The markets use to hang on the words of yellen... now ? Possibly the tweets of trump

what a world

http://www.marketwatch.com/story/fe...ignificantly-higher-interest-rates-2017-02-14

Fed’s Lacker calls for ‘significantly higher’ interest rates

Significantly higher interest rates are warranted, a Federal Reserve official said Tuesday in comments that reflect the breadth of debate at the central bank.

Richmond Fed President Jeffrey Lacker, who is retiring and isn’t a voting member of the Federal Open Market Committee, said that almost all policy rules are recommending higher interest rates. The Fed currently targets its federal-funds rate between 0.5% and 0.75% after making two hikes in a decade.

“Taking the range of plausible alternatives into account, my view is that, with unemployment at or below levels corresponding to maximum sustainable employment and with inflation very close to our announced target of 2%, significantly higher rates are warranted,” he said.

The risk of waiting is that an unanticipated rise in inflation pressures will rise, which in turn will force a quick increase in rates, he said. “Such rapid adjustments can be hard to calibrate, and they heighten the risk of overdoing it and sending the economy into an unnecessary recession,” he said.

<iframe id="google_ads_iframe_/2/marketwatch.com/economy_thefed_2" title="3rd party ad content" name="google_ads_iframe_/2/marketwatch.com/economy_thefed_2" width="1" height="1" scrolling="no" marginwidth="0" marginheight="0" frameborder="0" style="box-sizing: border-box; margin: 0px; padding: 0px; border-width: 0px; border-style: initial; outline: 0px; vertical-align: bottom; background: transparent; width: 1px !important; height: 1px !important;"></iframe>

Lacker has consistently been at the hawkish end of the Fed spectrum with respect to interest rates.

The market will put more attention on the comments of Federal Reserve Chairwoman Janet Yellen, who is speaking before the Senate Banking Committee on Tuesday. The Fed’s last dot plot suggested three interest-rate hikes in 2017.

Lacker also discussed the market’s reaction to the election of President Donald Trump. One move he found “striking” were the implied probabilities derived from the options market, which now point to inflation above 3% being twice as likely as inflation below 1%. He also said the estimated term premium on 10-year Treasury securities has moved from negative territory to closer to zero, “suggesting that investors see less value in Treasuries as a hedge against deflation and are becoming more concerned about the exposure of the nominal Treasuries to the risk of inflation.”

...........

one sector that is poised to gain from higher interest rates are the financials. Couple that with possible chnages to dodd-frank and we have fuel.........re-posting;

xlf

the 10 yr monthly

the volume from 4 months ago (candlestick 4th from the right, massive white one) was telling. Largest volume month in over 5 yrs . Volume...volume...volume.

6th month daily chart

was channeling for awhile, yesterday broke. Any pullback and buy .....

it would need something catastrophic to change the trend in the chart.........of course that could happen.

she had a few words today..........

http://www.marketwatch.com/story/go...llen-testimony-2017-02-14?link=MW_latest_news

[h=1]Treasury yields rise for 4th day as Yellen leaves door open to March hike[/h]

In her semiannual testimony before the Senate Banking Committee, Yellen cautioned that the Fed will consider raising interest rates at its coming meetings, and that the risks of waiting too long to raise rates outweigh those for moving too quickly.

The yield on the 10-year Treasury note TMUBMUSD10Y, +1.51% rose 3.6 basis points to 2.470%, its highest level in a week and a half, while the yield on the two-year note TMUBMUSD02Y, +3.37% gained 3.2 basis points to 1.234%, its highest level in two weeks. The yield on the 30-year Treasury bond TMUBMUSD30Y, +0.98% climbed 2.7 basis points to 3.062%. Bond yields rise as prices fall.

“Fed Chair Yellen’s statement and testimony was far more hawkish than the bond market contemplated. She said it would be ’unwise to wait too long to tighten’, which has bond investors fearing a March interest rate increase is coming,” said Tom di Galoma, managing director for Treasury trading at Seaport Global.

“Janet Yellen is NOT committing herself to a March rate increase but she’s doing what I thought she should do and that is put March on the table,” said Peter Boockvar, chief market analyst at the Lindsey Group.

http://www.marketwatch.com/story/go...llen-testimony-2017-02-14?link=MW_latest_news

[h=1]Treasury yields rise for 4th day as Yellen leaves door open to March hike[/h]

The yield on the 10-year Treasury note TMUBMUSD10Y, +1.51% rose 3.6 basis points to 2.470%, its highest level in a week and a half, while the yield on the two-year note TMUBMUSD02Y, +3.37% gained 3.2 basis points to 1.234%, its highest level in two weeks. The yield on the 30-year Treasury bond TMUBMUSD30Y, +0.98% climbed 2.7 basis points to 3.062%. Bond yields rise as prices fall.

“Fed Chair Yellen’s statement and testimony was far more hawkish than the bond market contemplated. She said it would be ’unwise to wait too long to tighten’, which has bond investors fearing a March interest rate increase is coming,” said Tom di Galoma, managing director for Treasury trading at Seaport Global.

“Janet Yellen is NOT committing herself to a March rate increase but she’s doing what I thought she should do and that is put March on the table,” said Peter Boockvar, chief market analyst at the Lindsey Group.

Wall Street hits 5 straight days of all-time highs.

The President Trump Effect :aktion033

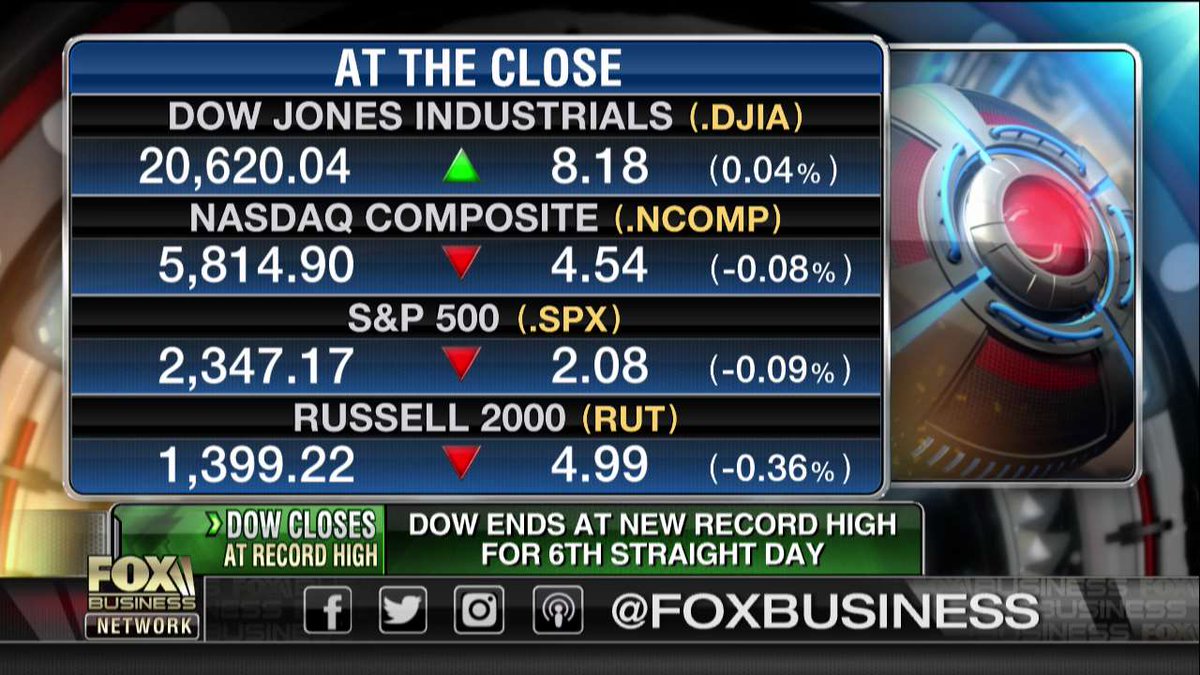

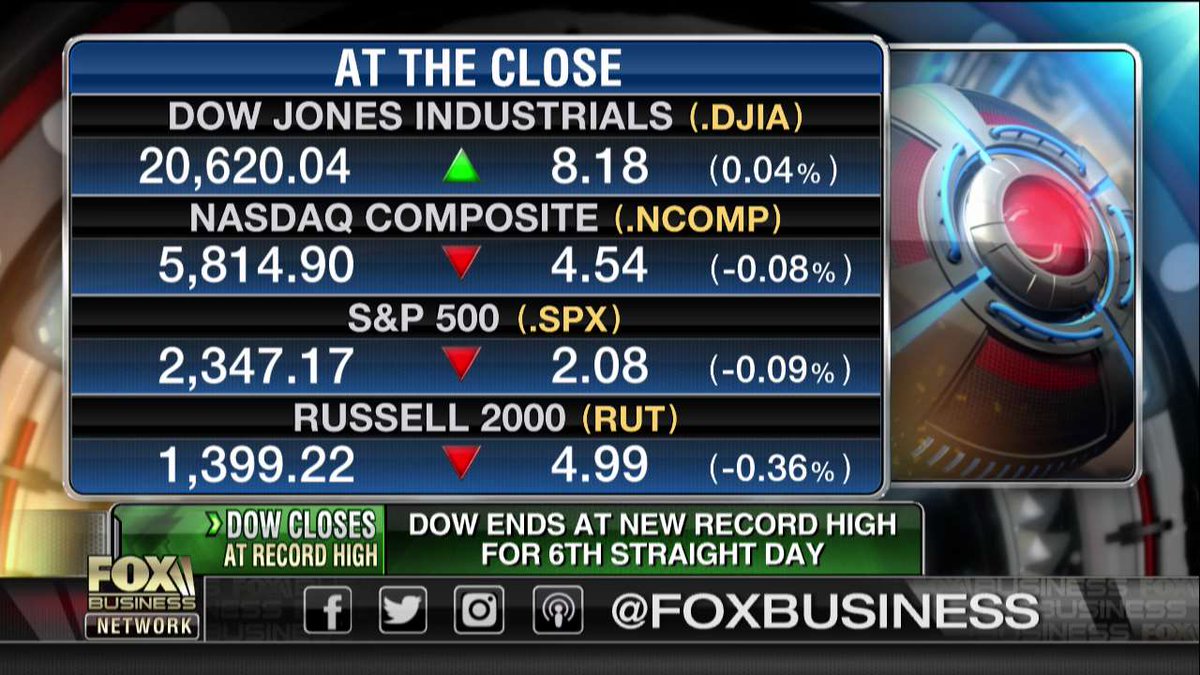

Dow ends at a new record high for the 6th straight day.

You never,ever hear CNN talking about this.

You never,ever hear CNN talking about this.

As usual, this blithering idiotic mental midget has no idea what he's talking about.Dow ends at a new record high for the 6th straight day.

You never,ever hear CNN talking about this.

http://money.cnn.com/2017/02/15/investing/nasdaq-record-stocks-trump/

http://money.cnn.com/2017/02/15/investing/stock-market-record-trump/

http://money.cnn.com/2017/02/16/investing/stock-market-rally-trump-history/

incredible run for the markets.........

DIA (the dow)

the 5 yr weekly

SPY (the s&p500)

5 yr weekly

qqq (nasdaq)

5 yr weekly

all 3 charts have similar, near vertical recent accents. All getting too far away from the 50 SMA (the curved line)--both of these are unstable for major indices. All three had volume last week that was greater than the previous week . Also, none have candlestick anatomy that suggests a turn. So , looks like we may be headed higher this week, at least for the start of the week. No red flags. ....................for now......

DIA (the dow)

the 5 yr weekly

SPY (the s&p500)

5 yr weekly

qqq (nasdaq)

5 yr weekly

all 3 charts have similar, near vertical recent accents. All getting too far away from the 50 SMA (the curved line)--both of these are unstable for major indices. All three had volume last week that was greater than the previous week . Also, none have candlestick anatomy that suggests a turn. So , looks like we may be headed higher this week, at least for the start of the week. No red flags. ....................for now......

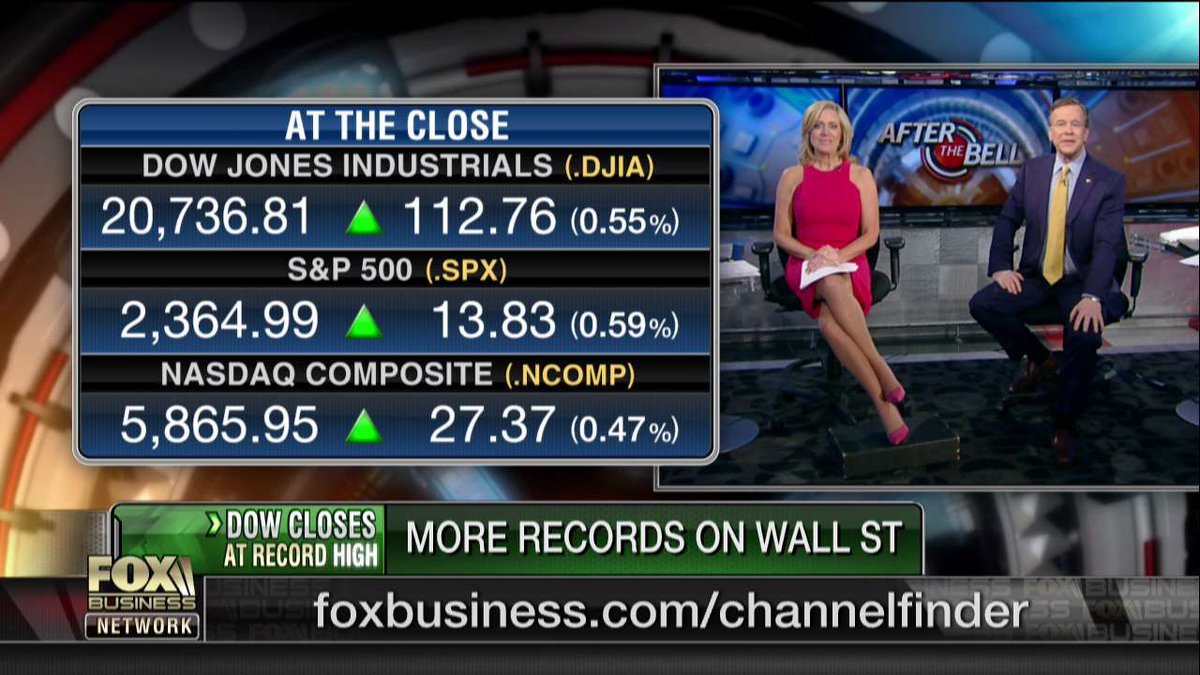

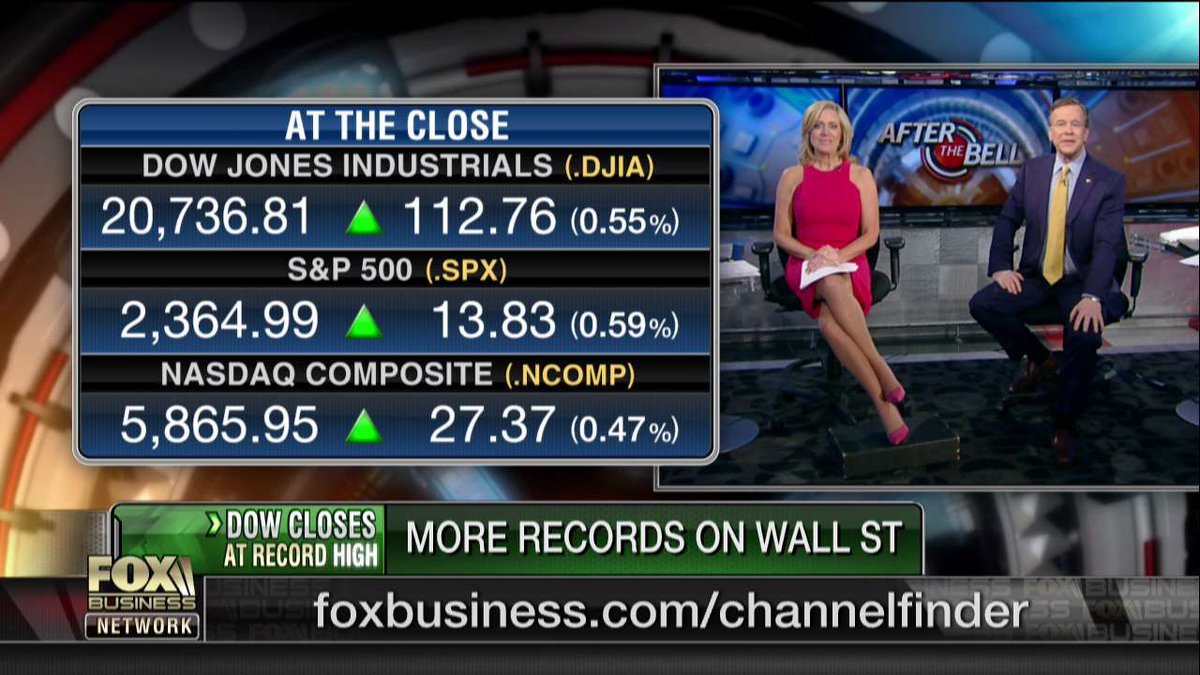

Another Day.....Another Record......You Go President Donald J. Trump :aktion033

incredible run for the markets.........

all 3 charts have similar, near vertical recent accents. All getting too far away from the 50 SMA (the curved line)--both of these are unstable for major indices. All three had volume last week that was greater than the previous week . Also, none have candlestick anatomy that suggests a turn. So , looks like we may be headed higher this week, at least for the start of the week. No red flags. ....................for now......

....let's see how she ends the week. Today's candlesticks were doji's , indecision, on lower vol. At the cross-roads..........running out of steam....dagone.......

....let's see how she ends the week. Today's candlesticks were doji's , indecision, on lower vol. At the cross-roads..........running out of steam....dagone....... Fed's minutes came out

why does she wear blue? terrible!!!.....

'The Dow on Wednesday eked out a slight gain to log its best record-setting streak in three decades, but the broader equity benchmarks struggled as Federal Reserve minutes implied that the central bank is comfortable with raising interest rates “fairly soon.”'

......

keep in mind, she has stated (late 2016) that 3 rate increases are on tap for 2017. Of course, she DID suggest similar for 2016, and that was a no go-- HOWEVER, whole different animal in Wash now..

beside the financials, another asset class poised to run with higher interest rates are preferred shares. Don't expect mass gains , rather a slow grind whilst collecting a very attractive yield. There are various etf products, posting below the Gorilla (by total assets) in the field

iShares U.S. Preferred Stock ETF

PFF

3 yr weekly

note the accent follwoing Trump winning, the massive vol in early Nov.

6 month daily

Looks like another record day.......My President breaking records on a daily basis cheersgif

Trump is working hard to make America Great again! I am sure you and Guesstard are pissed that you wont be abke to piss in the ladies room anymore lmao !

I don't care about the bathroom thing. I care how much he lies about it though "Caitlyn Jenner can use any bathroom she wants in trump tower"

trump is a total disaster so far. Worse every day.

Ill have to bump this in 2030

https://www.thestreet.com/video/141...strial-average-could-hit-100-000-by-2030.html

The Dow Jones Industrial Average could be headed to 100,000 by 2030. The tracking ETF for the Dow is the SPDR Dow Jones Industrial Average ETF (DIA) .

That's according to financial expert Ric Edelman, author of The Truth About Your Future: The Money Guide You Need Now, Later and Much Later.

The blue-chip index is currently just shy of 21,000. A surge to 100,000 would represent a roughly 376% increase.

"If I'm wrong, it'll be 150,000," he said. "We're going to see incredible profits in the United States, as well as globally."

Edelman's book aims to educate investors on how to save for retirement in the age of technology, where life expectancy is on the rise.

https://www.thestreet.com/video/141...strial-average-could-hit-100-000-by-2030.html

The Dow Jones Industrial Average could be headed to 100,000 by 2030. The tracking ETF for the Dow is the SPDR Dow Jones Industrial Average ETF (DIA) .

That's according to financial expert Ric Edelman, author of The Truth About Your Future: The Money Guide You Need Now, Later and Much Later.

The blue-chip index is currently just shy of 21,000. A surge to 100,000 would represent a roughly 376% increase.

"If I'm wrong, it'll be 150,000," he said. "We're going to see incredible profits in the United States, as well as globally."

Edelman's book aims to educate investors on how to save for retirement in the age of technology, where life expectancy is on the rise.

You are doing a great job,keep on doing it

You are doing a great job,keep on doing it