You are just a dumb lib who loves his freedoms infringed on.....the more they take away the more you cheer them on.....The IRS is short staffed as it is and plenty more are retiring.

Have you tried calling them these past 2 years? You'll stay on hold forever and then they will hang up on you due to heavy call volume

Have you tried mailing anything into them? If they respond within 6 months, you'll be lucky

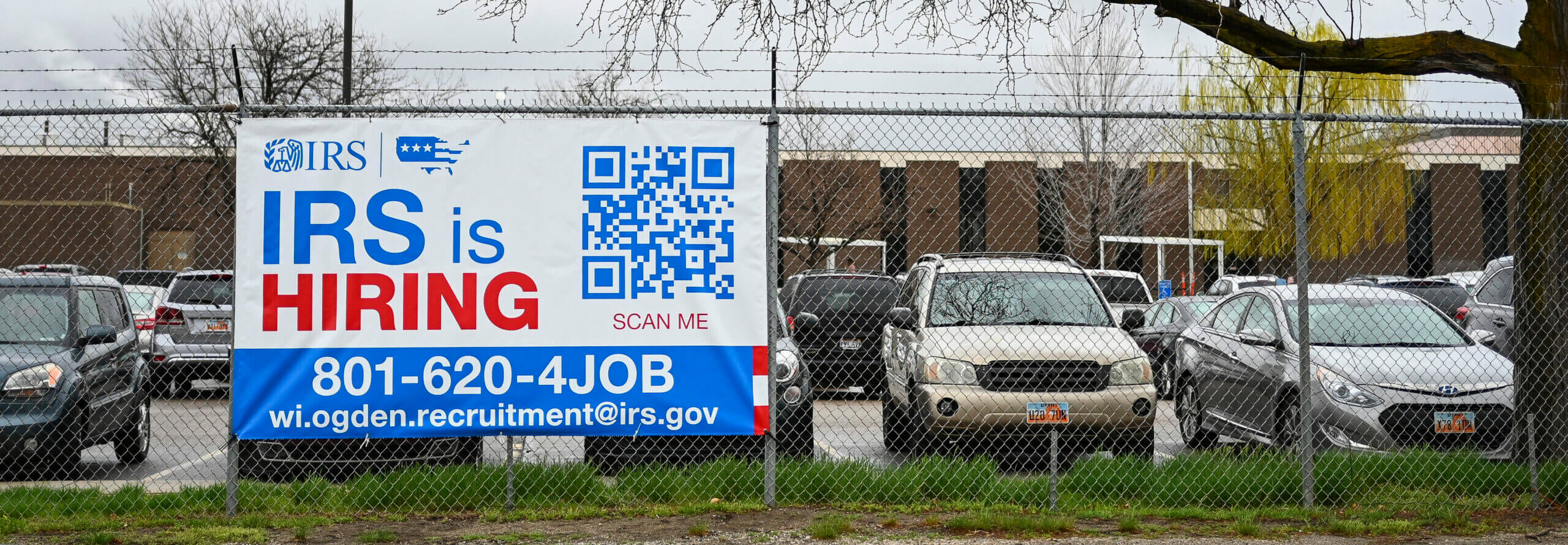

These agent hirings will be over a 10 year span. Biden has been saying for a while that he was going to increase agents.

I dont think they are coming for the14 year old who received $1,000 in venmo from babysitting money.

Regarding the job posting, one of my neighbors actually does this for a living. Works for the IRS and carries a gun with him. He goes after the fraudsters and big scammers. The person who collected $400 from fantasy winnings isnt going to be held by gunpoint by an IRS agent

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Why Do I.R.S Agents Need 700k$ In Amminition ?

- Thread starter rwjr

- Start date

Those are the people the IRS will terrorize ....... the IRS areI dont think they are coming for the14 year old who received $1,000 in venmo from babysitting OR The person who collected $400 from fantasy winnings isnt going to be held by gunpoint by an IRS agent

LIARS & a Domestic Terrorist group .

U can't believe anything they tell u , tell your friend/neighbor whoever it is to kiss my Red , White & Blue Ass

He is too ignorant to realize that is EXACTLY the kind of shit they will come after if they were fully staffed and had the manpower.Those are the people the IRS will terrorize ....... the IRS are

LIARS & a Domestic Terrorist group .

U can't believe anything they tell u , tell your friend/neighbor whoever it is to kiss my Red , White & Blue Ass

Why does Venmo, PP and Zelle have to now 1099 you for $600+ in commercial transactions in a year...the dummies will say "well that is just for business", yeah that is how it starts....then they will start to question all the payments and make you prove that the money you got was actually NOT BUSINESS or Commerical....babysitters and fantasy players being targeted is inevitable.

Everytime people think "Oh they wont do that", that is EXACTLY what they are either doing or plan to do.

The point of increasing IRS funding by roughly 80B is to increase tax revenue by 200B in that same period for a net of 124B, this is the administration's words, not mine.

Asking sincerely, where do people think that 200B is coming from? Probably not anyone on the forbes list, who avoid taxes legally.

If people don't care about the gov't being more invasive then so be it, but it is another big gov't clusterfuck waiting to happen.

Asking sincerely, where do people think that 200B is coming from? Probably not anyone on the forbes list, who avoid taxes legally.

If people don't care about the gov't being more invasive then so be it, but it is another big gov't clusterfuck waiting to happen.

Just more $$$ launderingThe point of increasing IRS funding by roughly 80B is to increase tax revenue by 200B in that same period for a net of 124B, this is the administration's words, not mine.

Asking sincerely, where do people think that 200B is coming from? Probably not anyone on the forbes list, who avoid taxes legally.

If people don't care about the gov't being more invasive then so be it, but it is another big gov't clusterfuck waiting to happen.

IRS training video below, just a quick two minute watch

they are simulating a typical scenario with an armed auditor having a conversation with a landscaper who is trying to sell his business which includes two vehicles. Anyone know a billionaire landscaper with 2 trucks? how about a millionaire landscaper? i didn't think so

all you need is an accounting degree and a desire to be a cunty authoritarian to take down small business owners while drowning them in legal fees and red tape until they surrender their business and layoff their employees.

anyone who works for the govt is a piece of shit

they are simulating a typical scenario with an armed auditor having a conversation with a landscaper who is trying to sell his business which includes two vehicles. Anyone know a billionaire landscaper with 2 trucks? how about a millionaire landscaper? i didn't think so

all you need is an accounting degree and a desire to be a cunty authoritarian to take down small business owners while drowning them in legal fees and red tape until they surrender their business and layoff their employees.

anyone who works for the govt is a piece of shit

Sen. Rick Scott Warns New IRS Employees: ‘This Will Be a Short-Term Gig’ › American Greatness

In an open letter posted on LinkedIn, Senator Rick Scott (R-Fla.) vowed that Republicans plan to roll back the hiring of 87,000 new tax collection agents for the IRS, a key provision in the inaptly…

80% of new IRS revenue will come from small businesses earning under $200K

Small business owners may soon be in for a lengthy and expensive battle with the IRS, tax experts warn.

A key provision in the Inflation Reduction Act — which throws an extra $80 billion to the IRS to improve the agency’s collection of under-reported income — will end up targeting small business owners to pay for the legislation, according to nonpartisan watchdog the Joint Committee on Taxation.

The group estimates that between 78% and 90% of the estimated additional $200 billion the IRS will collect will come from small businesses making less than $200,000 annually.

Just 4% to 9% would come from businesses making north of $500,000 a year — meaning the legislation is in sharp contrast to President Biden’s longstanding claim that he wouldn’t raise taxes on anyone making less than $400,000.

“The IRS will have to target small and medium businesses because they won’t fight back,” Joe Hinchman, executive vice president at National Taxpayers Union Foundation, told The Post. “We’ve seen this play out before … the IRS says ‘We’re going after the rich’ but when you’re trying to raise that much money, the rich can only get you so far.”

In fact, going after the lower and middle class can actually be more lucrative for IRS auditors than trying to get more money from the wealthy. “The rich have their lawyers and fight it — that’s why the poor are easier to go after,” Hinchman adds.

Accordingly, tax experts warn that the IRS’s audits will be far more painful and costly for small business owners — even for those who think they’re filing their taxes correctly.

“Most small business aren’t doing anything wrong,” Daniel Bunn, executive vice president at the Tax Foundation, told The Post. “We don’t make the tax code simple and the complicated tax code makes it difficult for small business owners to comply with all the requirements.”

Even if small business owners get everything right, they may still be faced with a headache since part of the IRS expansion will involve sending out more notices and letters to businesses, Bunn adds. For individual contractors or small businesses, an IRS letter that they owe more money or made an error on their taxes can put them underwater.

“Anytime you get a IRS letter, it could take months or years to get it settled — we’re talking many thousands of dollars to address,” Bunn added. “Large companies have constant reviews and lawyers going through everything … small business doesn’t have the resources to fight back in the way.