Anyone get in on BA when it bottomed out last week?

I did at 99, and again at 129, last little scoop at 149. Ready to fly now...lol

HD at 145.

Delta at 29.

NEE at 205.

Anyone get in on BA when it bottomed out last week?

I did at 99, and again at 129, last little scoop at 149. Ready to fly now...lol

HD at 145.

Delta at 29.

NEE at 205.

| � |

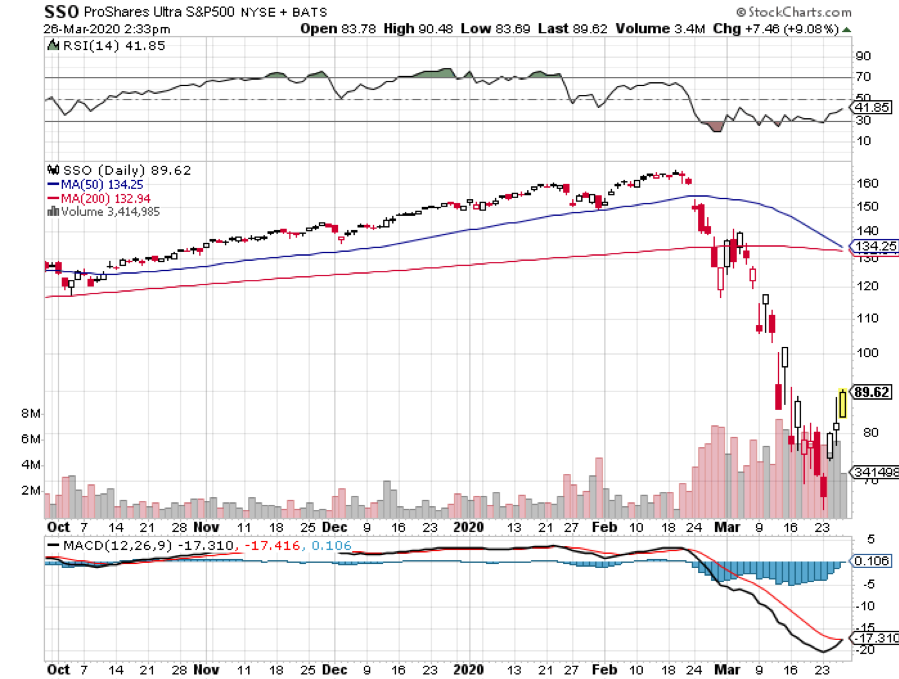

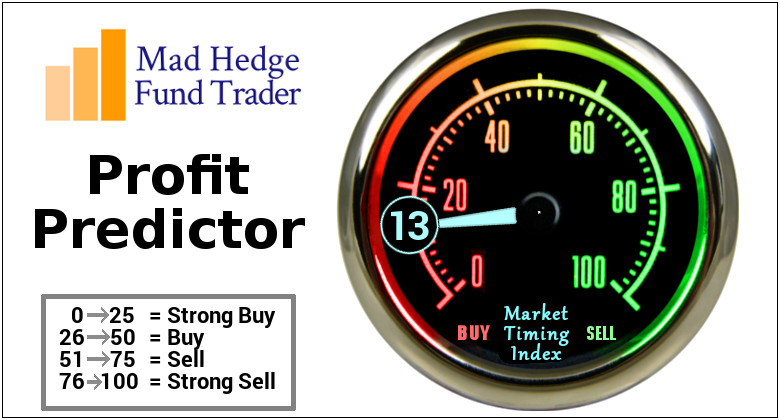

March 25, 2020 - Biweekly Strategy Webinar Q&A Below please find subscribers’ Q&A for the Mad Hedge Fund Trader March 25 Global Strategy Webinar broadcast from Silicon Valley, CA with my guest and co-host Bill Davis of the Mad Day Trader. Keep those questions coming! Q: Since we flipped the off button on the economy, I don’t see how we can simply flip the on button and have a V-shaped recovery. It seems much more unlikely that it will get back to pre-recession levels. A: Actually, all we really need is confidence. Confident people can go outside and not get sick. Once we start seeing a dramatic decline in the number of new cases, the shelter-in-place orders may be cancelled, and we can go outside and go back to work. It’s really that simple. So, we will get an initial V-shaped recovery probably in the third quarter, and after that, it will be a slower return spread over several quarters to get back to normal. Everybody wants to get back to normal and let's face it, there's an enormous amount of deferred consumption going on. I have hardly spent any money myself other than what I’ve spent online. All of those purchases get deferred, so in the recovery, there's going to be a massive binge of entertainment, shopping, and travel that is all being pent up now—that will get unleashed once the airlines start flying again and the shelter-in-place orders are cancelled. We’re not losing so much of this growth, we’re just deferring it. Obviously, some of the growth is gone permanently; you can forget about any kind of vacation in the next couple of months. I would say, the great majority of consumption in the US—and thus growth and thus stock appreciation—is just being deferred, not cancelled outright. Q: Other than the ProShares Ultra Technology ETF (ROM), do you have any other leveraged sectors coming into the recovery? A: There is a 50/50 chance the Roaring 20s started 2 days ago, on Monday, March 23 at the afternoon lows. We may go back and test those lows one more time, which at this point is 3,700 points below here, but we are clocking 1,000 points a day. It doesn’t take much, like a bad non-farm payroll number, to go back and test those lows. The good news is out; they're not going to spend any more money other than the $10 trillion they're putting in now. Q: Would you buy Boeing (BA) here? Is this the bottom? A: The bottom was at $94 on Monday; we went up 100% in three days and now we’re at $180. Incredible moves, and a total lack of liquidity. One reason I haven't added any positions lately is that they have closed the New Yok Stock Exchange floor and its not clear that of I send out a trade alert, it could get done. We have gone totally online, so I just want to see what happens as a result of that. I don’t want to be putting out trade alerts that no one can get in or out of, heaven forbid. Q: What do you mean by “The spike to $80 in the Volatility Index (VIX) was totally artificial?” A: When you have a series of cascading shorts triggered by margin calls, that is artificial. I have seen this happen many times before, both on the upside and the downside. This happened twice in the (VIX) in the last two years. When you go from a (VIX) of $25 to $80 and back down to $39 in days, which is what we did, you know it was a one-time-only spike and we are not going to visit the $80 level again— at least not until the next financial crisis because those positions are gone and are never coming back. A (VIX) of $80 means we are going to have 1,000 point move in the Dow Average for the next 30 days. Q: I bought some ProShares Ultra Pro ETF (UPRO) which is the 3x long the S&P 500 at $1,829. Do I take profits by selling calls or just hold longer? A: I would just sell the whole position outright. The (UPRO) is so incredibly volatile that you are rewarded heavily for just coming out completely and then reopening fresh positions on these big meltdown days. We will probably be doing trade alerts on (UPRO) or its cousin, the 2x long ProShares Ultra S&P 500 (SSO) sometime in the near future. Q: With 2-year LEAPs, would you go at the money or out of the money? A: This is the golden opportunity to go way out of the money because the return goes from 100% to 500%, or even 1000% if you go, say, 30%-50% out of the money. A lot of these stocks are ripe for very quick 30% bouncebacks, especially the (ROM). So yes, you want to do out of the money 20% to 30%. It will easily recover those losses in weeks if you are picking the right stocks. Over a two-year view, a lot of these big tech stocks could double by the time your LEAP expires, and then you will get the full profit. The rule of thumb is: the farther out of the money you go, the bigger the profit is. But I wouldn’t go for more than a 1000% profit in 2 years; you don't want to get greedy, after all. Q: You called the Dow to hit 15,000. Is that still possible? We got down to the 18 handle. A: Yes, if the coronavirus data gets worse, which is certain, we could get another panic selloff. How will the market handle 100,000 US deaths, given the exponential rise in cases we are seeing? With cases doubling every three days that is entirely within range. So, I would say, there is a 50% chance we hit the bottom on Monday at 18,000, and 50% chance we go lower. Q: Do you know anything about the coronavirus stocks like Regeneron (REGN)? A: Actually, I do, it's covered by the Mad Hedge Biotech & Health Care Letter, click here for the link. If you get the Biotech Letter, you already know all about stocks like Regeneron. Regeneron literally has hundreds of drugs in testing right now to work as vaccines or antivirals, and some of them, like their arthritis drug, have already been proven to work. So, we just have to get through the accelerated trials and testing to unleash it on the market. But for anybody who has a drug, it's going to take a year to mass-produce enough to inoculate the entire country, let alone the world. So, don't make any big bets on getting a vaccine any time soon—it's a very long process. Even in normal times, some of these drugs take months to manufacture. Q: Are there any ventilator stocks out there? A: There are; a company called Medtronic (MDT), which the Mad Hedge Biotech & Healthcare Letter also covers. They are the largest ventilator company in the US. Their normal production is 100 machines a week. Now, they are increasing that to 500 a week as fast as they can, but it isn’t enough. We need about 100,000 ventilators. China is now selling ventilators to the US. Elon Musk from Tesla (TSLA) just bought 1,000 ventilators in China and had them shipped over to San Francisco at his own expense, and Virgin Atlantic just flew over a 747 full of ventilators and masks and other medical supplies from China. So yes, there are stocks out there to play these things, they have already had large moves. We liked them anyway, even before the pandemic, so those calls were quite good. And China thinks their epidemic is over, so they are happy to sell us all the medical supplies they can make. Q: Why did 30-year mortgage rates just go up instead of down? I thought the Fed rate cuts were supposed to take them down; am I missing something? A: In order to get 30-year mortgage rates down, you have to have buyers of 30-year loans, and right now there are buyers of nothing. The lending that is happening is from banks lending their own money, which is only a tiny percentage of the total loan market. When the Fed moves into the mortgage market, you will see those yields move to the 2% range. The other problem is how to get a loan if all the banks are closed. They are running skeletal staff now, and you can’t close on real estate deals because all the notaries and title offices are closed; so essentially the real estate industry is going to shut down right now and hopefully, we’ll finish that in a month. Q: Do you think Uber (UBER) and Lyft (LYFT) will go bankrupt? A: It is a possibility because one to one human contact inside a car is about the last situation you want to be in during a pandemic. Their traffic was down 25% according to a number I saw. It’s very heavily leveraged, very heavily indebted, and those are the companies that don’t survive long in this kind of crisis. So, I would say there is a chance they will go under. I never liked these companies anyway; they are under regulatory assault by everybody, depend on non-union drivers working for $5 an hour, and there are just too many other better things to do. Q: Is this the end of corporate buybacks? A: To some extent, yes. A future Congress may make it either illegal or highly tax corporate buybacks, in some fashion or another because twice in 12 years now, we have had companies load up on buying back their own stock, boosting CEO compensation to the hundreds of millions—if not billions—and then going broke and asking for government bailouts. Something will be done to address that. If you take buybacks out of the market (the last 10,000-point gain in the Dow were essentially all corporate buybacks), we may not see a 20X earnings multiple again for another generation. Individuals were net sellers of stock for those two years. We only reached those extreme highs because of buybacks, so you take those out of the equation and it's going to get a lot harder to get back to the super inflated share prices like we had in January. Q: How long before an Italian bank collapses, and will they need a bailout? A: I don’t think they will get a collapse; I think they will be bailed out inside Italy and won’t need all of Europe to do this. But the focus isn't on Europe right now, it's on the US. Q: Do you think this virus is really subsiding in China based on their past history of dishonest reporting? A: Yes, that is a risk, and that's why people aren’t betting the ranch right now—just because China is reporting a flattening of cases. And China could be hit with a second wave if they relax their quarantine too soon. Q: What's your opinion on how the Fed is doing and Steve Mnuchin in this crisis? A: I think the Fed is doing everything they possibly can. I agree with all of their moves—this is an all-hands-on-deck moment where you have to do everything you can to get the economy going. Notice it’s Steve Mnuchin doing all the negotiating, not the president, because nobody will talk to him. For a start, he may be a Corona carrier among other things, and you’re not seeing a lot of social distancing in these press conferences they are holding. About which 50% of the information they give out is incorrect, and that's the 50% coming from Donald Trump. Q: What do you think about no debt and no pension liability? A: That’s why Tech has been leading the upside for the last 10 years and will lead for the next 10. You can really narrow the market down to a dozen stocks and just focus on those and forget about everything else. They have no net debt or net pension fund liabilities. Q: Why have we not heard from Warren Buffet? A: I'm sure negotiations are going on all over the place regarding obtaining massive stakes in large trophy companies that he likes, such as airlines and banks. So that will be one of the market bottom indicators that I mentioned a couple of days ago in my letter on “Ten Signs of a Market is Bottoming.” Q: What’s the outlook for gold? A: Up. We just had to get the financial crisis element out of this before we could go back into gold, so I would be looking to buy SPDR Gold Shares ETF (GLD), the gold miners like Barrick Gold (GOLD) and Newmont Mining (NEM), the Van Eck Vectors Gold Miners ETF (GDX), and the 2X long ProShares Gold ETF (UGL). Q: Does the Fed backstop give you any confidence in the bond market? A: Yes, it does. I think we finally may be getting to the natural level of the market, which is around an 80-basis point yield. Let’s see how long we can go without any 50-point gyrations. Q: Do you foresee a depression? A: We are in a depression now. We could hit a 20% unemployment rate. The worst we saw during the Great Depression was 25%. But it will be a very short and sharp one, not a 12-year slog like we saw during the 1930s. Good Luck and Good Trading and stay healthy. John Thomas CEO & Publisher The Diary of a Mad Hedge Fund Trader

|

Quote of the Day "You make the most money when things go from terrible to only bad," said Tim Seymour of emerging market hedge fund, Triogem Asset Management.

|

I'm considering some of the airline stocks also....and maybe add a few cruiselines.

For anyone who's been sitting on the sidelines, if you have cash now is the time to jump in. Sure, we don't know what's happening yet...but America is resilient. The market WILL come back.

I got BA at $97. It's down today, but this is a good stock. It was close to $400 not long ago and many investors were saying to buy when/if it drops below $300....now look at it. I only bought 20 shares, but it's been fun watching it rise.

I have no clue where the market is heading. If we can get back to some normalcy (get back to work), I think BA goes to $250+ within a year.

Also, anyone w/ some extra money: I've added a few oil stocks (MRO, OXY) and plan to sit on it - it may take a year or longer, but these stocks will triple or more. I've bought the oil dips for years and waited it out and made some good returns. Also suggest only buy dividend paying oil stocks, so while you wait it out you're getting extra shares.

great Q&A! Thanks for posting all of this!

|

Bozzie, the problem is....when do we know when "the bottom is found"???? I wish one of us had a crystal ball!!

I haven't taken much of a position yet but all these pros talk about a "bottom" being built now and buying on the dips...

Reality about the amount of time parts of the economy are going to be shuttered might be starting to sink in, last weeks talk about opening back up for biz by Easter had a + effect...

| Jobs will be a major focus in the week ahead as the U.S. economy reels from the impact of the pandemic. The ADP employment report and weekly initial jobless claims report are due out before the March jobs report drops on April 4. The March jobs report is expected to only show a loss of about 300K jobs as the real damage doesn't arrive until April and May. Moody's Analytics Chief Economist Mark Zandi forecasts the unemployment rate in the U.S. will hit double digits within a few months on delayed repercussions. PMI prints will also pour out next week from Spain, Germany, the U.K. and U.S. to give a quick snapshot of economic activity. The corporate event and earnings calendars are thin once again next week, but investors should be strapped in for plenty of action as animal spirits rage on. Earnings spotlight: A trio of companies seeing spikes in demand for food products are due to report next week, with egg-producer Cal-Maine Foods (NASDAQ:CALM) on tap for March 30 and pantry loaders Conagra (NYSE:CAG) and McCormick (NYSE:MKC) both reporting on March 31. Other companies due to spill numbers during the week include Lamb Weston (NYSE:LW) on April 1; Walgreens Boots Alliance (NASDAQ:WBA), Chewy (NYSE:CHWY) and CarMax (NYSE:KMX) on April 2, as well as Constellation Brands (NYSE:STZ) on April 3. Go deeper: See Seeking Alpha's complete list of earnings reporters IPO watch: WiMi Hologram Cloud (WIMI) is expected to price its IPO on March 30. IPO lockup periods expire on Viela Bio (NASDAQ:VIE), Aprea Therapeutics (NASDAQ:APRE), Frequency Therapeutics (NASDAQ:FREQ) and MetroCity Bankshares (NASDAQ:OTC:MCBS) on March 31. The analyst quiet period runs out on GFL Environmental (NYSE:GFL) on March 30. Across the Pacific, the IPO lockup period expires on Budweiser Brewing Company (BUDBC) in Hong Kong. Shares of BUDBC are down 22% since the beer company was set free from Anheuser-Busch InBev (NYSE:BUD). Go deeper: Catch up on all the latest IPO news. Projected dividend changes (quarterly): Bank OZK (NASDAQ:OZK) to $0.27 from $0.26, Constellation Brands to $0.76 from $0.75, SM Energy (NYSE:SM) to $0.01 from $0.05, and Dollarama (OTC  LMAF) to C$0.050 from C$0.044. LMAF) to C$0.050 from C$0.044.Go deeper: Read the latest dividend analysis. M&A tidbits: Shareholders with the Rubicon Project (NYSE:RUBI) vote on the company's merger with Telaria (NYSE:TLRA) on March 30. The walk data on China Oceanwide's acquisition of Genworth Financial (NYSE:GNW) is March 31. The tender off expires on the Super ROI Global-Jumei International (NYSE:JMEI) deal on April 1. Analyst/investor meetings: Pfizer (NYSE:PFE) rescheduled its investor day update that was planned for March 31 without setting a new date. Bristol-Myers Squibb (NYSE:BMY) also pulled the plug on its event, while GoDaddy (NYSE:GDDY) is going to an online format with its presentation set for April 2. Enterprise Products Partners (NYSE:EPD) and The Andersons (NASDAQ:ANDE) also have events scheduled. Apple's non-event: While Apple (NASDAQ:AAPL) made a surprise announcement already of new versions of iPad Pro, Mac Mini and MacBook Air devices with its March 31 keynote event canceled, the company stopped short of announcing a launch of the new lower-cost iPhone 9. Some reports indicate that Apple has held internal discussions about potentially delaying the launch by months due to supply chain issues arising from the pandemic. There is also some talk that Apple will push back the debut of the highly-anticipated Apple 12 5G smartphone from the traditional September window. "We believe the chances for a launch in the September/October time frame is "extremely unlikely" and would assign a 10%-15% probability it happens given the lingering supply chain issues that remain across Asia," warns Wedbush Securities analyst Dan Ives. The firm is still bullish on Apple for the long term due in part to the 5G super cycle. IT disruption: The tech sector has been disrupted by the pandemic, not just with share price declines, but an upheaval of IT demand changes that could be a game changer. Taking the long view, JPMorgan sees an acceleration in certain slow-moving IT infrastructure trends driven by the broadening disruption of COVID-19. In particular, the firm notes increasing bandwidth requirements due to the increasing number of employees working from home in a trend that looks positive for Ciena (NYSE:CIEN), CommScope (NASDAQ:COMM), Infinera (NASDAQ:INFN) and Hewlett-Packard Enterprises' (NYSE:HPE) Aruba. An increase in leverage of the public cloud is seen setting up Arista Networks (NYSE:ANET) and NICE Ltd. (NASDAQ:NICE), while the increase in migration from proprietary hardware solutions to virtual solutions is seen as a win for VMware (NYSE:VMW). Then there is the sudden growth of contactless transactions, led by the adoption of electronic wallets to reduce human-to-human interaction. That development looks good for Diebold Nixdorf (NYSE:OTCPK  BD) and NCR (NYSE:NCR). With everyone burning up their laptops for the next few weeks or longer, JP sees an upgrade cycle benefit for HP (NYSE:HPQ), Dell Technologies (NYSE:DELL) and Logitech (NASDAQ:LOGI). In semiconductors, the firm taps Broadcom (NASDAQ:AVGO), Intel (NASDAQ:INTC), Micron Technology (NASDAQ:MU), Marvell Technology (NASDAQ:MRVL), Qorvo (NASDAQ:QRVO), Inphi (NYSE:IPHI) and Nvidia (NASDAQ:NVDA) as attractive amid the anticipated strong growth in cloud and hyperscale datacenter spending. BD) and NCR (NYSE:NCR). With everyone burning up their laptops for the next few weeks or longer, JP sees an upgrade cycle benefit for HP (NYSE:HPQ), Dell Technologies (NYSE:DELL) and Logitech (NASDAQ:LOGI). In semiconductors, the firm taps Broadcom (NASDAQ:AVGO), Intel (NASDAQ:INTC), Micron Technology (NASDAQ:MU), Marvell Technology (NASDAQ:MRVL), Qorvo (NASDAQ:QRVO), Inphi (NYSE:IPHI) and Nvidia (NASDAQ:NVDA) as attractive amid the anticipated strong growth in cloud and hyperscale datacenter spending.Spotlight on Nielsen numbers: While Nielsen data is pushed out every few weeks for analysts to size up, the firm's release next week of 4-week trends will be a showstopper. The huge efforts of U.S. consumers to stockpile a variety of different household and pantry products should be on full display when the report drops. Companies that are expected to see some strong numbers include Coca-Cola, Keurig Dr Pepper (NYSE:KDP), Monster Beverage (NASDAQ:MNST), Clorox (NYSE:CLX), Procter & Gamble (NYSE:PG), Kimberly-Clark (NYSE:KMB), Church & Dwight (NYSE:CHD) and Edgewell Personal Care (NYSE:EPC). Cowen thinks pantry loading by consumers in March also included the beer and other alcohol categories. That prediction could be confirmed in the Nielsen data for Constellation Brands, Molson Coors (NYSE:TAP), Craft Brew Alliance (NASDAQ:BREW), Anheuser-Busch InBev and Brown-Forman (NYSE:BF.A) (NYSE:BF.B). Macau: Macau authorities will post gross gaming revenue numbers for March sometime during the first few days of April. Analysts see March GGR falling by as much as 75% compared to a year ago as tourism remains at a standstill in the gambling mecca. An initial bounce in Macau traffic to 10K visitors a day fell back to 7K visitors by the third week of the month as global headlines worsened. Before the coronavirus outbreak, weekly tourist visits of +100K were the norm. Names to watch for another round of volatility include Wynn Macau (OTCPK:WYNMF), Wynn Resorts (NASDAQ:WYNN), Sands China (OTCPK:SCHYY), Las Vegas Sands (NYSE:LVS), MGM China (OTCPK:MCHVF), MGM Resorts (NYSE:MGM), Galaxy Entertainment (OTCPK:GXYEF), SJM Holdings (OTCPK:SJMHF), Melco Resorts & Entertainment (NASDAQ:MLCO) and Studio City International (NYSE:MSC). U.S. auto sales: Edmunds forecasts U.S. auto sales will fall 35.5% Y/Y in March to 1,044,805 new cars and trucks amid the coronavirus pandemic. "The first two months of the year started off at a healthy sales pace, but the market took a dramatic turn in mid-March as more cities and states began to implement stay-at-home policies due to the coronavirus crisis, and consumers understandably shifted their focus to other things," notes Edmunds director Jessica Caldwell. "Automakers can count on capturing some deferred demand once we get past the worst of this pandemic, but since they'll be competing with so many other companies for consumer spending at that point, they're really going to need to create incentives to spur some sales," she predicts. TrueCar sees a 42% drop to below 1M units for the month. Meanwhile, J.D. Power thinks the pandemic and economic crisis are likely to accelerate the move to online sales by auto dealerships. Edmunds March forecast by manufacturer - General Motors (NYSE:GM) -31.3% to 186K units, Ford (NYSE:F) -31.0% to 160K, Fiat Chrysler Automobiles (NYSE:FCAU) -28.1% to 144K, Toyota (NYSE:TM) -36.2% to 137K, Honda (NYSE:HMC) -41.8% to 86K, Nissan (OTCPK:NSANY) -46% to 82K, Hyundai/Kia (OTCPK:HYMLF) -31.4% to 81K, Volkswagen/Audi (OTCPK:VWAGY) -41.4% to 34K. TrueCar's March estimate for Tesla (NASDAQ:TSLA) is -23.5% to 9,939. New video conferencing player in town: RingCentral (NYSE:RNG) is expected to launch a video product to compete with Zoom Video Communications (NASDAQ:ZM) next week. "In the very near term, RCMeeting will not only begin to be sold in RingCentral Office bundles across most U.S. segments, but it will also begin to replace the installed base of ZM at RNG customers," previews Rosenblatt Securities. Shares of RingCentral are up 30% over the last week, while Zoom Video is up 45% over the last four weeks. Retail check: Retail chains that are seeing high demand for the early part of the stay-at-home spring in the U.S. are likely to continue to outperform next week and beyond, reasons Odeon Capital. The list of chains with positive sales trends includes Target (NYSE:TGT), Walmart (NYSE:WMT), Costco (NASDAQ:COST), BJ's Wholesale Club (NYSE:BJ), Ollie's Bargain Outlet Holdings (NASDAQ:OLLI), Home Depot (NYSE:HD), Lowe's (NYSE:LOW), Tractor Supply (NASDAQ:TSCO), Ulta Beauty (NASDAQ:ULTA), Best Buy (NYSE:BBY), Lululemon (NASDAQ:LULU) and Dick's Sporting Goods (NYSE:DKS). The common theme is that the businesses provide essential or at least therapeutic products (even psychologically so) to consumers and have a robust digital penetration. Gene therapy: The 4th Annual Gene Therapy for Rare Disorders Summit was canceled, but it's possible the list of companies due to appear could still make announcements. That list includes bluebird bio (NASDAQ:BLUE), BioMarin Pharmaceutical (NASDAQ:BMRN), Orchard Therapeutics (NASDAQ:ORTX), Takeda Pharmaceuticals (NYSE:TAK), Spark Therapeutics (NASDAQ:ONCE), REGENXBIO (NASDAQ:RGNX), Biogen (NASDAQ:BIIB), Voyager Therapeutics (NASDAQ:VYGR), Amicus Therapeutics (NASDAQ:FOLD), Sanofi (NASDAQ:SNY), Ultragenyx Pharmaceutical (NASDAQ:RARE), Sarepta Therapeutics (NASDAQ:SRPT), Selecta Biosciences (NASDAQ:SELB), Pfizer (PFE), AVROBIO (NASDAQ:AVRO), Invitae (NYSE:NVTA), Repligen (NASDAQ:RGEN), BridgeBio Pharma (NASDAQ:BBIO), Sangamo Therapeutics (NASDAQ:SGMO), Bio-Rad Laboratories (NYSE:BIO) and uniQure (NASDAQ:QURE). Barron's mentions: The publication finds bargains in tech stocks and municipal bonds this week. The list of favorite picks blasted out by a roundtable of tech stock pickers includes DocuSign (NASDAQ:DOCU), Equinix (NASDAQ:EQIX), Digital Realty Trust (NYSE:DLR), CyrusOne (NASDAQ:CONE), CoreSite Realty (NYSE:COR), Twitter (NYSE:TWTR), Disney (NYSE:DIS), Advanced Micro Devices (NASDAQ:AMD), Lam Research (NASDAQ:LRCX), AT&T (NYSE:T), Comcast (NASDAQ:CMCSA), Taiwan Semiconductor Manufacturing (NYSE:TSM), Micron Technology (MU), Alibaba (NYSE:BABA), Applied Materials (NASDAQ:AMAT), Zynga (NASDAQ:ZNGA), Take-Two Interactive Software (NASDAQ:TTWO), Electronic Arts (NASDAQ:EA) and NetEase (NASDAQ:NTES). While municipal bonds might not get the same amount of attention as the tech sector, high yields and the potential for a recovery are seen making them stand out. The VanEck Vectors High Yield Municipal Index ETF (BATS:HYD) and iShares National Muni Bond ETF (NYSEARCA:MUB) are two catch-all ways to play the bounceback in munis. Finally, the cover story on America vs. COVID-19 is worth a read and relevant to pretty much everyone. So is the conclusion that if "we" get this right and stay healthy, it could be the opportunity of a lifetime. |

| � |

| Mad Hedge Hot Tips April 2, 2020 Fiat Lux The Five Most Important Things That Happened Today (and what to do about them)

|

Weekly Jobless Claims Explode to 6.64 Million, bringing total losses for this cycle to 10 million. That’s three full recessions of job losses in two weeks. We are already approaching Great Depression levels. The headline unemployment rate is likely 10% on its way to 30%. Will tomorrow’s March Nonfarm Payroll Report be worse? |

| � |

This guy has been very good for a long time...

Mad Hedge Hot Tips

March 25, 2020

Fiat Lux

The Five Most Important Things That Happened Today

(and what to do about them)

�

The Mad Hedge Fund Trader is not an Investment advisor

For full disclosures click here at:

http://www.madhedgefundtrader.com/disclosures

The "Diary of a Mad Hedge Fund Trader"(TM)

and the "Mad Hedge Fund Trader" (TM)

are protected by the United States Patent and Trademark Office

The "Diary of the Mad Hedge Fund Trader" (C)

is protected by the United States Copyright Office

Futures trading involves a high degree of risk and may not be suitable for everyone.