You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Obama's Continued lie: Cut Taxes for 95% Americans

- Thread starter festeringZit

- Start date

September 19, 2008Tax Plan Comparison: 43 to 44 Percent of Tax Filers Would Owe Nothing Under McCain, Obama Plans

Serious Public Discussion Needed on How Many "Nonpayers" U.S. Can Afford

Washington, DC, September 19, 2008 - A newly released study from the Tax Foundation shows that while current law would give 33 percent of tax filers zero liability next year, that figure would increase to 43 and 44 percent if John McCain's and Barack Obama's tax plans, respectively, were enacted in 2009.

In Tax Foundation Fiscal Fact No. 146, "Both Candidates' Tax Plans Will Reduce Millions of Taxpayers' Liability to Zero (or Less)," Tax Foundation President Scott Hodge estimates that while 47 million tax filers would see zero liability under current law in 2009, if all of McCain's or Obama's tax provisions were instituted next year, the number of "non-payers" would rise to 62 or 63 million, respectively.

"Both the McCain and Obama plans would increase this number by expanding existing tax benefits or creating new ones," says Hodge. "The 15 million filer increase in non-payers under the McCain plan is almost all due to McCain's health care credit, which dramatically realigns health care incentives and gives people a powerful motive to buy health insurance. Obama uses a longer list of smaller tax credit ideas, including a new ‘Making Work Pay Credit' and a ‘Universal Mortgage Credit,' to take 16 million filers off the tax rolls."

The tax code has historically contained provisions that reduce the income tax burden for lower-income workers, giving around 21 percent of filers no tax liability from 1950 to 1990. Since the early 1990s, Hodge explains that lawmakers have increasingly used the tax code, instead of government spending programs, to funnel money to groups of people they want to reward, enacting credits to subsidize families with children, college students, and purchasers of hybrid cars. Furthermore, Hodge urges a public debate over the costs and benefits of narrowing the tax base and using the tax code to further social and political goals.

"For many folks, tax returns have become, in effect, a claim form for a subsidy delivered through the tax system rather than a direct payment from a traditional government program like welfare or farm supports," Hodge states. "It is time for a serious public discussion of whether it is desirable to have so many Americans disconnected from the cost of government and what the consequences are of using the tax system as a vehicle for social policy."

Hodge says that some of those consequences include added complexity for low-income Americans who pay tax preparers to benefit from the earned income tax credit (EITC), punitive effective marginal tax rates for taxpayers in the phase-out range of the EITC (higher rates than even the most affluent Americans, according to the President's Tax Reform Panel), and revenue volatility due to a narrowing base as higher-income taxpayers include wildly fluctuating business, dividend and capital gains income.

Fiscal Fact No. 146 can be found at http://www.taxfoundation.org/publications/show/23631.html.

The Tax Foundation is a nonpartisan, nonprofit organization that has monitored fiscal policy at the federal, state and local levels since 1937.

Serious Public Discussion Needed on How Many "Nonpayers" U.S. Can Afford

Washington, DC, September 19, 2008 - A newly released study from the Tax Foundation shows that while current law would give 33 percent of tax filers zero liability next year, that figure would increase to 43 and 44 percent if John McCain's and Barack Obama's tax plans, respectively, were enacted in 2009.

In Tax Foundation Fiscal Fact No. 146, "Both Candidates' Tax Plans Will Reduce Millions of Taxpayers' Liability to Zero (or Less)," Tax Foundation President Scott Hodge estimates that while 47 million tax filers would see zero liability under current law in 2009, if all of McCain's or Obama's tax provisions were instituted next year, the number of "non-payers" would rise to 62 or 63 million, respectively.

"Both the McCain and Obama plans would increase this number by expanding existing tax benefits or creating new ones," says Hodge. "The 15 million filer increase in non-payers under the McCain plan is almost all due to McCain's health care credit, which dramatically realigns health care incentives and gives people a powerful motive to buy health insurance. Obama uses a longer list of smaller tax credit ideas, including a new ‘Making Work Pay Credit' and a ‘Universal Mortgage Credit,' to take 16 million filers off the tax rolls."

The tax code has historically contained provisions that reduce the income tax burden for lower-income workers, giving around 21 percent of filers no tax liability from 1950 to 1990. Since the early 1990s, Hodge explains that lawmakers have increasingly used the tax code, instead of government spending programs, to funnel money to groups of people they want to reward, enacting credits to subsidize families with children, college students, and purchasers of hybrid cars. Furthermore, Hodge urges a public debate over the costs and benefits of narrowing the tax base and using the tax code to further social and political goals.

"For many folks, tax returns have become, in effect, a claim form for a subsidy delivered through the tax system rather than a direct payment from a traditional government program like welfare or farm supports," Hodge states. "It is time for a serious public discussion of whether it is desirable to have so many Americans disconnected from the cost of government and what the consequences are of using the tax system as a vehicle for social policy."

Hodge says that some of those consequences include added complexity for low-income Americans who pay tax preparers to benefit from the earned income tax credit (EITC), punitive effective marginal tax rates for taxpayers in the phase-out range of the EITC (higher rates than even the most affluent Americans, according to the President's Tax Reform Panel), and revenue volatility due to a narrowing base as higher-income taxpayers include wildly fluctuating business, dividend and capital gains income.

Fiscal Fact No. 146 can be found at http://www.taxfoundation.org/publications/show/23631.html.

The Tax Foundation is a nonpartisan, nonprofit organization that has monitored fiscal policy at the federal, state and local levels since 1937.

###

Libertarian Neil Boortz says this about the 95% lie:

Let's put this nonsense about tax cuts for 95% of Americans to rest. The bottom 50% of income earners don't even pay income taxes, so how is Our Savior going to give them a tax break? What Obama is really talking about is tax credits. Here's how his plan will work. He'll come up with some fancy new tax credit to reward his minions for some type of acceptable behavior – like voting Democrat. Let's say the tax credit is $2000. But ... these people don't owe any taxes! So what good is a tax credit to them? Well, this is a new type of credit called a "refundable" tax credit. If you're eligible for the $2000 credit, and you don't owe any income taxes, you just get a check form the federal government for $2000. Just a very simple wealth redistribution plan. Remember, Obama and the Democrats think that wealth in the United States is not earned, it's distributed. It's the government's job to re-work that distribution to make it more "fair."

Let's put this nonsense about tax cuts for 95% of Americans to rest. The bottom 50% of income earners don't even pay income taxes, so how is Our Savior going to give them a tax break? What Obama is really talking about is tax credits. Here's how his plan will work. He'll come up with some fancy new tax credit to reward his minions for some type of acceptable behavior – like voting Democrat. Let's say the tax credit is $2000. But ... these people don't owe any taxes! So what good is a tax credit to them? Well, this is a new type of credit called a "refundable" tax credit. If you're eligible for the $2000 credit, and you don't owe any income taxes, you just get a check form the federal government for $2000. Just a very simple wealth redistribution plan. Remember, Obama and the Democrats think that wealth in the United States is not earned, it's distributed. It's the government's job to re-work that distribution to make it more "fair."

Libertarian Neil Boortz says this about the 95% lie:

Let's put this nonsense about tax cuts for 95% of Americans to rest. The bottom 50% of income earners don't even pay income taxes, so how is Our Savior going to give them a tax break? What Obama is really talking about is tax credits. Here's how his plan will work. He'll come up with some fancy new tax credit to reward his minions for some type of acceptable behavior – like voting Democrat. Let's say the tax credit is $2000. But ... these people don't owe any taxes! So what good is a tax credit to them? Well, this is a new type of credit called a "refundable" tax credit. If you're eligible for the $2000 credit, and you don't owe any income taxes, you just get a check form the federal government for $2000. Just a very simple wealth redistribution plan. Remember, Obama and the Democrats think that wealth in the United States is not earned, it's distributed. It's the government's job to re-work that distribution to make it more "fair."

Hence socialism. Look up Obama's daddy the socialist in Kenya.

The WSJ was all over this as a wealth redistrution scheme. Obama wants to hook up his home boys in the projects with some good LALA money.

GTC?

Sweet Lou?

Crickets?

The biggest ploy of Obamas plan is for him to think for people that cannot think for themselves. Tell them they will get tax cuts...cuts from what?

How do you cut nothing? This guy is the anti-christ. And the libs thought Bush was the anti-christ.

You won't see the liberal kool-aid drinkers respond to this, because

they don't like facts. There is no response to these lies.

gtc08 would rather quote the National Enquirer and make up stories

about Palin than deal with issues and facts.

GTC?

Sweet Lou?

Crickets?

The biggest ploy of Obamas plan is for him to think for people that cannot think for themselves. Tell them they will get tax cuts...cuts from what?

How do you cut nothing? This guy is the anti-christ. And the libs thought Bush was the anti-christ.

What do you mean they don't pay taxes... Money comes out of their pay check right?

See? Even people on here listen to the lies and believe it.

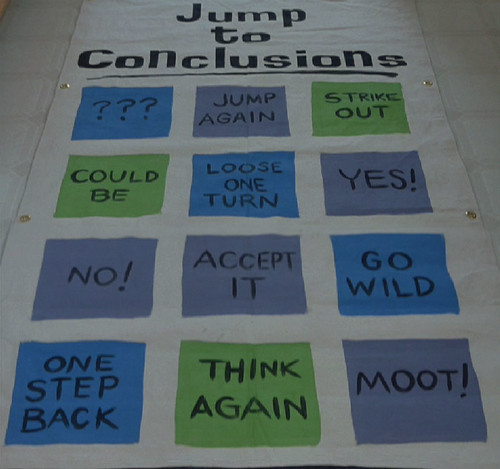

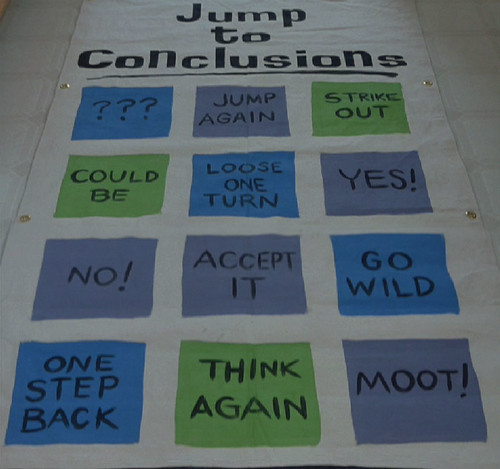

Zit, do me a favor and don't jump to conclusions.

i have not researched this number (and i won't be starting on the rx if i get into it) but it is clearly just one of his talking points. i know where i personally would stand under each candidates tax proposals.

Zit, do me a favor and don't jump to conclusions.

i have not researched this number (and i won't be starting on the rx if i get into it) but it is clearly just one of his talking points. i know where i personally would stand under each candidates tax proposals.

Yawn. Try addressing the actual issue and facts, and admit you

are wrong. It's not a talking point, it's an actual lie that he keeps

repeating, why can't you admit that?

Why can't you admit it is a boldfaced lie?