| |

Top News

Facebook under fire

Shutterstock The pressure on Facebook (NASDAQ:FB) is not letting up following a three-hour Senate hearing last week in which lawmakers grilled the social media giant over its harmful effects on young people. Over the weekend, a Facebook whistleblower named Frances Haugen, who leaked the docs for the WSJ's "Facebook Files," accused the company of repeatedly prioritizing profit over clamping down on hate speech and misinformation. Her lawyers have already filed at least eight complaints with the SEC, according to the interview on CBS's 60 Minutes.

Quote: "The thing I saw at Facebook over and over again was there were conflicts of interest between what was good for the public and what was good for Facebook," said Haugen, who worked as a product manager on the civic misinformation team. "Facebook, over and over again, chose to optimize for its own interests, like making more money. It is subsidizing, it is paying for its profits with our safety."

Haugen even went as far as to suggest the moneymaking moves contributed to the deadly Jan. 6 storming of the U.S. Capitol (after the company prematurely disbanded its Civic Integrity team designed to thwart misinformation). She'll also testify before a Senate subcommittee tomorrow in a hearing titled "Protecting Kids Online" and hopes her statements will result in "regulation being put into place." Facebook's annual revenue has more than doubled from the $56B seen in 2018, when a newsfeed content flow change went into effect. The new algorithm has fostered discord, according to Haugen, while contributing to more divisiveness on a network meant to bring people together.

Response from Facebook: "Every day our teams have to balance protecting the ability of billions of people to express themselves openly with the need to keep our platform a safe and positive place," Facebook spokesperson Lena Pietsch said in a statement. "We continue to make significant improvements to tackle the spread of misinformation and harmful content. To suggest we encourage bad content and do nothing is just not true." (18 comments)

| | Stocks

Market on edge

Get ready for a volatile October... The month, traditionally known for its ups and downs, didn't disappoint traders overnight. S&P 500 futures opened the session solidly in the green on Sunday evening, only to fall 0.7%, before heading back to the flatline. Contracts linked to the DJIA moved in line with the benchmark index, while the Nasdaq saw even steeper price swings.

While the main focus this week will be ADP's September employment report and the non-farm payrolls report for last month, investors are also sizing up what kind of returns could be in store for the rest of the quarter:

The bulls: "Q4 2021 will likely record a higher-than-average return," noted CFRA chief investment strategist Sam Stovall. "However, investors will need to hang on tight during the typically tumultuous ride in October, which saw 36% higher volatility when compared with the average for the other 11 months."

The bears: "We're headed for some trouble ahead," declared Wharton finance professor Jeremy Siegel, who's known for his positive market forecasts. "Inflation, in general, is going to be a much bigger problem than the Fed believes. I do not believe that the market is prepared for an accelerated taper."

Macro front: Echoes of the trade war were heard overnight as U.S. trade representative Katherine Tai vowed to enforce Phase 1 of the trade deal with China. Under the pact, Beijing pledged to buy at least $200B more U.S. goods and services over 2020 and 2021, compared to 2017, though as of August, China had only reached 62% of that target, based on export data compiled by the Peterson Institute for International Economics. Tai also said there were "serious concerns" about the country's "state-centered and non-market trade practices" - which were not addressed under the current framework - but would "raise these broader policy concerns with Beijing." (2 comments)

| | Sponsored By StartEngine

Invest In The Future Of Equity Crowdfunding

With a goal to help raise $10 billion by 2029, StartEngine has big plans... and they’re already gaining momentum:

With a goal to help raise $10 billion by 2029, StartEngine has big plans... and they’re already gaining momentum:

- 146% revenue growth YoY in the first half of 2021.

- 500,000 prospective investors on the platform

- Led by Howard Marks, co-founder of Activision(NASDAQ:ATVI).

- Launched a first-of-its-kind trading platform

- $400M raised for more than 500 companies.

- Moving into wine collections, real estate, and more

Now you can join 22,000 other investors and invest in StartEngine itself.

Check it out here for more information.

Disclaimer:Reg A+ offering made available through StartEngine Crowdfunding, Inc. Investment is speculative, illiquid, and involves a high degree of risk, including the possible loss of your entire investment. View StartEngine Crowdfunding, Inc’s offering circular and selected risks. Past performance may not be indicative of future results.

| | Covid

Vaccine updates

BioNTech (BNTX) CEO Ugur Sahin, whose company developed one of the first COVID-19 vaccines along with Pfizer (PFE), predicts that a new formula may be needed next year to protect against future virus mutations. While current variants, particularly the Delta strain, are leading to a surge in breakthrough cases, he said they're not different enough to undermine the effectiveness of current jabs. That could change, though, and the company is planning accordingly.

Thought bubble: One of the biggest differences between the flu vaccine and many other vaccines is that the flu evolves much quicker than viruses like polio and measles. If someone was vaccinated as a child against the latter diseases, it's extremely likely their body will recognize the disease at a much later date. While the scientific evidence is still pouring in on coronavirus, it may be closer to the flu in terms of its adaptability. "I think this virus is here to stay with us and it will evolve like influenza pandemic viruses," said Dr. Mike Ryan, executive director of the World Health Organization's Health Emergencies Program.

Sahin also made some other predictions. He sees two main streams of vaccination programs in 2022, including booster shots for those who have been vaccinated, as well as a continued push to vaccinate people who have had minimal access to them. Last month, the U.S. announced it would buy another 500M doses of the BioNTech/Pfizer vaccine at not-for-profit rates to give to lower-income countries. Shares of BNTX have surged more than 200% YTD amid vaccine developments, booster shots and FDA authorization, while PFE has gained around 17%.

Go deeper: Vaccine makers are on the backfoot again this morning after Merck & Co. (MRK) dropped a bomb in the global fight against COVID-19 on Friday. Results from Merck's experimental pill cut the risk of hospitalization and death from COVID in half, and were so encouraging that it stopped enrolling patients to begin the process of regulatory approval. The pill, which is most effective when given early in course of infection, is also said to work against all COVID variants including Delta. (13 comments)

| | Energy

More oil to market?

An energy supply crunch that has led to gas lines in the U.K.and China to secure supplies "at all cost" is prompting investors to closely watch the sector. The latest headlines could come today as OPEC+ holds a virtual meeting to review its output policy. In July, the group led by Saudi Arabia and Russia agreed to boost monthly output by 400K barrels per day until at least April 2022, phasing out 5.8M bpd in cuts.

Chatter before the gathering: OPEC+ may consider going beyond its existing deal to boost production by another 400K barrels per day. There are even suggestions for an increase of 800K bpd for one month, with zero the next month, while other delegates feel there is currently no need to take extraordinary measures. The nearest month any increase could occur is November since OPEC+'s last meeting decided the October volumes.

"Obviously, the price of oil is of concern," White House Press Secretary Jen Psaki said this past Thursday, adding that the U.S. was talking to OPEC and looking at every tool to address its cost. Some see the request as hypocritical, as the country discourages drilling at home in its fight against climate change, while others see it as a stopgap measure until the U.S. transitions away from fossil fuels toward cleaner energy sources. President Biden has set a goal to decarbonize the economy by 2050 and has paused new drilling lease auctions on federal lands pending a review of environmental and climate impacts.

Elsewhere: One of the largest oil spills in recent Southern California history occurred over the weekend, with at least 126,000 gallons of oil leaking into the waters off Orange County. Local officials are calling it an environmental catastrophe as black globules along with dead birds and fish wash ashore. The spill was caused by a breach connected to the Elly oil rig, which was operated by a California subsidiary of Houston-based Amplify Energy Corporation (AMPY). (13 comments)

| | Today's Markets

In Asia, Japan -1.1%. Hong Kong -2.2%. China closed. India +0.9%.

In Europe, at midday, London +0.2%. Paris +0.1%. Frankfurt -0.1%.

Futures at 6:20, Dow -0.3%. S&P -0.4%. Nasdaq -0.5%. Crude +0.1% at $75.94. Gold -0.5% at $1749.30. Bitcoin -0.5% at $47598.

Ten-year Treasury Yield +3 bps to 1.49%

Today's Economic Calendar

Auto Sales

10:00 Factory Orders

10:00 Fed's Bullard: “Mastering the Economic Revival”

10:00 Fed's Rosengren: “Racial Disparities in Today's Economy”

12:30 PM Investor Movement Index

Companies reporting earnings today »

| |

What else is happening...

California to require COVID-19 vaccines for school kids.

Moderna (NASDAQ:MRNA) shot linked to higher rates of heart inflammation.

| Global Market Comments

October 4, 2021

Fiat Lux

Featured Trade:

(THE MAD HEDGE SUMMIT VIDEOS ARE UP),

(MARKET OUTLOOK FOR THE WEEK AHEAD,

or IT’S SHOPPING TIME),

(MS), (GS), (JPM), (BLK), (BRKB), (C), (TLT), (F), (CRPT)

| | �

The Mad Hedge Summit Videos are UpThe Mad Hedge Summit videos are up from the September 14-16 confab. Listen to 27 speakers opine on the best strategies, tactics, and instruments to use in these volatile markets. It is a true smorgasbord of investment strategies. Find the best one to suit your own goals.

The product discounts offered last week are still valid. Start, stop, and pause the videos at your leisure. Best of all, access to the videos is FREE. Access them all by clicking here at www.madhedge.com, click on SEPTEMBER 14-16, 2021 REPLAYS in the upper right-hand corner, and then chose the speaker of your choice.

|

The Market Outlook for the Week Ahead, or It’s Shopping TimeAll indications are that we have a total nightmare of a Christmas coming up this year. Santa Claus and his elves can’t get any parts, and the reindeer are short of hay.

There are now a record 70 large container ships from China parked off the coast of Long Beach, CA and nobody to unload them. If they could be unloaded, there are no trucks to move the cargo or drivers to drive them. It turns out that stores don’t have enough staff to sell the products either.

You see this in share prices that are traditionally strong going into the holidays which have lately taken a pasting, like UPS (UPS) and FedEx (FDX).

Perhaps the US economy is losing up to a third of its total output due to parts and labor shortages. This will take at least a year to sort out.

Then there is the issue of 10 million missing workers. Are they afraid of dying of Covid? Or have they decided it’s time for a career change and that working for a minimum wage of $7.25 an hour is no longer worth it? This may take a decade to sort out.

Covid could be masking fundamental changes to the American economy and society which won’t become obvious until well into the 2030s.

Those of us who analyze these things can’t wait for the outcome. The global economy has just undergone more change than at any time since WWII. But what exactly happened we may not know for years.

Better to complete your Christmas shopping early this year or you may end up with a piece of coal in your stocking (where do I find coal in California?). And don’t forget to do some shopping for your retirement portfolio as well. Valuations are the best they have been in a year and this bull market in stocks has another nine years to run.

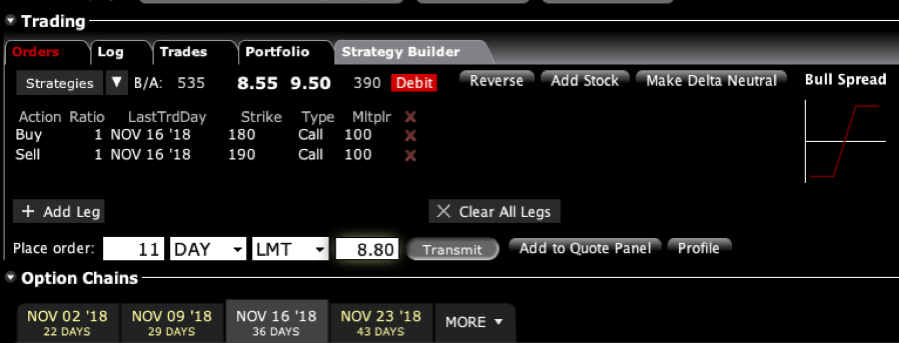

In the meantime, after dumping all of my technology stocks, I’ll be betting my entire persona net worth buying financial ones. These should lead the markets for the next six months, or until bond yields hit 2.0%, whichever comes first. Bonds now yield 1.46%.

With interest rates rising sharply, economic growth continuing at record levels, and default rates plunging, we are just entering a new golden age of banking.

Powell sees Inflation lasting higher for longer. It was enough to kill off a nascent rally in the bond market. The Dollar Store is about to become the $2 Store. Shortages from China are the reason.

Treasury Yields hit a three-month high. You can blame the coming taper, deal on a deficit-financed infrastructure bill, and drained Fed accounts against a coming massive supply of bonds. I’m already running a massive bond short. Keep selling rallies in the (TLT), or buy (TBT).

China bans Crypto, triggering a 7% plunge in Bitcoin. Financial systems the government can’t control are forbidden in the Forbidden City. It’s all part of a flight out of a restricted Yuan into unrestricted crypto by wealthy Chinese. China used to account for 99% of all Bitcoin mining and now it is at zero. The business will flock to the US, Canada, and any other country with cheap electricity. It’s a short-term negative for crypto but a long-term positive. Buy Bitcoin and Ethereum on the dip.

Case Shiller shatters all records, rising an astronomical 18.7% in June, a new record. Home prices are now 41% higher than the last peak in 2006. Phoenix was up an eye-popping 29.3%, San Diego by 27.1%, and Seattle by 25.0%. What are they putting in the water in these cities? My belief is that the structural shortfall of housing continues for another decade.

New Home Sales jump by 1.5% in August to a seasonally adjusted 740,000 units. The south saw the biggest gains at 6.0%. Median New Home Prices jumped an amazing 20.1% to 390,000 YOY. The exodus from the city to the burbs continues unabated. Inventory is at 6.1 months.

Pending Home Sales rocket, in August by 8.1% on a signed contract basis compared to only 1.2% expected. That’s a seven-month high. The Midwest led the charge with a 10.4% gain. Rising inventories and continued low interest rates were a big help. The bidding wars are abating.

China Energy Shortage causes Apple and Tesla cutback and they are buying 70% of America’s coal production to meet the shortfall. Several key chip packaging and testing service providers supplying Intel, Nvidia, and Qualcomm also received notices to suspend production at their facilities in Jiangsu for several days. It’s Another Black Swan from the Middle Kingdom.

The First Trust Skybridge Crypto Industry & Digital Economy ETF (CRPT)launched on September 23. It will be kicked off by my longtime friend and Mad Hedge Summit speaker Anthony Scaramucci. Get on the crypto train before it leaves the station.

Ford (F) announced massive $11.4 Billion in US EV factories in Kentucky and Tennessee in partnership with South Korea’s SK Innovations, creating 11,000 jobs. It is one of the largest US industrial investments in recent memory. It is all part of a plan to completely reposition the company and invest $30 billion in EVs by 2025. A smart move, (F) finally read the writing on the wall.

My Ten-Year View

When we come out the other side of pandemic, we will be perfectly poised to launch into my new American Golden Age, or the next Roaring Twenties. With interest rates still at zero, oil cheap, there will be no reason not to. The Dow Average will rise by 800% to 240,000 or more in the coming decade. The American coming out the other side of the pandemic will be far more efficient and profitable than the old. Dow 240,000 here we come!

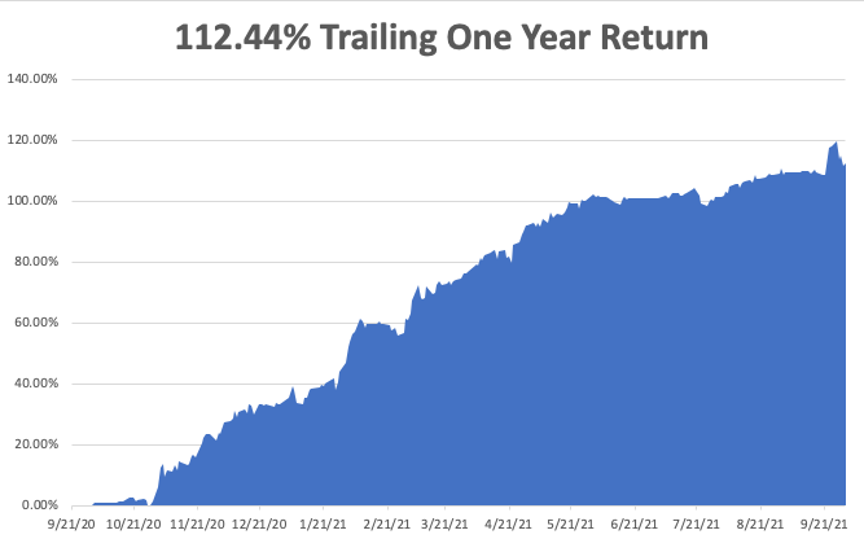

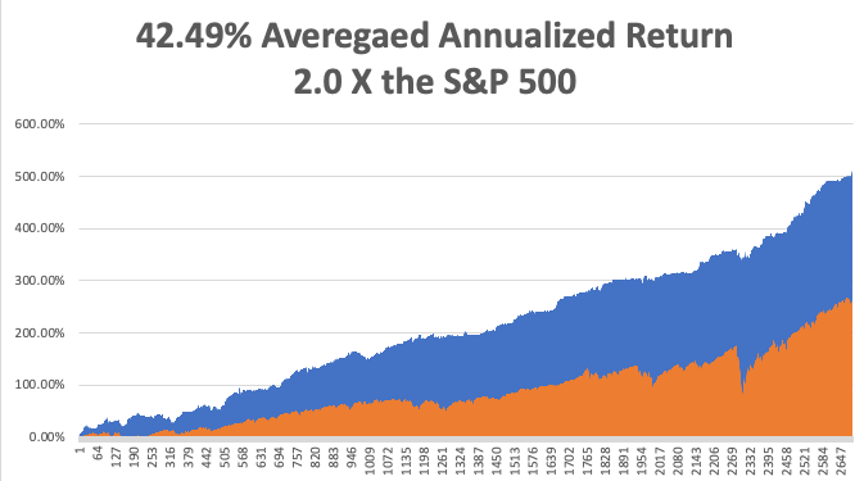

My Mad Hedge Global Trading Dispatch saw a modest +1.03% gain in September. That’s against a Dow Average that was down -5.65% for the month. My 2021 year-to-date performance soared to 80.30%. The Dow Average was up 12.18% so far in 2021.

Figuring that we are either at or close to a market bottom, and being a man of my convictions, I am 80% invested in financial stocks. Those include (MS), (GS), (JPM), (BLK), (BRKB), and (C). In for a penny, in for a pound. I am also 10% invested in the (SPY) and 10% long bonds (TLT).

I quick trip by the Volatility Index (VIX) to $29 and a rapid 45 basis point leap in ten-year US Treasury bond yields gave us the entry point for all of these positions.

That brings my 12-year total return to 502.85%, some 2.00 times the S&P 500 (SPX) over the same period. My 12-year average annualized return now stands at an unbelievable 42.49%, easily the highest in the industry.

My trailing one-year return popped back to positively eye-popping 112.44%. I truly have to pinch myself when I see numbers like this. I bet many of you are making the biggest money of your long lives.

We need to keep an eye on the number of US Coronavirus cases at 44 million and rising quickly and deaths topping 701,000, which you can find here.

The coming week will be slow on the data front.

On Monday, October 4 at 10:00 AM, US Factory Orders for August are out.

On Tuesday, October 5 at 8:30 AM, the US Balance of Trade for August is announced.

On Wednesday, October 6 at 8:15 AM, we get the Challenger Private Jobs Report for September.

On Thursday, October 7 at 8:30 AM, Weekly Jobless Claims are announced.

On Friday, October 8 at 8:30 AM, we learn the September Nonfarm Payroll Report. At 2:00 PM, the Baker Hughes Oil Rig Count are disclosed.

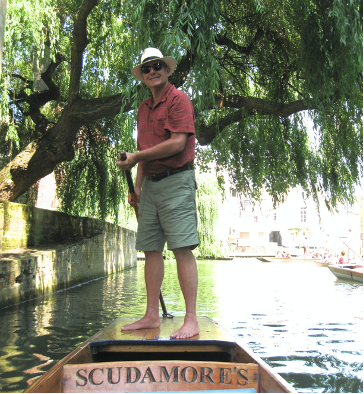

As for me, in my many travels around the world, I never hesitate to visit places of historical interest. The London grave of Carl Marx, the Paris grave of Jim Morrison, the bridge of the cruiser of the USS San Francisco, which took a direct hit from an 18-inch Japanese shell, you name it.

After attending one of my global strategy luncheons in Charleston, South Carolina, where the Civil War began with the Confederates firing on Fort Sumter in 1861, I looked for something to do. Fort Sumter was a full day trip and there wasn’t much to see anyway.

So I pulled out my trusty iPhone to get some ideas. It only took me a second to decide. I attended Sunday church services at the Mother Emanuel African Methodist Episcopal Church, where 15 people were gunned down by a deranged white nationalist in 2014.

The church was built in 1891 by freed slaves and their children. The congregation dates back earlier to 1791. It has every bit a handmade touch with fine Victorian stained-glass windows.

The ushers stopped me at the door for 20 minutes where they suspiciously eyed me. Then they invited me in and sat me down next to the only other white person there, a Jewish woman from New York.

It was a working-class congregation and polyester suites and print dresses were the order of the day. Everyone was polite, if not respectful, and I sang the hymns with the air of a book in the pew in front of me.

The gospel singing was incredible, if not angelic. When I left, an usher thanked me for supporting their cause. Very moving. I praised them for their strength and tossed a $100 bill into the basket.

Charleston is a big wedding destination now, with young couples pouring in from all over the South to tie the knot. Saturday night on Market Street saw at least a dozen bachelor and hen parties going bar to bar and getting wasted, the women falling off their platform shoes.

The United States still has a lot of healing to go to recover from the recent years of turmoil. I thought this was one small step.

Mother Emanuel African Methodist Episcopal Church |

Quote of the Day“I have not failed, I have just found 10,000 ways that do not work,” said the inventor, Thomas Edison.

| This is not a solicitation to buy or sell securities

The Mad Hedge Fund Trader is not an Investment advisor

For full disclosures click here at:

http://www.madhedgefundtrader.com/disclosures

The "Diary of a Mad Hedge Fund Trader"(TM)

and the "Mad Hedge Fund Trader" (TM)

are protected by the United States Patent and Trademark Office

The "Diary of the Mad Hedge Fund Trader" (C)

is protected by the United States Copyright Office

Futures trading involves a high degree of risk and may not be

|

Five ways to play the worldwide energy crunch - Barron's.

Instacart? Rivian? IPOs and SPACs seem poised for a hot Q4.

'Clickbait' leads streaming ratings for Netflix (NASDAQ:NFLX).

Tesla (NASDAQ:TSLA) tops expectations with Q3 deliveries of 241K.

Moonshot watch: Valuation on Fanatics (FANA) soars off sports betting.

Rocket Lab (NASDAQ:RKLB) #1 industrial gainer thrice in a month.

Shares of China's Evergrande (OTCPK:EGRNF) suspended in Hong Kong.

Fumio Kishida elected as Japan's 100th prime minister.

| | Seeking Alpha’s Wall Street Breakfast Podcast

| | �

|

|