Golden Entertainment Enters into Definitive Agreement to Acquire American Casino & Entertainment Properties for $850 Million

Business WireJune 12, 2017

LAS VEGAS--(BUSINESS WIRE)--

Golden Entertainment Inc. (GDEN) (“Golden” or the “Company”), announced today that it has entered into a definitive agreement to acquire American Casino & Entertainment Properties LLC (“American”), which owns three properties in Las Vegas including the Stratosphere Casino, Hotel & Tower, Arizona Charlie’s Decatur and Arizona Charlie’s Boulder, as well as its fourth property, the Aquarius Casino Resort in Laughlin. American is expected to generate approximately $413 million of net revenues and $103 million of EBITDA in 2017, and Golden expects to achieve approximately $18 million of annual run-rate synergies post-closing. The purchase price of $850 million includes working capital cash estimated to be approximately $28 million at closing.

The purchase consideration will consist of $781 million cash plus approximately four million shares of Golden stock issued to American’s current owner, Whitehall Street Real Estate Partners 2007 (“Whitehall”), a real estate private equity fund managed by the Merchant Banking Division of Goldman Sachs. The number of shares issued to Whitehall was determined based on Golden’s 10-day volume weighted average price of $17.05 as of June 9, 2017. Upon closing, Whitehall will own approximately 15% of Golden’s diluted shares outstanding. The transaction is expected to be immediately accretive to Golden’s operating results, increasing free cash flow and earnings per share significantly. Based on American’s estimated 2017 EBITDA, the acquisition represents an 8.0x pre-synergies multiple and a 6.8x post-synergies multiple.

Upon completion of the transaction, Golden will operate over 15,800 slot machines, 114 table games and more than 5,100 hotel rooms across eight casino properties and almost 1,000 distributed gaming locations including the largest branded tavern portfolio in Nevada. Pro forma for the completion of the transaction, the combined company would generate approximately $847 million of net revenues in 2017 and approximately $180 million of EBITDA in 2017, including $18 million of estimated run-rate synergies.

The transaction is not subject to a financing condition. Golden has received committed financing totaling $1.1 billion from JPMorgan Chase Bank, N.A., Credit Suisse, Macquarie Capital and Morgan Stanley & Co. LLC to fund the cash consideration as well as to refinance Golden’s existing credit facilities. The financing commitment includes a $100 million revolving credit facility to support Golden’s future organic and strategic growth initiatives.

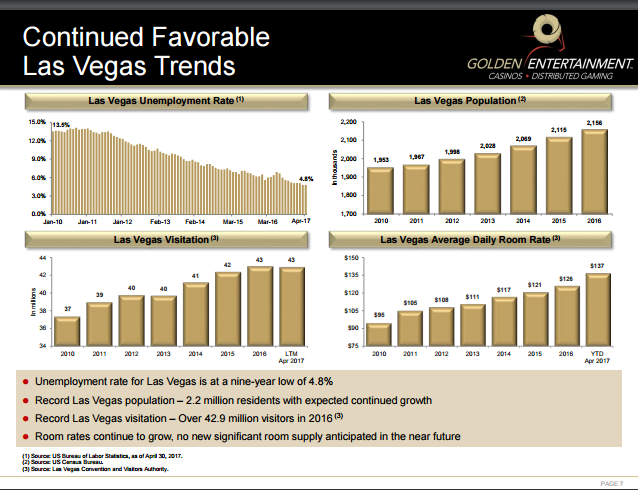

Blake L. Sartini, Chairman and Chief Executive Officer of Golden, commented, “This is a transformational event for our Company, creating a significant gaming portfolio centered around Nevada-based casinos that, in addition to our Pahrump properties, will include two well-known Las Vegas locals casinos, a destination resort in Laughlin, and the iconic Stratosphere property on the Las Vegas Strip. Our market leading distributed gaming businesses in Nevada and Montana, as well as our Casino Resort in Maryland, present several opportunities to cross-market and promote these new assets that we welcome to the Golden family. As with our existing businesses, we believe the American properties are poised to benefit tremendously from anticipated continued economic growth in Nevada, particularly from the continued strength in the Las Vegas market.”

Mr. Sartini further stated, “The American properties represent an ideal complement to our existing operations as they strengthen our presence in the Las Vegas locals market while providing us with an iconic destination property on the Las Vegas Strip. Our proven strategy of focusing on guest service, quality food and beverage offerings and effective player marketing will complement the strong existing operations currently at all of American’s properties. In addition, given the recent investment activity focused on the north end of the Las Vegas Strip, we see future potential to develop the approximately 15 acres of excess real estate surrounding the Stratosphere. This acquisition supports our goals for growth in many ways, including the potential to use our increased free cash flow and financial scale to pursue distributed gaming opportunities in existing or potential new markets.”

Charles Protell, Chief Financial Officer of Golden, concluded, “This transaction significantly increases the size of our operations and allows us to access the capital markets more efficiently while enhancing our ability to further expand our leading presence in distributed gaming. At closing, we anticipate our funded total debt to be approximately $1 billion resulting in a net leverage ratio of less than 5.5x. Post-closing, we anticipate leverage will be reduced by operating cash flow of the combined businesses. In addition, we expect that our new credit facility will provide us with the flexibility and liquidity to pursue future organic and strategic opportunities.

“With the acquisition of American, we will improve our position to benefit from Nevada’s strong economic trends which are driving gaming, room, and F&B revenues on the Las Vegas Strip, in the Las Vegas locals and in other Nevada gaming markets. Despite the significance of our Nevada casino portfolio after closing this transaction, we intend to continue to invest in the expansion of our industry leading distributed gaming business including our planned tavern developments in Las Vegas as well as our pursuit of potential distributed gaming operations in new jurisdictions.”

The transaction is subject to customary regulatory approvals and is expected to close by the end of 2017.

J.P. Morgan Securities LLC, Credit Suisse, Macquarie Capital, and Morgan Stanley & Co. LLC are acting as co-financial advisors and Latham & Watkins LLP is acting as legal counsel to Golden in connection with the proposed transaction. Macquarie Capital has also provided a Fairness Opinion to Golden’s board of directors in connection with the transaction. Goldman Sachs & Co. LLC is acting as financial advisor to American and Sullivan & Cromwell LLP is acting as its legal counsel.

Conference Call, Webcast, Investor Presentation

Golden will host a conference call today, Monday, June 12 at 4:30 p.m. ET to review the transaction. To access the conference call, interested parties may dial 866/394-1484 or 213/660-0701 for international callers. The Conference ID Number is 38250490. Participants can also listen to a live webcast of the call from Golden’s website at “Investors”. During the conference call and webcast, management will review a presentation summarizing the proposed transaction which can be accessed from Golden’s website at “Presentation”. A webcast replay will be available for 90 days following the live event at “Investors”. Please call five minutes in advance to ensure that you are connected. For the webcast, please allow 15 minutes to register, download and install any necessary software.

About American Casino & Entertainment Properties LLC

American owns and operates four gaming and entertainment properties in Nevada which in aggregate feature 3,879 slot machines, 89 table games and 4,895 hotel rooms:

Golden currently owns and operates gaming properties across two divisions – distributed gaming and resort and casino operations. Golden operates approximately 12,000 gaming devices and 25 table games in Nevada, Maryland and Montana. The Company owns four casino properties, 56 taverns and operates almost 1,000 distributed gaming locations in multiple jurisdictions. Golden is focused on maximizing the value of its portfolio by leveraging its scale, leadership position, and proven management capabilities across its two divisions. For more information, visit www.goldenent.com.

Business WireJune 12, 2017

LAS VEGAS--(BUSINESS WIRE)--

Golden Entertainment Inc. (GDEN) (“Golden” or the “Company”), announced today that it has entered into a definitive agreement to acquire American Casino & Entertainment Properties LLC (“American”), which owns three properties in Las Vegas including the Stratosphere Casino, Hotel & Tower, Arizona Charlie’s Decatur and Arizona Charlie’s Boulder, as well as its fourth property, the Aquarius Casino Resort in Laughlin. American is expected to generate approximately $413 million of net revenues and $103 million of EBITDA in 2017, and Golden expects to achieve approximately $18 million of annual run-rate synergies post-closing. The purchase price of $850 million includes working capital cash estimated to be approximately $28 million at closing.

The purchase consideration will consist of $781 million cash plus approximately four million shares of Golden stock issued to American’s current owner, Whitehall Street Real Estate Partners 2007 (“Whitehall”), a real estate private equity fund managed by the Merchant Banking Division of Goldman Sachs. The number of shares issued to Whitehall was determined based on Golden’s 10-day volume weighted average price of $17.05 as of June 9, 2017. Upon closing, Whitehall will own approximately 15% of Golden’s diluted shares outstanding. The transaction is expected to be immediately accretive to Golden’s operating results, increasing free cash flow and earnings per share significantly. Based on American’s estimated 2017 EBITDA, the acquisition represents an 8.0x pre-synergies multiple and a 6.8x post-synergies multiple.

Upon completion of the transaction, Golden will operate over 15,800 slot machines, 114 table games and more than 5,100 hotel rooms across eight casino properties and almost 1,000 distributed gaming locations including the largest branded tavern portfolio in Nevada. Pro forma for the completion of the transaction, the combined company would generate approximately $847 million of net revenues in 2017 and approximately $180 million of EBITDA in 2017, including $18 million of estimated run-rate synergies.

The transaction is not subject to a financing condition. Golden has received committed financing totaling $1.1 billion from JPMorgan Chase Bank, N.A., Credit Suisse, Macquarie Capital and Morgan Stanley & Co. LLC to fund the cash consideration as well as to refinance Golden’s existing credit facilities. The financing commitment includes a $100 million revolving credit facility to support Golden’s future organic and strategic growth initiatives.

Blake L. Sartini, Chairman and Chief Executive Officer of Golden, commented, “This is a transformational event for our Company, creating a significant gaming portfolio centered around Nevada-based casinos that, in addition to our Pahrump properties, will include two well-known Las Vegas locals casinos, a destination resort in Laughlin, and the iconic Stratosphere property on the Las Vegas Strip. Our market leading distributed gaming businesses in Nevada and Montana, as well as our Casino Resort in Maryland, present several opportunities to cross-market and promote these new assets that we welcome to the Golden family. As with our existing businesses, we believe the American properties are poised to benefit tremendously from anticipated continued economic growth in Nevada, particularly from the continued strength in the Las Vegas market.”

Mr. Sartini further stated, “The American properties represent an ideal complement to our existing operations as they strengthen our presence in the Las Vegas locals market while providing us with an iconic destination property on the Las Vegas Strip. Our proven strategy of focusing on guest service, quality food and beverage offerings and effective player marketing will complement the strong existing operations currently at all of American’s properties. In addition, given the recent investment activity focused on the north end of the Las Vegas Strip, we see future potential to develop the approximately 15 acres of excess real estate surrounding the Stratosphere. This acquisition supports our goals for growth in many ways, including the potential to use our increased free cash flow and financial scale to pursue distributed gaming opportunities in existing or potential new markets.”

Charles Protell, Chief Financial Officer of Golden, concluded, “This transaction significantly increases the size of our operations and allows us to access the capital markets more efficiently while enhancing our ability to further expand our leading presence in distributed gaming. At closing, we anticipate our funded total debt to be approximately $1 billion resulting in a net leverage ratio of less than 5.5x. Post-closing, we anticipate leverage will be reduced by operating cash flow of the combined businesses. In addition, we expect that our new credit facility will provide us with the flexibility and liquidity to pursue future organic and strategic opportunities.

“With the acquisition of American, we will improve our position to benefit from Nevada’s strong economic trends which are driving gaming, room, and F&B revenues on the Las Vegas Strip, in the Las Vegas locals and in other Nevada gaming markets. Despite the significance of our Nevada casino portfolio after closing this transaction, we intend to continue to invest in the expansion of our industry leading distributed gaming business including our planned tavern developments in Las Vegas as well as our pursuit of potential distributed gaming operations in new jurisdictions.”

The transaction is subject to customary regulatory approvals and is expected to close by the end of 2017.

J.P. Morgan Securities LLC, Credit Suisse, Macquarie Capital, and Morgan Stanley & Co. LLC are acting as co-financial advisors and Latham & Watkins LLP is acting as legal counsel to Golden in connection with the proposed transaction. Macquarie Capital has also provided a Fairness Opinion to Golden’s board of directors in connection with the transaction. Goldman Sachs & Co. LLC is acting as financial advisor to American and Sullivan & Cromwell LLP is acting as its legal counsel.

Conference Call, Webcast, Investor Presentation

Golden will host a conference call today, Monday, June 12 at 4:30 p.m. ET to review the transaction. To access the conference call, interested parties may dial 866/394-1484 or 213/660-0701 for international callers. The Conference ID Number is 38250490. Participants can also listen to a live webcast of the call from Golden’s website at “Investors”. During the conference call and webcast, management will review a presentation summarizing the proposed transaction which can be accessed from Golden’s website at “Presentation”. A webcast replay will be available for 90 days following the live event at “Investors”. Please call five minutes in advance to ensure that you are connected. For the webcast, please allow 15 minutes to register, download and install any necessary software.

About American Casino & Entertainment Properties LLC

American owns and operates four gaming and entertainment properties in Nevada which in aggregate feature 3,879 slot machines, 89 table games and 4,895 hotel rooms:

- The Stratosphere Casino, Hotel & Tower features the 1,149-foot Stratosphere Tower, one of the most iconic landmarks on the North Las Vegas Strip and the tallest freestanding observation tower in the U.S., offering views of the city, award-winning fine dining and lounges, specialty retailers, the world's highest thrill rides and SkyJump Las Vegas. The property features an 80,000 sq. ft. casino with 743 slot machines, 42 table games, 2,427 guestrooms and suites, 13 restaurants, nine bars, two pools and entertainment venues.

- The Aquarius Casino Resort, located in Laughlin, Nevada, is an award-winning destination resort located on the banks of the Colorado River. The largest casino operations and hotel in Laughlin, Aquarius features 1,227 slot machines, 33 table games, and 1,906 guestrooms and suites offering river, mountain and desert views. Guests enjoy over 57,000 sq. ft. of casino floor space, eight restaurants, three bars, an entertainment Pavilion and a range of outdoor and sports amenities.

- Arizona Charlie's Hotel & Casino – Decatur is located just off the Las Vegas Strip. The property features 1,060 slot machines, seven table games, 259 hotel rooms, a Poker Room, a Race & Sportsbook, the city's only 24-hour bingo room, live Keno, fine dining and a café and buffet.

- Arizona Charlie's Hotel & Casino – Boulder is located on Boulder Highway, just off the U.S. 95 freeway. The property features 849 slot machines, seven table games, 303 hotel rooms, a full service casino with a hotel and RV park; the property also features a 24-hour bingo room, and fine and casual dining options.

Golden currently owns and operates gaming properties across two divisions – distributed gaming and resort and casino operations. Golden operates approximately 12,000 gaming devices and 25 table games in Nevada, Maryland and Montana. The Company owns four casino properties, 56 taverns and operates almost 1,000 distributed gaming locations in multiple jurisdictions. Golden is focused on maximizing the value of its portfolio by leveraging its scale, leadership position, and proven management capabilities across its two divisions. For more information, visit www.goldenent.com.