A new system to bet college footbal

Chad Millman

ESPN INSIDER

I met 27-year-old Mike Wohl at the MIT Sloan Sports Analytics Conference in March. He was the MBA graduate student coordinator for the panel I was on about the world of sports betting today. This was my second year appearing at the conference, and meeting the student liaisons is one of the highlights.

They are the perfect combination of obsequious without being Eddie Haskell-like (as if they aren't scrambling on their Internet machines to figure out who that is) and slightly arrogant without asking to be punched. They know they're brilliant, definitely smarter than the panelists they have to cater to, and they know they'll probably retire, counting their collection of Caribbean Islands and commuting via private jet to adjunct positions at Sloan, before they hit puberty.

Mostly though, they are fierce, in the best possible way. Both years, my pre-panel prep included an inbox full of emails outlining topics to be addressed by the moderator, areas each panelist should concentrate on and how we would be introduced. Thrown in are a couple of conference calls and follow-up memos outlining what was discussed on the calls. These people are no joke.

What's fun about doing the sports gambling panel is that the audience members, as well as the hosts I've met, are hard-core gambling fans. The SSAC has a lot of star power -- Jeff Van Gundy, Mark Cuban, Bill Simmons -- but the gambling enthusiasts do not come for the panelists; they come for the info. Most folks sitting out there, especially the students, probably have an iPad stuffed in their backpack that contains the next great system for betting on sports.

It's at places like Sloan, and all the other brainiac grad institutions, where the real revolution in sports wagering is taking place. I often talk about the middle ground that exists between the sharps who do this for a living and the squares who can't. That gray area is where the finance guys in their 30s and 40s who know enough about scouring the Internet to be dangerous are lingering.

It's people like Richard Stand, who won the Las Vegas Hilton SuperContest a couple of years ago but moonlights as a high-ranking financial officer of a public company. The current crop of MBAs are version 2.0 of these quantitative analysts, and they will be able to take advantage of new laws legalizing sports betting in the next few years.

Wohl is one of those guys. Late last spring, he sent me his Sloan independent study called "The Missing Asset Class." I didn't know what that title meant either, but essentially he wrote about how to examine various sports bets in different ways, through the same prism of opportunity and analysis that Wall Streeters view stocks. Of course, I am very busy because I write this blog, do a podcast and am the editor-in-chief of an oversized magazine. I cannot be bothered to respond to such emails. So Wohl emailed me again a few weeks later and, essentially, said, "WTF, dude. No time for me?" Clearly he had dropped the Eddie Haskell routine. I felt like an ass and read the paper.

It was very good.

<offer>

Wohl played soccer at Amherst and spent four years after college working in a firm as a financial adviser for high-net-worth individuals and families who have an average bankroll of $22 million. Along the way, he dabbled as a sports bettor, for much smaller stakes. He realized, as he wrote in the paper, that the risk and return from sports wagering was equal to or better than investing in the market, only the time for potential return on investment was shorter and each sports bet lived independent from another. In other words, losing a Green Bay Packers bet had nothing to do with the three other NFC North teams losing. With stocks, a 500-point drop in the Dow is bad for all.

Wohl was smart enough to recognize that making a bet on the point spread didn't exactly offer a level playing field. That pesky 10 percent commission most sports books charge got in the way, forcing bettors to win at least 52.3 percent of the time to see any profit. Thus, he went on a journey for, all together now, "The Missing Asset Class."

This is what is cool about a place like MIT, and probably other high-end business schools: Ideas win. As Wohl went on his analytical search for betting advantages and word spread of his efforts, he says he "went from being that dude who went to Vegas to bet on college football all fall to being the guy with the innovative idea."

He found the asset, or at least one of them, in college football money-line bets. For those who don't know, money lines allow you to pick a straight-up winner rather than betting against the spread. The catch is that betting on the favorite usually costs a lot more. For example, last fall the Arizona State Sun Devils were 2.5-point favorites over USC. It would have cost you $110 to win $100 betting the spread. On the money line, the Sun Devils were a -135 favorite to win outright. You would have had to bet $135 to win $100. There is a premium for betting straight-up on the team that is expected to win.

There is, however, a long-tail advantage -- if you are willing to be patient, something most bettors have a problem with. Wohl found his advantage in betting the money lines for college football teams that were favored by 20-25 points. He wrote in his paper: "There were 376 games in the last six seasons (approximately 62 per season or approximately 4.5 per week) that had spreads of between 20.0 and 25.0. Of those 376 games, 94.95 percent of the favorites won the game outright. Investing equal amounts on all 376 contests produces six straight years of profitable returns with an average annual (non-compounded and non-annualized) return of 12.24 percent."

I asked Wohl where he got his data. He told me he spent a semester going through the Covers website, manually inputting the 1,591 games that had a spread between 10 and 25, as well as their money-line price.

"I chose 25 points because the offshores offered money-line prices on up to 25-point favorites," Wohl said.

Everyone reading this column presumably knows that you aren't going to get rich betting heavy money-line favorites. For one thing, unless you already have a substantial bankroll, the price of entry for a decent payoff is very high. For another, no amateur has the willpower to make big dollar wagers that yield more consistent, yet smaller, returns.

"Seeking a 5-15 percent return over the course of 15 weeks betting college football is hard," he wrote in an email, "especially when it is risking tens of thousands of dollars to potentially win seven or eight hundred dollars."

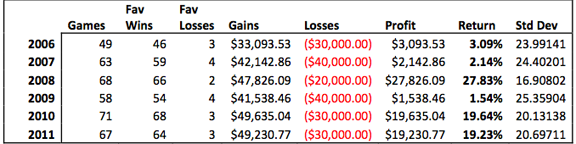

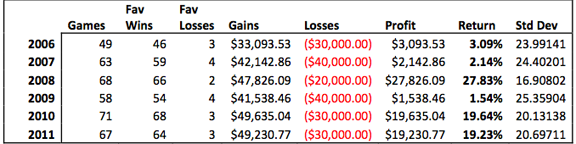

For a more specific breakdown of his math, here is an example I cribbed from his paper:

"This asset class would start with $100,000 of capital and would experience 376 wagers of $10,000 a piece over six years. 357 would be winning investments and 19 would be complete losses. The following table summarizes each year's activity."

<cite>Mike Wohl</cite>

<cite>Mike Wohl</cite>

Wohl isn't looking to get rich quick by gambling. That would be nice, but he has a bigger end game. He wants to prove that you can invest in sports betting as a sound portion of an overall investment strategy. That is what he is going to do this year. In Vegas, with his own money.

He will email with updates as the season progresses. I promised I would return them immediately.

</offer>

Chad Millman

ESPN INSIDER

I met 27-year-old Mike Wohl at the MIT Sloan Sports Analytics Conference in March. He was the MBA graduate student coordinator for the panel I was on about the world of sports betting today. This was my second year appearing at the conference, and meeting the student liaisons is one of the highlights.

They are the perfect combination of obsequious without being Eddie Haskell-like (as if they aren't scrambling on their Internet machines to figure out who that is) and slightly arrogant without asking to be punched. They know they're brilliant, definitely smarter than the panelists they have to cater to, and they know they'll probably retire, counting their collection of Caribbean Islands and commuting via private jet to adjunct positions at Sloan, before they hit puberty.

Mostly though, they are fierce, in the best possible way. Both years, my pre-panel prep included an inbox full of emails outlining topics to be addressed by the moderator, areas each panelist should concentrate on and how we would be introduced. Thrown in are a couple of conference calls and follow-up memos outlining what was discussed on the calls. These people are no joke.

What's fun about doing the sports gambling panel is that the audience members, as well as the hosts I've met, are hard-core gambling fans. The SSAC has a lot of star power -- Jeff Van Gundy, Mark Cuban, Bill Simmons -- but the gambling enthusiasts do not come for the panelists; they come for the info. Most folks sitting out there, especially the students, probably have an iPad stuffed in their backpack that contains the next great system for betting on sports.

It's at places like Sloan, and all the other brainiac grad institutions, where the real revolution in sports wagering is taking place. I often talk about the middle ground that exists between the sharps who do this for a living and the squares who can't. That gray area is where the finance guys in their 30s and 40s who know enough about scouring the Internet to be dangerous are lingering.

It's people like Richard Stand, who won the Las Vegas Hilton SuperContest a couple of years ago but moonlights as a high-ranking financial officer of a public company. The current crop of MBAs are version 2.0 of these quantitative analysts, and they will be able to take advantage of new laws legalizing sports betting in the next few years.

Wohl is one of those guys. Late last spring, he sent me his Sloan independent study called "The Missing Asset Class." I didn't know what that title meant either, but essentially he wrote about how to examine various sports bets in different ways, through the same prism of opportunity and analysis that Wall Streeters view stocks. Of course, I am very busy because I write this blog, do a podcast and am the editor-in-chief of an oversized magazine. I cannot be bothered to respond to such emails. So Wohl emailed me again a few weeks later and, essentially, said, "WTF, dude. No time for me?" Clearly he had dropped the Eddie Haskell routine. I felt like an ass and read the paper.

It was very good.

<offer>

Wohl played soccer at Amherst and spent four years after college working in a firm as a financial adviser for high-net-worth individuals and families who have an average bankroll of $22 million. Along the way, he dabbled as a sports bettor, for much smaller stakes. He realized, as he wrote in the paper, that the risk and return from sports wagering was equal to or better than investing in the market, only the time for potential return on investment was shorter and each sports bet lived independent from another. In other words, losing a Green Bay Packers bet had nothing to do with the three other NFC North teams losing. With stocks, a 500-point drop in the Dow is bad for all.

Wohl was smart enough to recognize that making a bet on the point spread didn't exactly offer a level playing field. That pesky 10 percent commission most sports books charge got in the way, forcing bettors to win at least 52.3 percent of the time to see any profit. Thus, he went on a journey for, all together now, "The Missing Asset Class."

This is what is cool about a place like MIT, and probably other high-end business schools: Ideas win. As Wohl went on his analytical search for betting advantages and word spread of his efforts, he says he "went from being that dude who went to Vegas to bet on college football all fall to being the guy with the innovative idea."

He found the asset, or at least one of them, in college football money-line bets. For those who don't know, money lines allow you to pick a straight-up winner rather than betting against the spread. The catch is that betting on the favorite usually costs a lot more. For example, last fall the Arizona State Sun Devils were 2.5-point favorites over USC. It would have cost you $110 to win $100 betting the spread. On the money line, the Sun Devils were a -135 favorite to win outright. You would have had to bet $135 to win $100. There is a premium for betting straight-up on the team that is expected to win.

There is, however, a long-tail advantage -- if you are willing to be patient, something most bettors have a problem with. Wohl found his advantage in betting the money lines for college football teams that were favored by 20-25 points. He wrote in his paper: "There were 376 games in the last six seasons (approximately 62 per season or approximately 4.5 per week) that had spreads of between 20.0 and 25.0. Of those 376 games, 94.95 percent of the favorites won the game outright. Investing equal amounts on all 376 contests produces six straight years of profitable returns with an average annual (non-compounded and non-annualized) return of 12.24 percent."

I asked Wohl where he got his data. He told me he spent a semester going through the Covers website, manually inputting the 1,591 games that had a spread between 10 and 25, as well as their money-line price.

"I chose 25 points because the offshores offered money-line prices on up to 25-point favorites," Wohl said.

Everyone reading this column presumably knows that you aren't going to get rich betting heavy money-line favorites. For one thing, unless you already have a substantial bankroll, the price of entry for a decent payoff is very high. For another, no amateur has the willpower to make big dollar wagers that yield more consistent, yet smaller, returns.

"Seeking a 5-15 percent return over the course of 15 weeks betting college football is hard," he wrote in an email, "especially when it is risking tens of thousands of dollars to potentially win seven or eight hundred dollars."

For a more specific breakdown of his math, here is an example I cribbed from his paper:

"This asset class would start with $100,000 of capital and would experience 376 wagers of $10,000 a piece over six years. 357 would be winning investments and 19 would be complete losses. The following table summarizes each year's activity."

Wohl isn't looking to get rich quick by gambling. That would be nice, but he has a bigger end game. He wants to prove that you can invest in sports betting as a sound portion of an overall investment strategy. That is what he is going to do this year. In Vegas, with his own money.

He will email with updates as the season progresses. I promised I would return them immediately.

</offer>