CAREFUL , VERY THIN 9.25

as always , do your own research

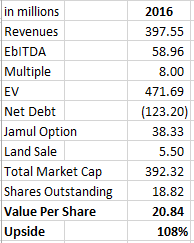

think this one goes much higher earnings wed after the close

They have 43% OF THE SLOT MACHINE MARKET IN LAS VEGAS

http://www.lakesentertainment.com/

http://www.lakesentertainment.com/

as always , do your own research

think this one goes much higher earnings wed after the close

They have 43% OF THE SLOT MACHINE MARKET IN LAS VEGAS

Golden Gaming and Lakes Entertainment Merger Closes

×-

Golden Gaming and Lakes Entertainment Merger Closes

LAS VEGAS and MINNEAPOLIS, Aug. 3, 2015 /PRNewswire/ -- Golden Entertainment, Inc. (formerly Lakes Entertainment, Inc.) (NASDAQ: LACO) announced today that the merger between Sartini Gaming, Inc. ("Golden Gaming") and a subsidiary of Lakes Entertainment, Inc. has closed, after receiving various approvals from the Lakes' shareholders at the company's annual meeting on July 29. In connection with the merger, Lakes has been renamed Golden Entertainment, Inc.

The all-stock transaction unites two renowned and respected brands in the gaming space. The newly combined company operates approximately 9,250 slot machines and video lottery terminals in Nevada and Maryland across four casino properties, 48 taverns and 670 route locations. Golden Entertainment's headquarters is now based in Las Vegas, Nevada.

"Today is a truly monumental and meaningful day for our company, our team members, our business partners and the markets we collectively serve," said Blake L. Sartini, the newly-appointed President, Chairman and Chief Executive Officer of Golden Entertainment, Inc. "With Golden Entertainment, we now have a national, diversified gaming company with strong assets across the country. And with this infrastructure, we look forward to further enhancing our unique blend of distributed gaming, casinos and taverns."

Lyle Berman, former Chairman of Lakes Entertainment Inc. stated, "Our cash along with the Rocky Gap Casino, when combined with the diverse operations of Golden Gaming, provides an exciting growth opportunity for our existing and future shareholders. The combined company's refinanced debt will provide an immediate benefit in company net income and free cash flow."

Lakes issued an aggregate of 8,229,908 shares of its common stock in connection with the merger, of which 7,772,736 shares (subject to post-closing adjustments) were issued to The Blake L. Sartini and Delise F. Sartini Family Trust, the sole shareholder of Golden Gaming. The company's common stock continues to be traded on the NASDAQ Stock Market and its trading symbol, effective August 4, 2015, will be changed from "LACO" to "GDEN".

In connection with the closing of the merger, the size of the board of directors of the combined company was increased from five to seven. Larry Barenbaum and Ray Moberg resigned from the formerly Lakes Entertainment board. Subsequently, Blake Sartini was appointed the new Chairman of the Board of Golden Entertainment, and the remaining three vacancies were filled by the following appointees:

- Mark Lipparelli – Chief Executive Officer of Gioco Ventures, a strategic advisory and product development firm serving the gaming, investment, technology and entertainment industries across the globe. Lipparelli also currently represents State Senate District 6 in the Nevada Legislature, a post he has held since December 2014. Lipparelli is a board trustee of the University of Nevada Foundation, board member of the National Center for Responsible Gaming and served as a board member and Chairman of the Nevada State Gaming Control Board between 2009 and 2012.

- Robert Miodunski – former Chief Executive Officer of American Gaming Systems from 2010 until its acquisition by Apollo Entertainment in late 2014. Miodunski also previously served as Chief Executive Officer of Alliance Gaming Corporation from 2001 to 2004 and President of United Coin from 1994 to 1999. From 2005 to 2008, Miodunski served on the board of directors of Elixir Gaming Technologies, Inc.

- Terrence Wright – Chairman of the Board and majority owner of Westcor Land Title Insurance Company, a company he founded in 1991 and which is licensed to issue policies of title insurance throughout the United States. Wright is currently on the board of Southwest Gas Corporation, is an emeritus member and past chairman of the University of Nevada Las Vegas Foundation Board and is the past chairman for the Nevada Development Authority, the Nevada Land Title Association and the Nevada Chapter of the Young Presidents' Organization.

Golden Entertainment also announced today the successful syndication and closing of a new $160 million senior secured credit facility, comprising a $120 million senior secured term loan (which was fully drawn at closing) and a $40 million senior secured revolving credit facility (of which $25 million was drawn at closing). The new facility matures in 2020. Borrowings under the new facility bear interest, at the company's option, at either (1) the highest of the federal funds rate plus 0.50%, the Eurodollar rate for a one-month interest period plus 1.00%, or the administrative agent's prime rate as announced from time to time, or (2) the Eurodollar rate for the applicable interest period, plus an applicable margin based on the company's leverage ratio ranging from 1.75% to 2.75% for Eurodollar loans and 0.75% to 1.75% for base rate loans. Net proceeds from the new facility were used to repay and discharge all of the outstanding senior secured indebtedness of Golden Gaming as well as Lakes' outstanding Rocky Gap indebtedness. The interest rates under the new senior secured credit facility, which are lower than previously anticipated, are expected to result in significant interest savings compared to Golden Gaming's prior interest expense. Capital One and KeyBank National Association acted as the joint lead arrangers and joint book runners for the new facility. Capital One acted as administration agent and KeyBank National Association acted as syndication agent in connection with the new facility.

Macquarie Capital served as Lakes' exclusive financial advisor. Gray, Plant, Mooty, Mooty & Bennett, P.A. served as legal counsel to Lakes. Union Gaming Advisors, LLC served as Golden Gaming's financial advisor. Latham & Watkins LLP served as legal counsel to Golden Gaming. Hunton & Williams LLP served as legal counsel to the lenders.

About Golden Entertainment, Inc.

Golden Entertainment, Inc., formerly Lakes Entertainment, Inc., offers an unmatched blend of gaming diversity. Through its three dynamic gaming divisions — Golden Casino Group, PT's Entertainment Group and Golden Route Operations — the Golden group of companies operates 9,250 slot machines and video lottery terminals, as well as 22 table games in Nevada and Maryland across four casino properties, 48 taverns and 670 route locations.

Golden Casino Group offers four distinctive, inviting resorts: In Pahrump, Nevada - the Pahrump Nugget Hotel & Casino, Gold Town Casino, and Lakeside Casino and RV Park and in Flintstone, Maryland - the Rocky Gap Resort. All feature an exciting mix of gaming, dining and entertainment and a superior level of guest service.

PT's Entertainment Group is Nevada's largest tavern operator, with 48 establishments. It operates PT's, Sierra Gold and Sean Patrick's in Southern Nevada and Sierra Gold and Sierra Junction in Northern Nevada. All Nevada locations feature the exclusive, proprietary Golden Rewards player rewards program.

Golden Route Operations is Nevada's largest distributed gaming operator, with more than 7,100 machines in 670 locations statewide. Golden Route Operations is a market leader in player tracking, rewards, player recognition and communication technology with its Golden Edge Slot Management System. Golden Route Operations includes Albertsons, Smith's, Vons, CVS, Pilot Travel, Love's Travel and Buffalo Wild Wings as long-term national partners. For more information, visit www.goldenent.com.

Media Contact:

Jesse Scott | 702-739-9933, ext. 228

Logo - http://photos.prnewswire.com/prnh/20150801/253916LOGO

SOURCE Golden Entertainment, Inc.

-